- United States

- /

- Building

- /

- NYSE:TREX

Does Andy Rose’s Insider Buy Clarify Trex’s (TREX) Long‑Term Governance and Strategy Direction?

Reviewed by Sasha Jovanovic

- Trex Company, Inc. recently appointed B. Andrew (Andy) Rose as an independent director, placing him on the Audit and Compensation Committees and bringing three decades of leadership experience in consumer and building products to its now ten-member Board.

- Rose’s decision to purchase Trex shares shortly after joining the Board adds weight to his appointment, as investors often read insider buying as a meaningful vote of confidence in a company’s direction and governance.

- Next, we’ll examine how Rose’s board appointment and insider share purchase intersect with Trex’s existing investment narrative and growth assumptions.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Trex Company Investment Narrative Recap

To own Trex, you generally need to believe in a long runway for composite decking replacing wood and in the company’s ability to protect margins despite softer repair and remodel demand and rising competition. Andy Rose’s appointment and insider share purchase support Trex’s governance story but do not materially change the near term catalyst around execution at its new Arkansas facility or the key risk from a weaker consumer spending backdrop.

Among recent announcements, the appointment of a new CFO in October 2025 stands out alongside Rose’s arrival, as both touch on capital allocation discipline and margin-focused execution at a time when Trex is investing heavily in capacity and product innovation. Together, these leadership changes sit in the background of investors’ focus on whether higher capital spending and pricing actions can translate into sustained earnings quality without eroding volume growth.

Yet while leadership changes may reassure some shareholders, the concentration in decking and railing still leaves Trex exposed in ways investors should be aware of...

Read the full narrative on Trex Company (it's free!)

Trex Company's narrative projects $1.5 billion revenue and $333.1 million earnings by 2028. This implies 10.2% yearly revenue growth and about a $146 million earnings increase from $186.7 million today.

Uncover how Trex Company's forecasts yield a $43.74 fair value, a 27% upside to its current price.

Exploring Other Perspectives

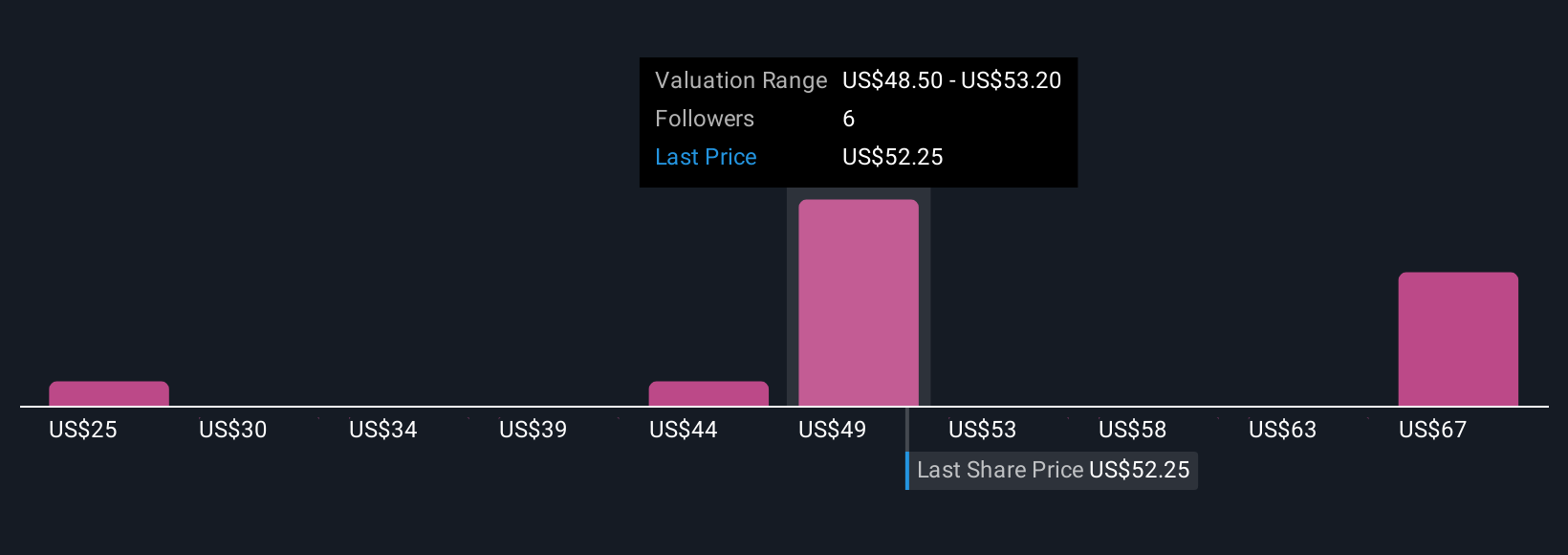

Four members of the Simply Wall St Community currently estimate Trex’s fair value between US$25 and US$47.12, reflecting a wide range of expectations. Set against concerns about softer repair and remodel demand, this spread underlines why it can help to compare several independent views before forming your own.

Explore 4 other fair value estimates on Trex Company - why the stock might be worth as much as 37% more than the current price!

Build Your Own Trex Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trex Company research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Trex Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trex Company's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trex Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TREX

Trex Company

Manufactures and sells composite decking and railing products in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026