- United States

- /

- Machinery

- /

- NYSE:NPO

Enpro (NPO): Evaluating Valuation After Strong Q3 Earnings and Raised Revenue Guidance

Reviewed by Simply Wall St

Enpro (NPO) caught investors’ attention after reporting third quarter earnings that topped expectations, driven by growth in its Sealing Technologies and Advanced Surface Technologies segments. Management also raised full-year revenue guidance to 7% to 8%.

See our latest analysis for Enpro.

Enpro’s standout third quarter results and raised revenue guidance sparked plenty of interest, with the stock now trading at $210.65. While there has been some short-term volatility, the momentum over the past year has been impressive, reflected in a 24.5% year-to-date share price return and a 29.6% total return for shareholders. The market seems to be rewarding Enpro’s growth, especially as recent acquisitions and investments in technology provide additional support for the future.

If this kind of steady momentum and transformation appeals to you, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

That kind of performance naturally raises the question: with shares near record highs and a strong run already behind it, is Enpro still undervalued, or has the market already priced in all of its future growth potential?

Most Popular Narrative: 15.4% Undervalued

Enpro's latest fair value estimate sits well above the recent close, suggesting further upside even after this year's robust rally and upgrade in guidance.

Elevated focus on product differentiation and applied engineering expertise in Sealing Technologies is enabling greater penetration into high-growth end markets such as semiconductors, life sciences, and aerospace. This approach reduces cyclicality and drives both top-line expansion and improved segment margins.

How is this ambitious price possible? The narrative expects Enpro to transform top-line growth and margin quality through aggressive engineering initiatives and targeted market expansion. Discover which financial assumptions and bold projections set this estimate apart from the crowd.

Result: Fair Value of $249 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing exposure to cyclical markets and the high costs associated with expansion could present challenges for Enpro’s ability to sustain its impressive growth trajectory.

Find out about the key risks to this Enpro narrative.

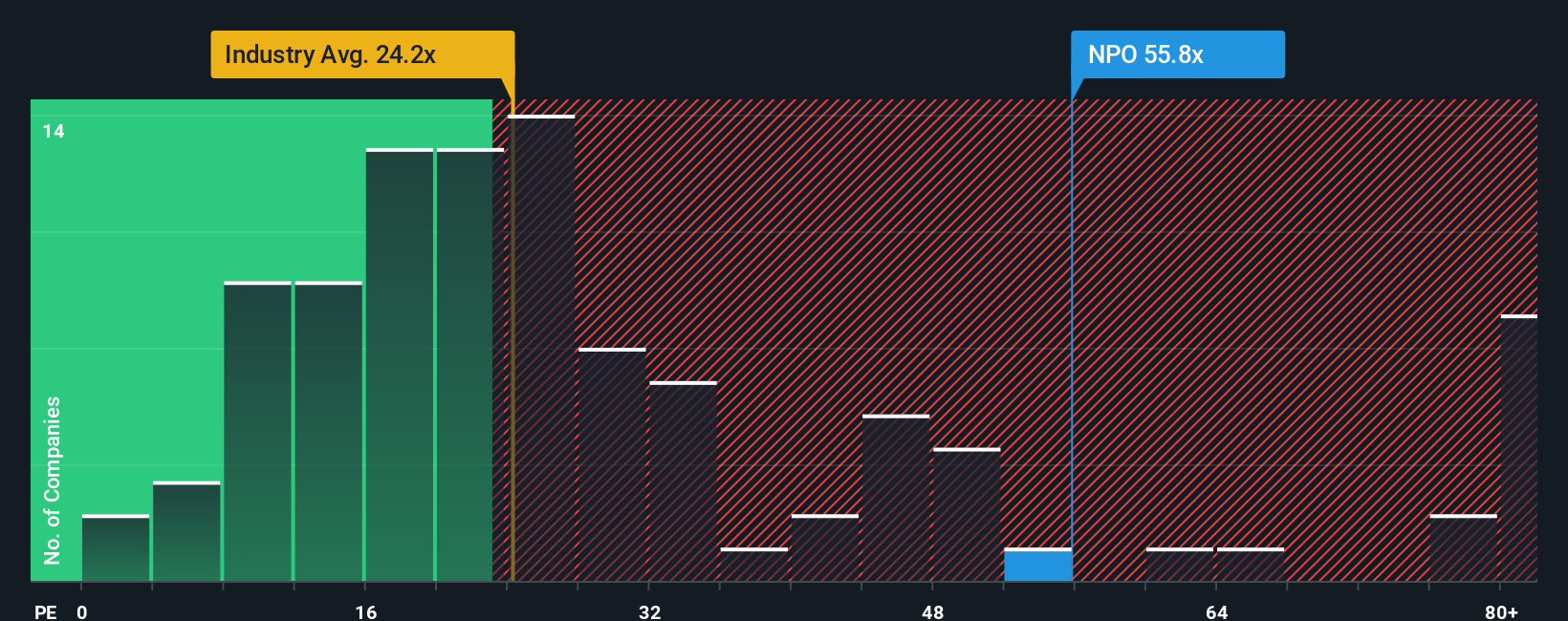

Another View: Market Multiples Paint a Different Picture

When we look at Enpro’s valuation through the lens of its price-to-earnings ratio, things appear far less optimistic. Enpro trades at 51.4x earnings, which is significantly higher than both the US Machinery industry average of 24.6x and its peer average of 32.5x. The fair ratio stands at 32x, suggesting the market is expecting a lot from future growth. This could potentially expose investors to more downside if the company does not deliver. Is the premium justified, or could sentiment swing the other way?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Enpro Narrative

If you have a different perspective or want to dig into the numbers firsthand, crafting your own Enpro outlook takes just a few minutes. Do it your way

A great starting point for your Enpro research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

You won’t want to miss out on other opportunities packed with growth, innovation, and income potential. Find your next winning idea among these handpicked screens:

- Capture reliable income streams when you tap into these 15 dividend stocks with yields > 3% with yields above 3% for steady portfolio growth.

- Stay ahead of tomorrow’s breakthroughs by checking out these 27 AI penny stocks that are powering advancements across industries with intelligent, data-driven solutions.

- Lock in value now with these 870 undervalued stocks based on cash flows trading below their intrinsic worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enpro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NPO

Enpro

An industrial technology company, design, develops, manufactures, and markets proprietary, value-added products and solutions to safeguard critical environments in the United States, Europe, Asia Pacific, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives