- United States

- /

- Construction

- /

- NYSE:MTZ

A Fresh Look at MasTec’s (MTZ) Valuation Following Strong Earnings Growth and Upgraded Outlook

Reviewed by Simply Wall St

MasTec (MTZ) delivered its third quarter earnings update, revealing considerable gains in both revenue and profits over the previous year. The company also raised its annual guidance, noting a record project backlog and strong demand.

See our latest analysis for MasTec.

MasTec’s upbeat earnings and raised outlook have certainly caught investors’ attention, with strong third-quarter results fueling optimism and a year-to-date share price return of 41.15%. Even after a dip of 1.70% in the most recent session, the narrative of long-term value stands out, highlighted by a five-year total shareholder return of 248.56%. Momentum is building further as project backlogs reach new highs.

If you’re keen to spot what else is gaining traction, now’s a great moment to broaden your perspective and discover fast growing stocks with high insider ownership

MasTec’s impressive results and higher guidance have strengthened the bull case. However, with shares advancing strongly this year, the key question is whether more upside remains or if the market has already priced in the company’s growth expectations.

Most Popular Narrative: 17% Undervalued

With MasTec’s fair value estimate at $238 per share against a recent close of $197.60, the current price sits well below what the most widely followed narrative believes the stock is worth. The stage is set for investors to consider the key drivers fueling this assessment and to examine what could propel MasTec higher.

Recent policy developments (including extended tax credits for renewables and regulatory clarity from new federal legislation) have strengthened MasTec's bookings pipeline and provide long-duration tailwinds, reducing policy risk and supporting visibility on new project awards. This improves future revenue predictability and supports a higher valuation.

What explains this ambitious price target? There is an aggressive future growth runway, a major margin leap, and valuation assumptions that might surprise even seasoned investors. Find out how much future profit is built into that bullish outlook. Read on for the full breakdown.

Result: Fair Value of $238 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, even with these tailwinds, MasTec faces risks if demand softens or project execution stumbles. This could potentially pressure margins and future earnings growth.

Find out about the key risks to this MasTec narrative.

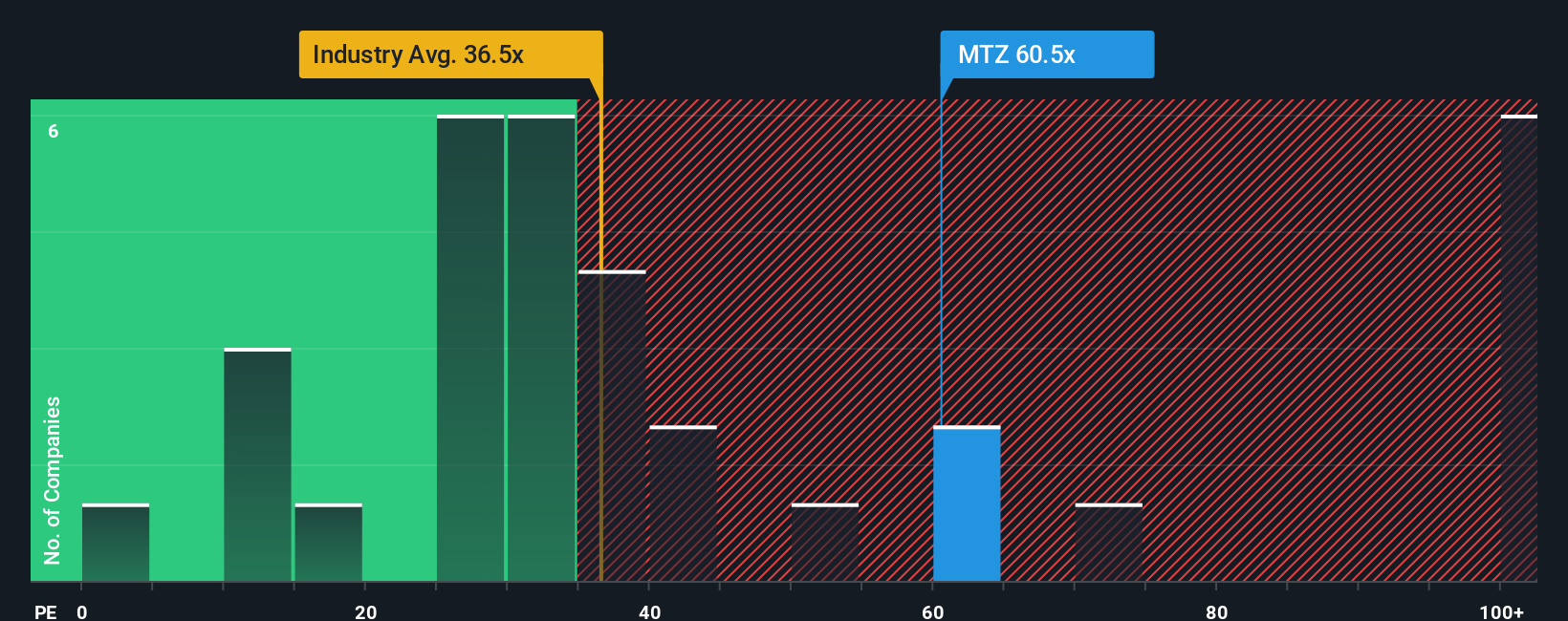

Another View: Market Comparisons Tell a Different Story

While the fair value estimate points to MasTec being undervalued, a look at the company’s price-to-earnings ratio offers a more cautious perspective. MasTec trades at 46.3 times earnings, which is higher than both the US Construction average (33.8x) and its peer group (48.8x), as well as above its fair ratio of 40.3x. This premium could signal market optimism or suggest elevated valuation risk. If the market rotates back toward fair value, will MasTec’s growth story be enough to hold its ground?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MasTec Narrative

If you feel a different story is emerging or if you’d rather dig into the numbers personally, you can build your own perspective in just a few minutes. Do it your way

A great starting point for your MasTec research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Thousands of investors use the Simply Wall Street Screener to stay a step ahead with unique opportunities in tomorrow’s leaders. Don’t let your next smart move pass by.

- Boost your income potential by checking out these 15 dividend stocks with yields > 3% delivering reliable yields above 3% and robust fundamentals.

- Uncover the next big leap in healthcare advancements by reviewing these 32 healthcare AI stocks at the forefront of innovation.

- Capitalize on underappreciated gems and target outstanding value with these 872 undervalued stocks based on cash flows based on compelling cash flow dynamics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTZ

MasTec

An infrastructure construction company, provides engineering, building, installation, maintenance, and upgrade services for communications, energy, utility, and other infrastructure primarily in the United States and Canada.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives