- United States

- /

- Trade Distributors

- /

- NYSE:QXO

Did QXO's (QXO) Surging Sales and Steep Losses Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- QXO, Inc. recently reported earnings for the third quarter and nine months ended September 30, 2025, showing sales of US$2.73 billion for the quarter versus US$13.1 million a year before, along with a net loss of US$139.4 million compared to net income previously.

- While revenue growth was very large year over year, the shift from profitability to a substantial loss highlights rising challenges in turning sales into profits for QXO.

- We'll explore how such significant sales growth combined with a sharp net loss impacts QXO's investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is QXO's Investment Narrative?

To be a QXO shareholder, you have to believe the company can successfully convert huge top-line growth into sustainable profitability, despite today's steep losses. The recent report showing sales surging from US$13.1 million to nearly US$2.73 billion in a year, but swinging from profit to a US$139.4 million loss, re-frames the near-term story: aggressive expansion and M&A have supercharged revenue, but margin pressures and integration costs are front and center. Previously, expected catalysts were centered around more acquisitions and index inclusions, with risks tied to execution, an inexperienced board and management team, and ongoing dilution from equity raises. This latest update sharpens the focus on the urgent need for profitability and execution, and may push profitability timelines further out. For now, confidence in QXO's scale-up strategy is still essential, but the mismatch between sales growth and losses is a more pressing risk than before. On the other hand, execution concerns with a new leadership team should now be top of mind for investors.

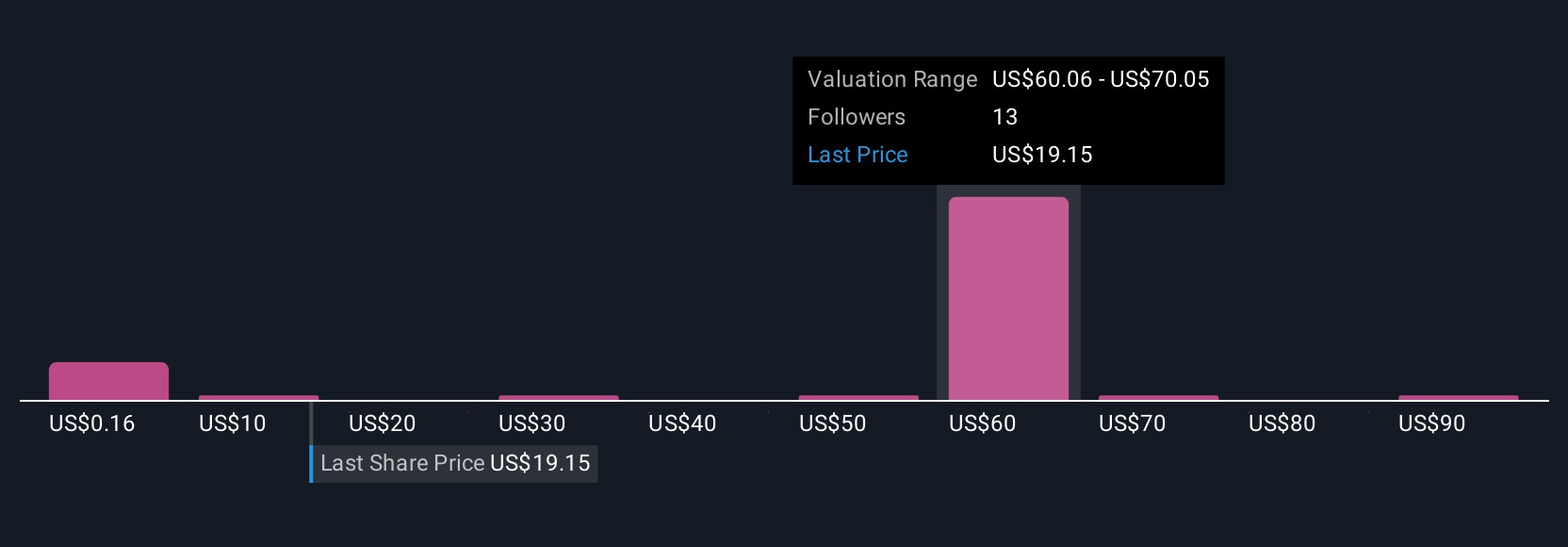

Despite retreating, QXO's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 12 other fair value estimates on QXO - why the stock might be worth less than half the current price!

Build Your Own QXO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QXO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free QXO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QXO's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QXO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QXO

QXO

Distributes roofing, waterproofing, and other building products in the United States.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives