- United States

- /

- Aerospace & Defense

- /

- NYSE:RDW

Redwire (RDW) Is Down 11.8% After Lowered Revenue Guidance and Widened Net Loss - What's Changed

Reviewed by Sasha Jovanovic

- In the past week, Redwire Corporation announced a follow-on equity offering of US$250 million and reported third-quarter results with sales of US$103.43 million but a widened net loss of US$41.15 million compared to the previous year.

- The company lowered its full-year revenue guidance to US$320 million–US$340 million, citing delayed U.S. government orders resulting from an ongoing government shutdown, which has influenced the timing of anticipated contract awards.

- We'll examine how Redwire's reduced revenue guidance and rising net loss affect analyst expectations for the company's recovery and growth.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Redwire Investment Narrative Recap

To be a Redwire shareholder, you need to believe that global momentum in space exploration, commercial satellites, and space-based defense will drive meaningful long-term growth, even as near-term earnings remain volatile. The recent reduction in full-year revenue guidance, due to delayed U.S. government orders, directly pressures Redwire's main short-term catalyst: contract wins and backlog growth. At the same time, it spotlights the greatest immediate risk, persistent unpredictability in U.S. government contracting and its effect on revenue timing.

Redwire's US$250 million follow-on equity offering, announced just after reporting wider third-quarter losses and lower outlook, is the most relevant recent event for current investors. While this new capital could support operations during a period of delayed orders, it brings shareholder dilution into focus, possibly impacting both sentiment and future per-share value at a time when revenue visibility is most uncertain. Yet, for investors, it's equally important to watch for risk factors that persist beyond any one earnings call, such as potential periods of contract and earnings volatility that may not be fully reflected in guidance ...

Read the full narrative on Redwire (it's free!)

Redwire's outlook anticipates $887.3 million in revenue and $73.2 million in earnings by 2028. This scenario is based on an annual revenue growth rate of 50.3% and an earnings increase of $322.7 million from current earnings of -$249.5 million.

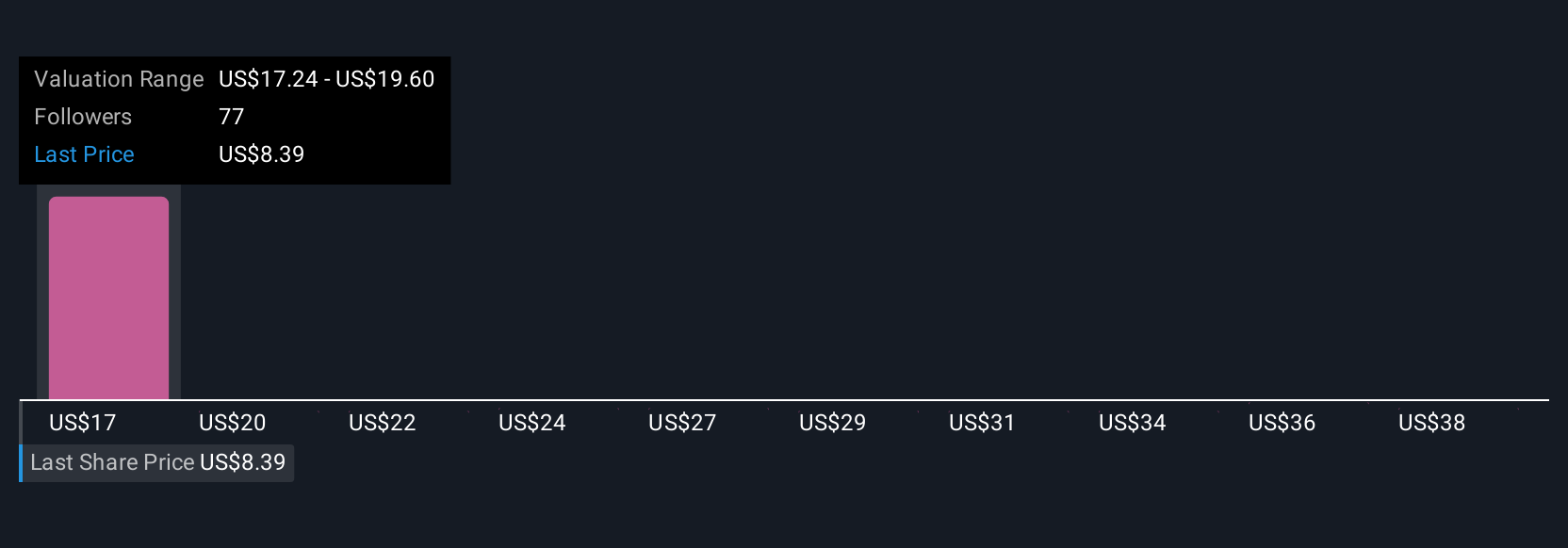

Uncover how Redwire's forecasts yield a $17.17 fair value, a 180% upside to its current price.

Exploring Other Perspectives

Nine individual fair value estimates from the Simply Wall St Community range between US$17.17 and US$38.41, signaling a wide spectrum of confidence on Redwire’s intrinsic value. With recent revenue delays and operating losses highlighting the risk of earnings volatility, you can see why opinions vary about the potential rewards and looming uncertainties for Redwire.

Explore 9 other fair value estimates on Redwire - why the stock might be worth just $17.17!

Build Your Own Redwire Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Redwire research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Redwire research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Redwire's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDW

Redwire

Provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives