- United States

- /

- Aerospace & Defense

- /

- NYSE:SPR

Spirit AeroSystems (SPR): Revisiting Valuation After Recent Share Price Rebound

Reviewed by Simply Wall St

Market context and recent move

Spirit AeroSystems Holdings (SPR) has been grinding higher recently, with the stock up about 11% over the past month as investors reassess its recovery prospects despite ongoing losses and a challenging aerospace supply chain backdrop.

See our latest analysis for Spirit AeroSystems Holdings.

Zooming out, the 17.8% year to date share price return and 22.6% one year total shareholder return suggest momentum is gradually rebuilding as investors warm to Spirit AeroSystems Holdings’ repair and recovery story.

If you are watching Spirit’s rebound and wondering what else is moving across aerospace, this could be a good moment to explore aerospace and defense stocks for more ideas.

With losses still heavy but revenue and earnings rebounding, and the share price already ahead of some analyst targets, investors now face a key question: Is Spirit AeroSystems undervalued, or is future growth already priced in?

Price-to-Sales of 0.7x: Is it justified?

On a price-to-sales basis, Spirit AeroSystems looks inexpensive at first glance, with the stock trading on a 0.7x multiple despite its recent share price gains.

The price-to-sales ratio compares the company’s market value to its annual revenue, a useful yardstick for loss making manufacturers where earnings are not yet a reliable guide.

For Spirit AeroSystems, that low multiple signals that the market is heavily discounting its sales base, even though revenue is forecast to grow faster than the broader US market and earnings are expected to swing from deep losses to profits over the next few years. However, when compared with our estimated fair price-to-sales ratio of 0.4x, today’s 0.7x level suggests the valuation has already moved ahead of where our regression based fair ratio indicates it could settle, even if sentiment on the recovery continues to improve.

Relative to peers, the contrast is stark. The wider US Aerospace and Defense group trades on about 3x sales, more than four times Spirit AeroSystems’ 0.7x. This underscores how cautiously investors are treating its balance sheet pressure, cash runway concerns and still negative equity position despite the improving top line outlook.

Explore the SWS fair ratio for Spirit AeroSystems Holdings

Result: Price-to-Sales of 0.7x (UNDERVALUED)

However, significant net losses and balance sheet strain mean any setback in aerospace demand or program execution could quickly undermine the current recovery narrative.

Find out about the key risks to this Spirit AeroSystems Holdings narrative.

Another view: DCF sends a very different signal

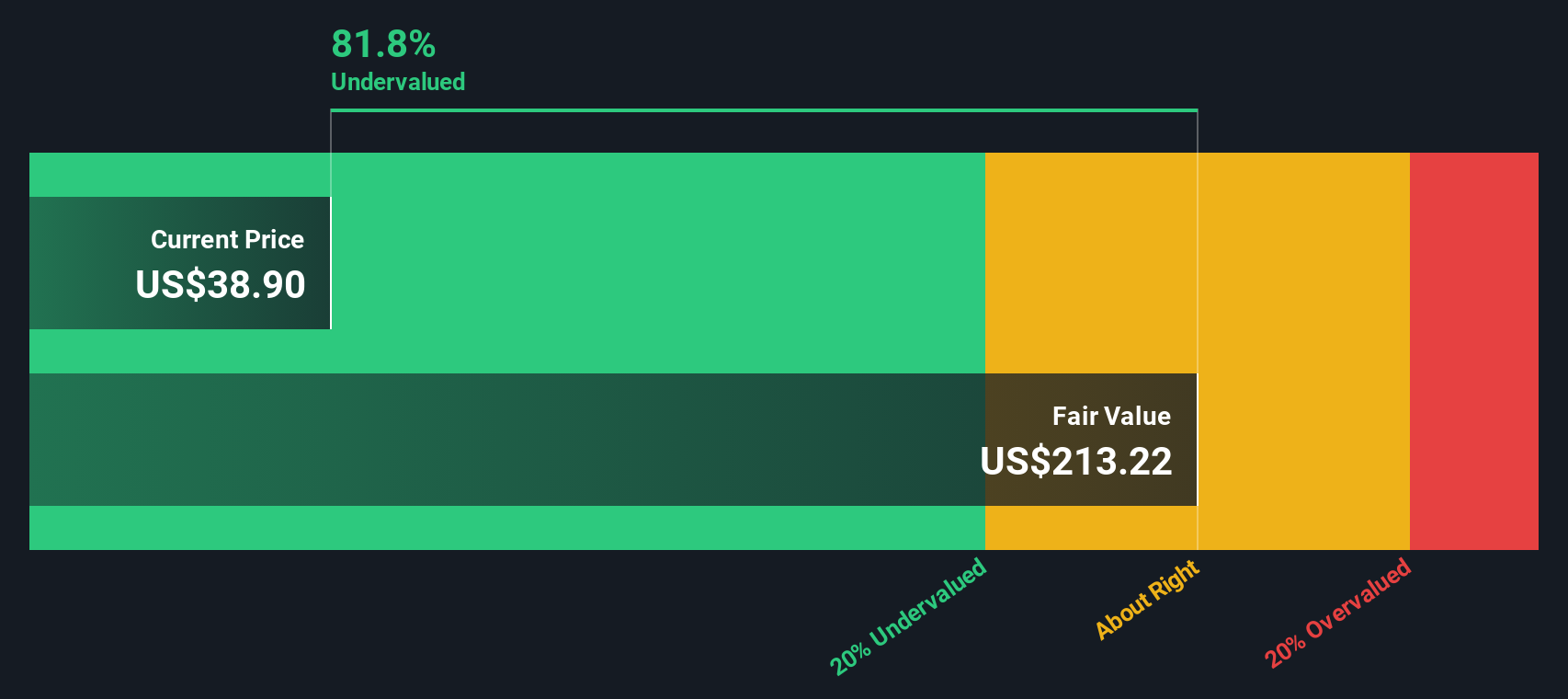

While the current 0.7x price to sales ratio suggests the stock is only modestly mispriced, our DCF model paints a far more dramatic picture. It indicates Spirit AeroSystems could be trading about 88% below its estimated fair value. Is the market missing something big, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Spirit AeroSystems Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Spirit AeroSystems Holdings Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a personalized view in just minutes by using Do it your way.

A great starting point for your Spirit AeroSystems Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with Spirit AeroSystems. Turn this momentum into a smarter watchlist by using targeted screeners that surface quality opportunities most investors overlook.

- Capture potential mispricings early by scanning these 906 undervalued stocks based on cash flows that stand out for strong cash flow support.

- Ride powerful secular trends by focusing on these 26 AI penny stocks positioned at the heart of intelligent automation.

- Strengthen your income stream by reviewing these 15 dividend stocks with yields > 3% that can support long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPR

Spirit AeroSystems Holdings

Engages in the design, engineering, manufacture, and marketing of commercial aerostructures worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026