- United States

- /

- Machinery

- /

- NYSE:MWA

How Investors Are Reacting To Mueller Water Products (MWA) Record 2025 Results And Insider Share Sales

Reviewed by Sasha Jovanovic

- Mueller Water Products recently reported record Q4 and fiscal 2025 results, citing stronger net sales and net income driven by operational improvements and prior strategic initiatives.

- At the same time, insider share sales by senior executives highlighted how leadership is rebalancing personal holdings even as the business delivers its strongest annual performance so far.

- We’ll now examine how these record financial results, alongside insider selling, influence Mueller Water Products’ existing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Mueller Water Products Investment Narrative Recap

To own Mueller Water Products, you need to believe its role in essential water infrastructure and municipal repair can translate solid operational execution into durable earnings, even if end markets stay uneven. The latest record Q4 and fiscal 2025 results reinforce that execution, while recent insider sales by senior executives appear immaterial to the core near term catalyst, which remains how effectively the company converts strong backlogs into cash against macro and funding risks.

The record Q4 and full year 2025 earnings release, with higher sales and net income, is the most relevant backdrop to these insider transactions, because it highlights that selling occurred alongside the strongest financial performance yet rather than during a downturn. For investors focused on catalysts such as infrastructure spending and municipal repair activity, this pairing of improved profitability with insider rebalancing simply adds another data point to weigh against existing concerns about funding timing and execution on capital intensive foundry upgrades.

Yet set against these records, investors should still be aware of how delays in federal infrastructure funding could...

Read the full narrative on Mueller Water Products (it's free!)

Mueller Water Products' narrative projects $1.6 billion revenue and $320.8 million earnings by 2028. This requires 4.1% yearly revenue growth and an increase of about $171.7 million in earnings from $149.1 million today.

Uncover how Mueller Water Products' forecasts yield a $27.67 fair value, a 13% upside to its current price.

Exploring Other Perspectives

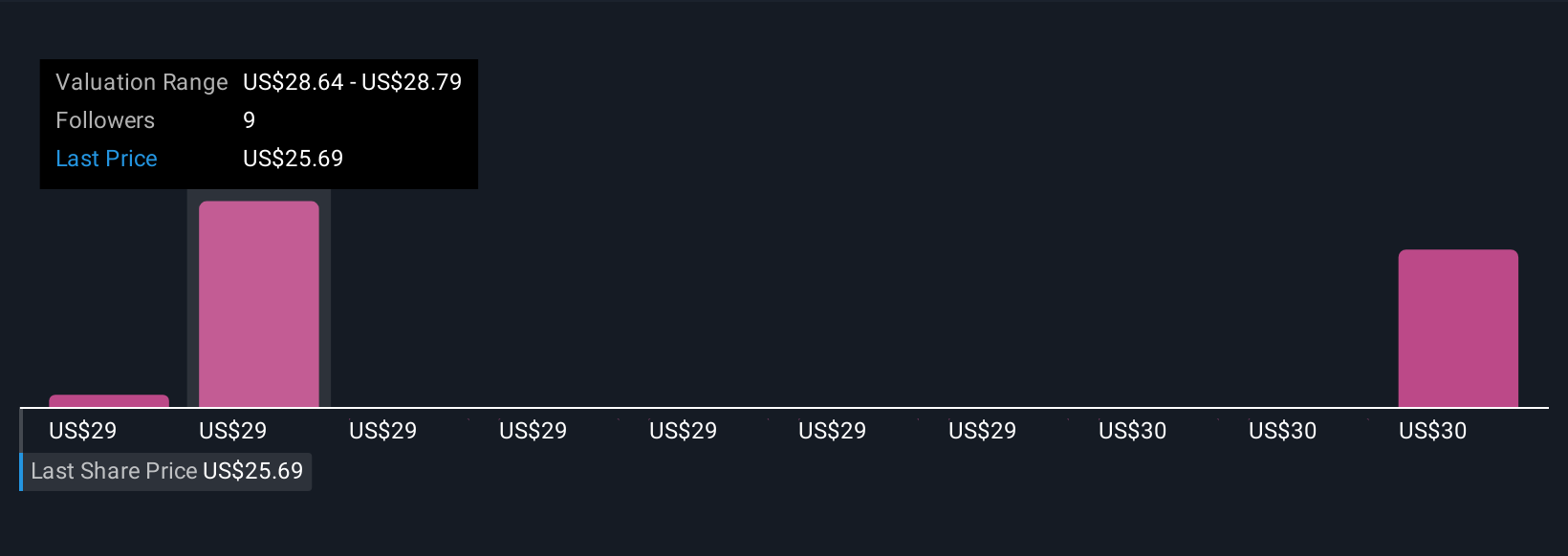

Three members of the Simply Wall St Community see fair value for Mueller Water Products between US$24.22 and US$27.67, underscoring how far personal estimates can spread. You can set these views against the current reliance on municipal repair and replacement demand, which ties the company’s fortunes to local budget decisions that may not align with your expectations.

Explore 3 other fair value estimates on Mueller Water Products - why the stock might be worth as much as 13% more than the current price!

Build Your Own Mueller Water Products Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mueller Water Products research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Mueller Water Products research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mueller Water Products' overall financial health at a glance.

No Opportunity In Mueller Water Products?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MWA

Mueller Water Products

Manufactures and markets products and services for the transmission, distribution, and measurement of water used by municipalities, and the residential and non-residential construction industries in the United States, Canada, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026