- United States

- /

- Aerospace & Defense

- /

- NYSE:RTX

A Fresh Look at Raytheon (RTX) Valuation After New Avio Partnership Boosts U.S. Rocket Motor Capacity

Reviewed by Simply Wall St

The new partnership between Raytheon, part of RTX, and Avio to establish a solid rocket motor facility in the US could strengthen RTX’s production capabilities as demand for advanced propulsion systems in the defense sector continues to grow.

See our latest analysis for RTX.

RTX has captured attention with a year-to-date share price return of 52.55%, signaling robust momentum as major defense projects and partnerships come into focus, such as its recent collaboration with Avio. Solid one-year total shareholder returns of 44.92% and exceptional multi-year figures show that investors have been well rewarded, reflecting growing optimism about the company's long-term strategic moves and earnings potential.

Curious to see which other aerospace and defense stocks could take off next? Explore new opportunities with our dedicated list: See the full list for free.

With shares rallying on strong results and new partnerships, is RTX now trading at a premium, or could the ongoing growth in defense demand mean investors are still getting in ahead of the curve?

Most Popular Narrative: 7.9% Undervalued

RTX’s most widely followed narrative points to a fair value above its last close, suggesting there is more upside than the recent rally reveals. Analyst consensus is leaning towards positive catalysts driving this view, setting the stage for expansion if certain trends hold.

Robust and growing backlog, highlighted by a 1.86 quarter book-to-bill ratio, $236 billion backlog (up 15% year-over-year), and major new international contracts (e.g., EU, MENA, Asia-Pacific) indicate RTX is well-positioned to benefit from sustained increases in global defense spending and heightened geopolitical tensions, setting up strong visibility for future revenue growth.

Curious what keeps this price target aloft? Only a handful of ambitious financial forecasts back it up, centered on margin expansion and relentless earnings progression. Want to test the numbers and see if you agree?

Result: Fair Value of $192.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff volatility and heavy reliance on defense budgets remain key risks that could quickly change the outlook for RTX.

Find out about the key risks to this RTX narrative.

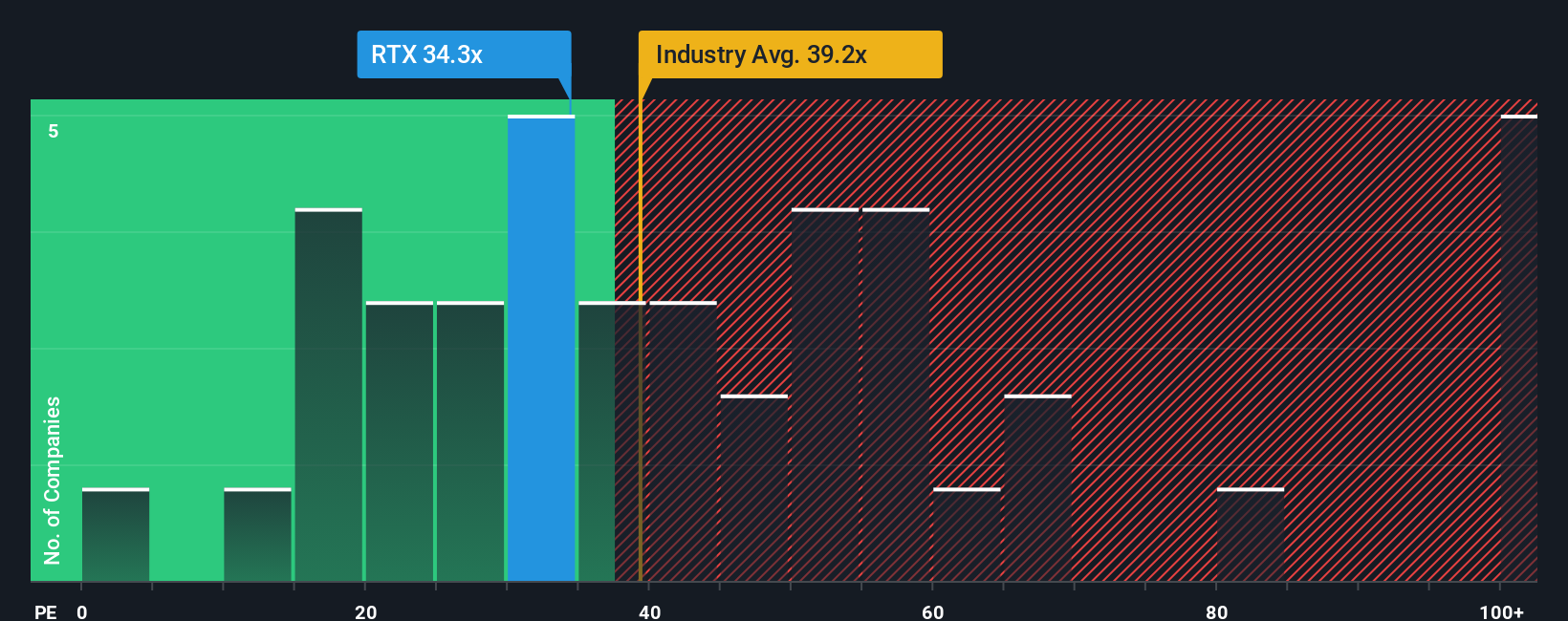

Another View: Sizing Up RTX with Earnings Multiples

Looking through the lens of earnings multiples, RTX trades at 36 times earnings, which is below the US Aerospace & Defense industry average of 38.5 and its peer group average of 36.3. However, this is just above its fair ratio of 35. What does this slim gap mean for investors chasing value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RTX Narrative

Choosing your own path is always an option. If these insights do not match your perspective, building your personal RTX story only takes a few minutes. Do it your way

A great starting point for your RTX research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want the edge in today’s market, now is the moment to act. Expand your investing horizon with these unique stock ideas:

- Maximize your yield potential and find out which companies are raising the bar with attractive payouts by checking out these 16 dividend stocks with yields > 3%.

- Catch the AI boom early and see which companies could shape tomorrow’s tech landscape through our curated selection of these 25 AI penny stocks.

- Stay ahead by uncovering hidden value opportunities poised for a turnaround. Start with these 882 undervalued stocks based on cash flows and never miss out on the next potential bargain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RTX

RTX

An aerospace and defense company, provides systems and services for the commercial, military, and government customers in the United States and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives