- United States

- /

- Aerospace & Defense

- /

- NYSE:NOC

Has Northrop Grumman’s Recent Pullback Created a New Opportunity for Investors?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Northrop Grumman’s stock price makes sense right now, you are in the right place. Let’s dig into its value together.

- While Northrop Grumman has outperformed the market with a 16.6% gain year-to-date and a 14.5% return over the past year, it has recently pulled back, down 6.5% in the last month and 3.5% in the past week.

- These recent declines come amid headlines about major new defense contracts and ongoing geopolitical tensions, both of which continue to shape investors’ perception of risk and opportunity in the sector. Notably, Northrop Grumman has secured several high-profile government contracts that could fuel growth despite short-term volatility.

- The company currently holds a valuation score of 4 out of 6, suggesting it screens as undervalued on most but not all key checks. We will break down what these ratings mean using the main valuation tools next. Stick around for a broader view on why numbers alone may not tell the whole story.

Find out why Northrop Grumman's 14.5% return over the last year is lagging behind its peers.

Approach 1: Northrop Grumman Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its future cash flows and then discounting those projections back to today at a reasonable rate. This approach aims to answer what Northrop Grumman is truly worth based on expected future performance, rather than just current market trends.

According to the latest analysis, Northrop Grumman generated $1.75 Billion in Free Cash Flow over the last twelve months. Looking ahead, analysts forecast steady cash flow growth. For example, Free Cash Flow is projected to reach $3.86 Billion by the end of 2029. While professional estimates typically extend only five years, further projections are extrapolated to provide a full ten-year outlook, giving a broader sense of potential financial performance.

