- United States

- /

- Aerospace & Defense

- /

- NYSE:RDW

Can Redwire’s (RDW) Upcoming Earnings Shift the Narrative on Revenue Reliability?

Reviewed by Sasha Jovanovic

- Redwire Corporation (NYSE: RDW) announced it would report its third-quarter 2025 financial results after the market close on November 5th, following recent quarters of missed revenue expectations and declines compared to the prior year.

- With analysts maintaining their forecasts in recent weeks, there is close attention on whether Redwire can address concerns about revenue reliability and execution in this upcoming report.

- With investors watching to see if Redwire can reverse its recent trend of revenue shortfalls, we'll explore the implications for its investment outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Redwire Investment Narrative Recap

For investors to remain confident in Redwire, they need to believe the company can capitalize on global growth in space and defense spending, while overcoming its current revenue reliability and execution concerns. The upcoming Q3 earnings release is a key near-term catalyst, as it could either signal improvement or reinforce fears about continued revenue volatility and persistent losses, right now, this update appears material given the ongoing trend of misses and investor sensitivity to financial consistency.

Among Redwire’s recent announcements, the Q3 report stands out as especially relevant, as it follows substantial board and executive changes announced in October. New board members and an incoming CFO may influence long-term governance and financial oversight, but with the business still facing unpredictable revenue cycles and recent index removal, these shifts add another layer of near-term uncertainty for shareholders considering catalysts and risks.

On the other hand, the complex risk of continuing Estimate at Completion (EAC) volatility on fixed-price contracts is something shareholders should pay close attention to…

Read the full narrative on Redwire (it's free!)

Redwire's outlook anticipates $887.3 million in revenue and $73.2 million in earnings by 2028. Achieving this requires 50.3% annual revenue growth and a $322.7 million increase in earnings from the current loss of $-249.5 million.

Uncover how Redwire's forecasts yield a $18.06 fair value, a 160% upside to its current price.

Exploring Other Perspectives

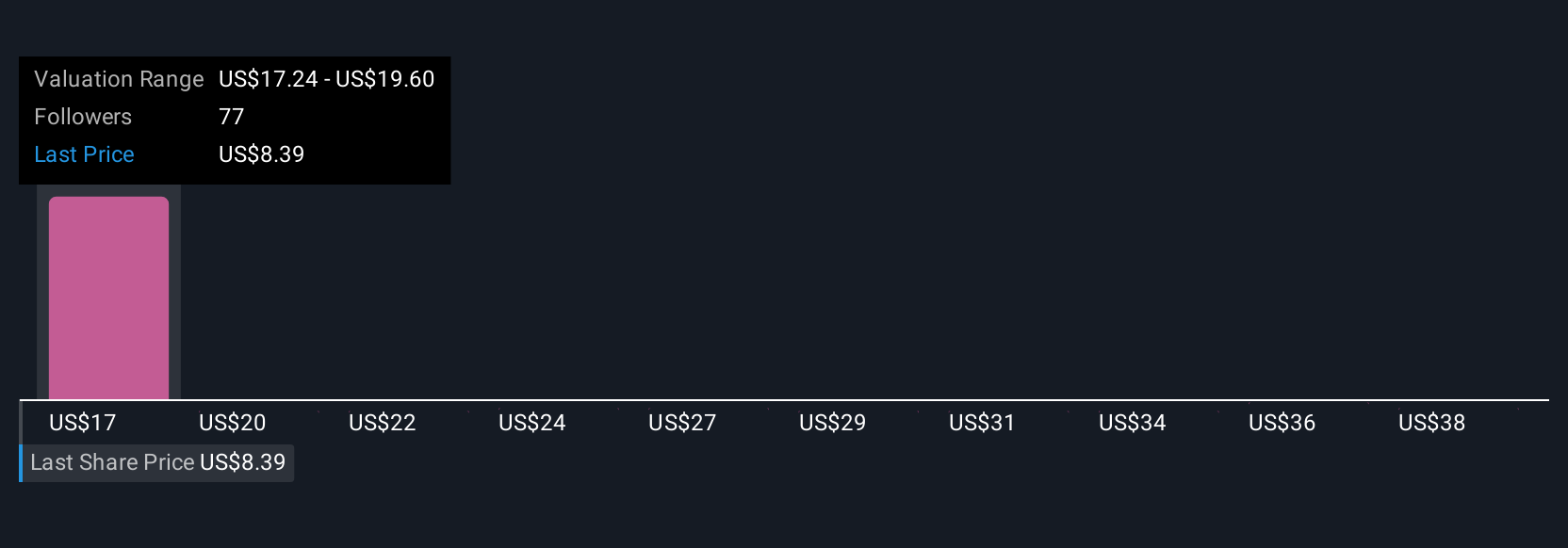

The Simply Wall St Community’s nine fair value estimates for Redwire range from US$17.24 to US$38.41 per share. These varied forecasts highlight both optimism about revenue growth and the significant ongoing uncertainty tied to execution and contract risks, see how your outlook compares.

Explore 9 other fair value estimates on Redwire - why the stock might be worth over 5x more than the current price!

Build Your Own Redwire Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Redwire research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Redwire research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Redwire's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDW

Redwire

Provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives