- United States

- /

- Construction

- /

- NYSE:PRIM

Will Zacks’ Upgraded Growth View and EPS Forecasts Change Primoris Services' (PRIM) Narrative?

Reviewed by Sasha Jovanovic

- In recent days, Primoris Services was highlighted by Zacks with a top Rank and favorable Growth Score, reflecting analysts’ upgraded expectations for its current-year earnings.

- This recognition, combined with earnings estimates that now point to significantly faster EPS expansion than the broader industry, suggests analysts see strengthening growth momentum in the company’s near-term fundamentals.

- We’ll now explore how Primoris’s upgraded growth outlook and upward earnings estimate revisions may reshape its existing investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Primoris Services Investment Narrative Recap

To own Primoris, you need to believe in long-term demand for infrastructure tied to renewables, utilities and data centers, and in the company’s ability to execute profitably across those areas. The recent Zacks recognition reinforces the near term earnings catalyst of upgraded profit expectations, but it does not materially change the core risk that growth is concentrated in highly competitive, award driven markets where project wins and margins can swing quickly.

The most relevant recent development is Primoris’s back to back increases to its 2025 earnings guidance, supported by strong Q2 and Q3 results and higher full year EPS targets of US$4.75 to US$4.95. That improved outlook aligns with analysts’ upgraded estimates and the Zacks ranking, but it also raises the bar for future performance at a time when data center and utility scale renewable projects are becoming more crowded and potentially harder to win at attractive terms.

Yet even with higher earnings guidance, investors should be aware that...

Read the full narrative on Primoris Services (it's free!)

Primoris Services’ narrative projects $8.7 billion revenue and $358.2 million earnings by 2028.

Uncover how Primoris Services' forecasts yield a $149.08 fair value, a 19% upside to its current price.

Exploring Other Perspectives

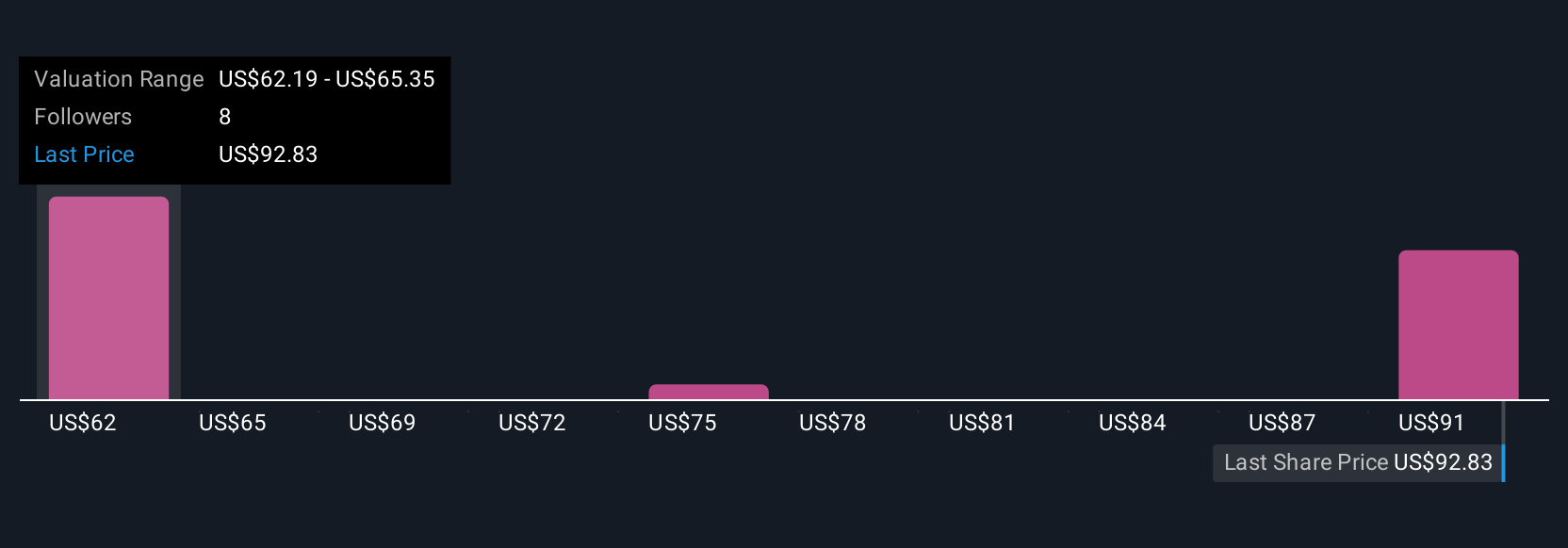

Five Simply Wall St Community fair value estimates for Primoris span from US$77.76 to US$149.08, highlighting how far apart individual views can be. When you set that against the company’s increased reliance on competitive data center and renewable projects, it underlines why checking several perspectives on Primoris’s future performance matters.

Explore 5 other fair value estimates on Primoris Services - why the stock might be worth as much as 19% more than the current price!

Build Your Own Primoris Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Primoris Services research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Primoris Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Primoris Services' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRIM

Primoris Services

Provides infrastructure services primarily in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026