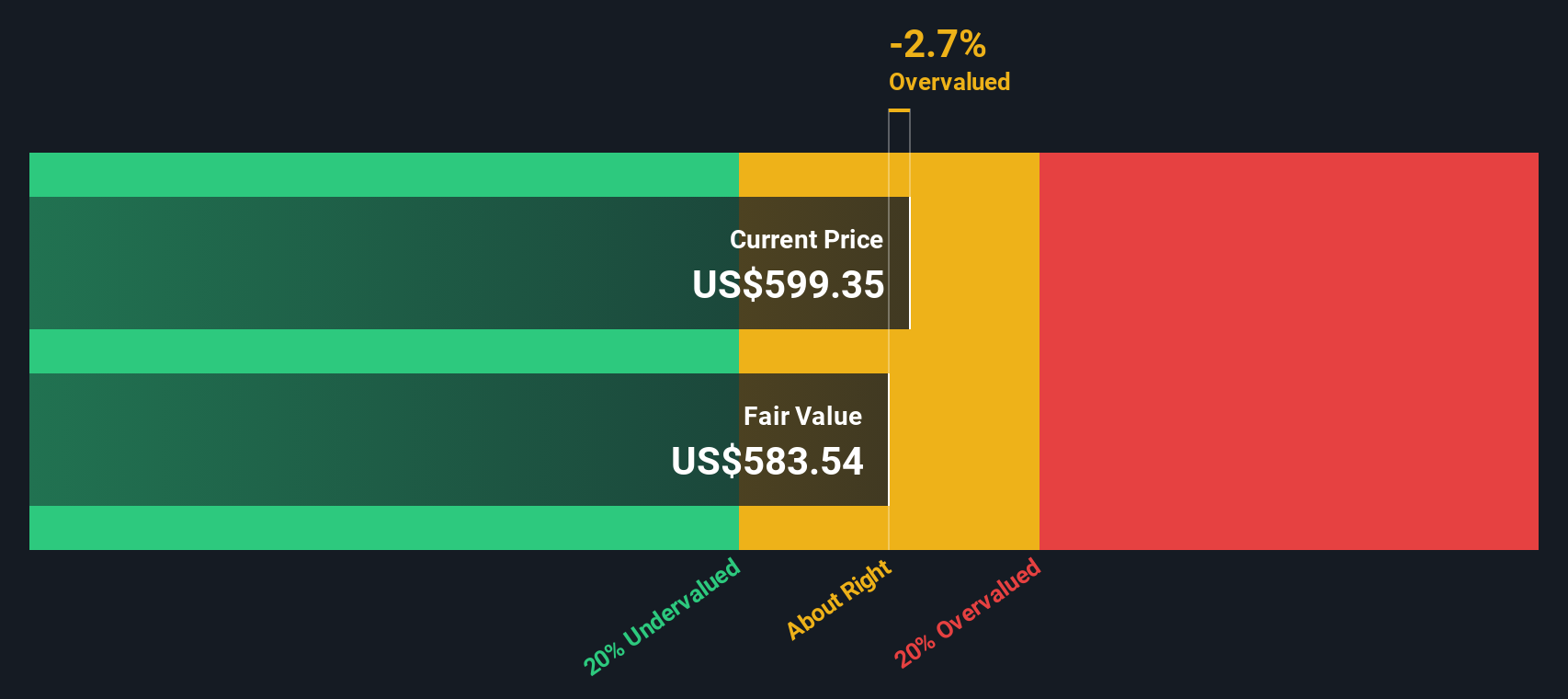

After this projection and discounting process, the DCF model calculates an intrinsic value of $534.34 per share. Compared to Northrop Grumman’s current price, this implies the stock is about 2.1% overvalued. That margin is slim, suggesting there is little disconnect between market sentiment and actual business prospects.

Result: ABOUT RIGHT

Northrop Grumman is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Northrop Grumman Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is widely used to assess the value of profitable companies because it compares a company’s market price directly to its earnings. This makes it especially relevant for mature businesses like Northrop Grumman that consistently generate profits. A company’s PE ratio can vary based on expected growth and the level of risk investors perceive. Higher growth prospects generally justify higher PE ratios, while increased risk tends to push them lower.

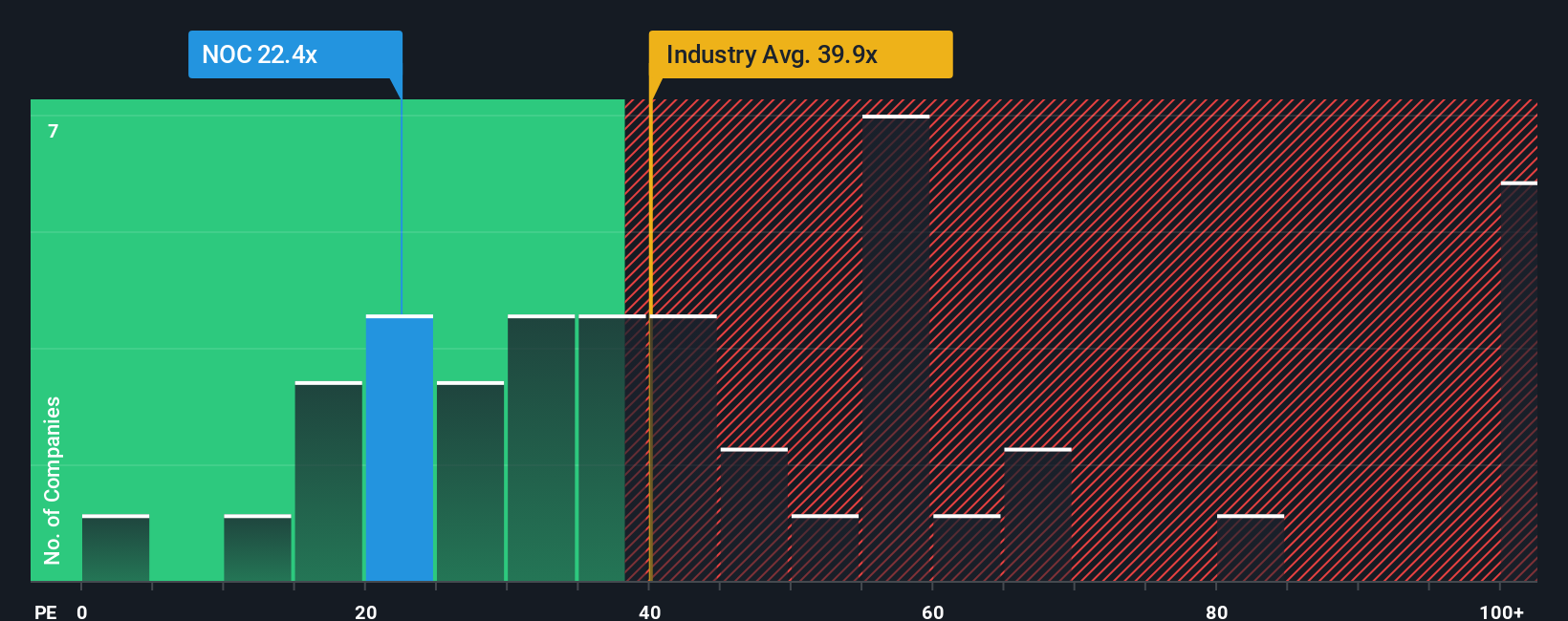

Northrop Grumman currently trades at a PE ratio of 19.4x. For context, the average PE among its Aerospace & Defense industry peers is a much higher 38.3x, and the peer group’s average is also elevated at 35.4x. On these benchmarks, Northrop Grumman appears attractively priced relative to its sector.

