- United States

- /

- Electrical

- /

- NYSE:SMR

NuScale Power (SMR): Examining Valuation Following ENTRA1 Energy Deal and Share Expansion Plans

Reviewed by Simply Wall St

NuScale Power (NYSE:SMR) is set to vote on increasing its authorized Class A shares at a special stockholder meeting in December. This move comes as investor attention intensifies around its small modular reactor technology and industry deals.

See our latest analysis for NuScale Power.

NuScale’s recent push to expand its share base coincides with sharp market swings. After announcing increased collaboration with major partners and its ENTRA1 Energy deal, the share price surged but has since seen a steep 1-month drop of nearly 60 percent. While year-to-date share price return is slightly positive at 2.1 percent, investor sentiment has clearly cooled, as reflected in the one-year total shareholder return of -27 percent, despite impressive gains over a three-year period.

If industry momentum and NuScale’s journey have piqued your interest, this could be the perfect time to explore fast growing stocks with high insider ownership.

Yet with such heightened volatility and a steep decline following recent highs, the central question remains: Is NuScale Power now trading below its true worth, or has the market already accounted for the company's future growth prospects, leaving little room for upside?

Most Popular Narrative: 55.4% Undervalued

At $18.08, NuScale Power trades far below the widely followed narrative's estimated fair value of $40.50. This notable gap sets the stage for a closer look at what underpins this viewpoint.

NuScale's involvement in the RoPower 6-module small modular reactor (SMR) power plant in Romania indicates future meaningful revenue and cash flow through its partnership in the Fluor-led Front-End Engineering and Design (FEED) Phase 2. This project enhances NuScale's revenue prospects. With an NRC-approved SMR technology and the commitment of over $2 billion towards its development and licensing, NuScale is uniquely positioned for immediate commercial deployment compared to competitors focused solely on demonstration plans. This potentially accelerates revenue growth once commercial operations commence.

Want to know why some see such explosive potential? This narrative alludes to remarkable growth, company-changing projects, and a profit transformation rarely forecast outside high-flying tech. The numbers behind this valuation will surprise even seasoned investors. Find out which bold assumptions shape this fair value story.

Result: Fair Value of $40.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in securing customer agreements or potential supply chain setbacks could challenge NuScale’s projected growth and put current fair value estimates at risk.

Find out about the key risks to this NuScale Power narrative.

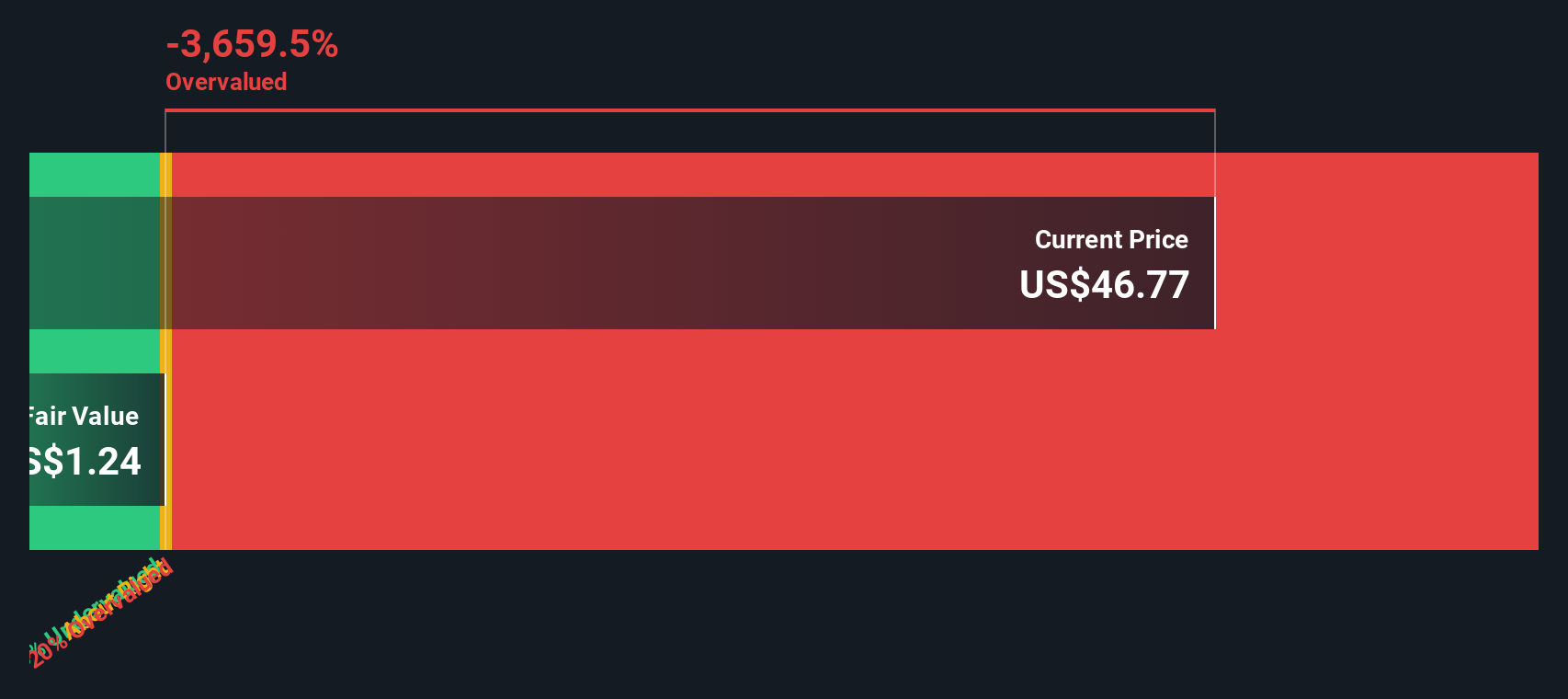

Another View: SWS DCF Model Signals Overvaluation

While the dominant narrative sees NuScale shares as deeply undervalued, a look through our DCF model tells a different story. The SWS DCF model places fair value at just $3.23, well below the current price. This suggests the market may be pricing in a lot of optimism. Which outlook will ultimately prove right?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NuScale Power for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NuScale Power Narrative

If you see things differently or want to take a hands-on approach, you can dive into the numbers and craft your own thesis in just minutes. Do it your way

A great starting point for your NuScale Power research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that the next big opportunity often hides in plain sight. To go beyond the obvious, here are three unique ways to target your next winning stock:

- Catch the surge in artificial intelligence by checking out these 25 AI penny stocks offering groundbreaking AI-led growth and innovation.

- Boost your portfolio’s earning power with these 14 dividend stocks with yields > 3% that reward shareholders with robust yields above 3 percent.

- Tap into rapidly evolving quantum computing trends with these 27 quantum computing stocks, where industry pioneers are pushing the limits of today's technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NuScale Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMR

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026