- United States

- /

- Construction

- /

- NYSE:PWR

Quanta Services (PWR): Valuation Check After Double-Digit Growth and Record $39.2 Billion Backlog

Reviewed by Simply Wall St

Quanta Services (PWR) is back in the spotlight after reporting double digit gains in revenue, adjusted EBITDA, and EPS, along with a record 39.2 billion dollar backlog that has investors rethinking its long term runway.

See our latest analysis for Quanta Services.

That strength is showing up in the market too, with Quanta’s share price at 464.84 dollars and a roughly 25 percent 3 month share price return helping extend an impressive multi year total shareholder return profile.

If Quanta’s momentum has you thinking more broadly about infrastructure and energy exposure, this could be a good moment to explore aerospace and defense stocks for other potential ideas.

With the stock hovering just shy of analyst targets after a powerful multi year run and robust growth, investors now face the key question: is Quanta still mispriced, or is the market already baking in years of expansion?

Most Popular Narrative Narrative: 2% Undervalued

With Quanta trading just below the narrative fair value of 474.38 dollars, the valuation case leans on a powerful long term earnings and revenue arc.

The accelerating demand for transmission and distribution infrastructure, driven by rising electric loads from AI/data center proliferation, grid modernization needs, and the broader energy transition, positions Quanta to benefit from a major, long-term investment cycle in power grid expansion and resilience; this is likely to support sustained revenue and backlog growth in future years.

Curious how this growth supercycle translates into today’s price? The narrative leans on ambitious revenue compounding, margin lift, and a punchy future earnings multiple.

Result: Fair Value of $474.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor constraints and potential permitting or regulatory delays on large transmission projects could quickly pressure margins and weaken today’s upbeat growth assumptions.

Find out about the key risks to this Quanta Services narrative.

Another Angle On Valuation

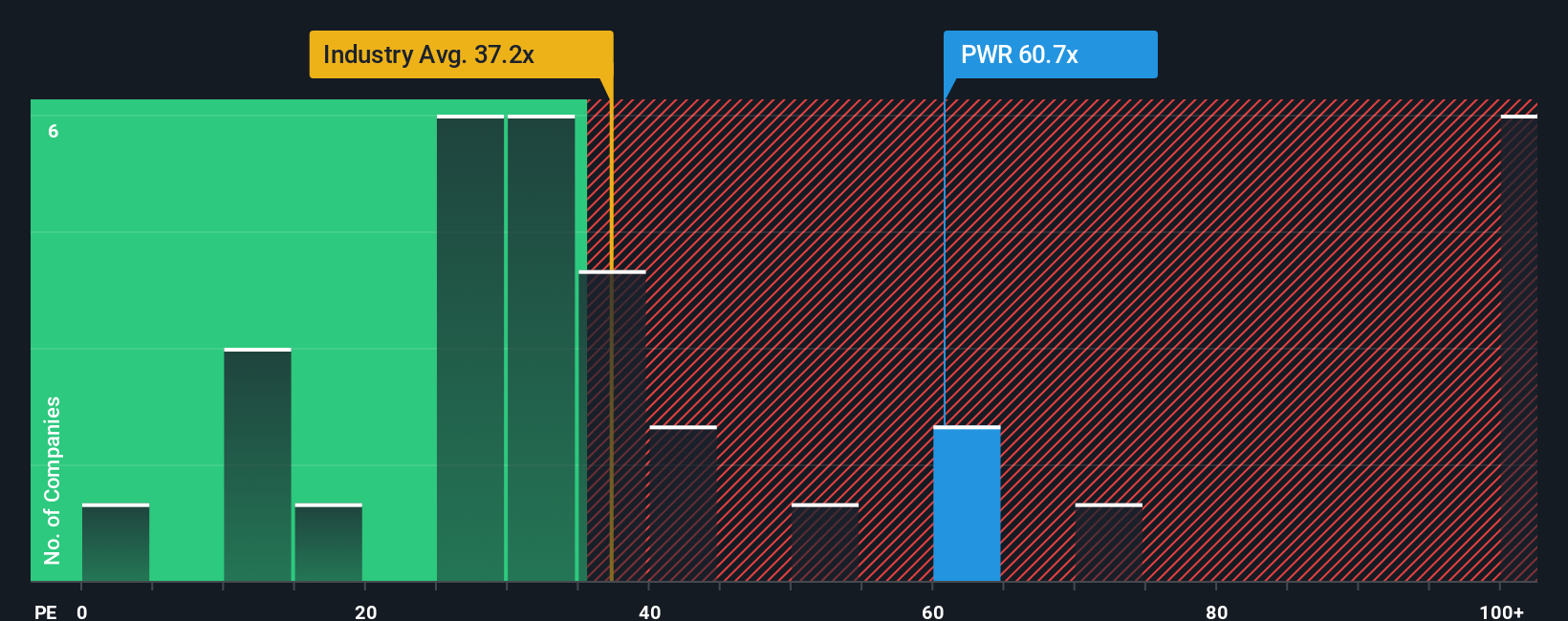

Step back from the narrative fair value and the picture looks different. On earnings, Quanta trades at about 68.1 times, well above the US Construction industry at 34.5 times, peers at 55.7 times, and a 39.9 times fair ratio that the market could drift toward. Is this a durable growth premium or a looming de rating risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Quanta Services Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your Quanta Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single winner; use the Simply Wall St Screener to uncover fresh opportunities that match your strategy before the market moves without you.

- Explore cash flow potential by targeting companies identified as undervalued using these 909 undervalued stocks based on cash flows that could rerate if sentiment catches up.

- Position yourself for the next wave of innovation by focusing on potential future winners in intelligent automation and software through these 26 AI penny stocks.

- Seek reliable income streams by concentrating on established businesses offering attractive yields via these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quanta Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PWR

Quanta Services

Offers infrastructure solutions for the electric and gas utility, renewable energy, communications, pipeline, and energy industries in the United States, Canada, Australia, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026