The “Fair Ratio” calculated by Simply Wall St is 27.0x. This proprietary metric goes beyond simple industry comparisons. It considers key drivers like Northrop Grumman’s earnings growth rate, risk profile, profit margins, market cap, and specific industry dynamics. As a result, the Fair Ratio is a more tailored benchmark reflecting the company’s true circumstances, rather than a one-size-fits-all approach typical of peer or industry averages.

When comparing Northrop Grumman’s actual PE of 19.4x to its Fair Ratio of 27.0x, the stock looks undervalued on this basis, trading well below what would be typical for a company with its characteristics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Northrop Grumman Narrative

Earlier we mentioned that numbers do not tell the whole story. Let’s introduce you to Narratives, a dynamic, human-centered way to value companies. A Narrative captures your personal perspective about Northrop Grumman, showing how you believe trends, risks, and opportunities will play out and then translating those assumptions into a long-term financial forecast and a Fair Value estimate.

On Simply Wall St’s Community page, Narratives make it easy for investors to craft and share their story-driven forecasts alongside millions of others. Narratives connect your view of the company’s future, including your thoughts about growth, profitability, and risks, to key numbers such as revenue, margin estimates, and fair valuation. Once saved, your Narrative is constantly updated as new news or earnings data arrive, keeping your fair value estimate relevant without any extra effort.

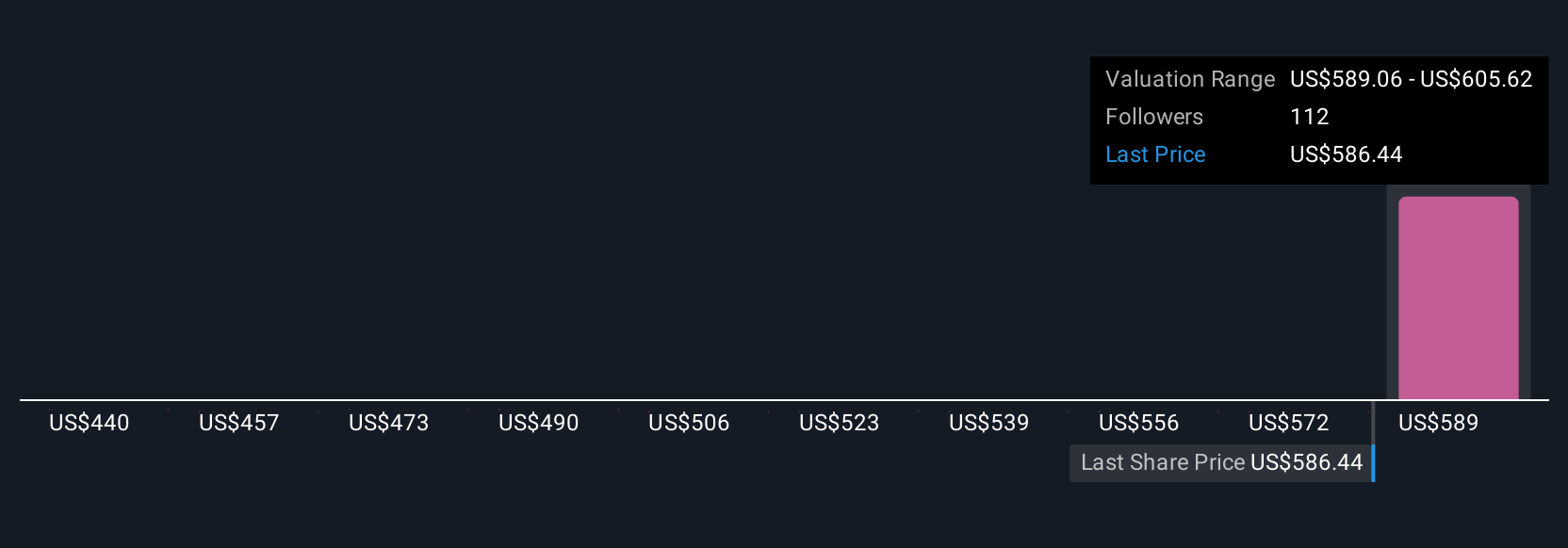

This tool helps users make smarter buy and sell decisions by comparing their personal Fair Value to the current share price. This process helps highlight when their conviction matches or departs from market sentiment. For example, some investors may predict robust defense spending and strong contract execution, leading them to a bullish fair value of $690 per share. Others focusing on execution risks and evolving global defense trends may arrive at a more cautious fair value closer to $510.

Do you think there's more to the story for Northrop Grumman? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northrop Grumman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOC

Northrop Grumman

Operates as an aerospace and defense technology company in the United States, the Asia/Pacific, Europe, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026