- United States

- /

- Building

- /

- NYSE:MAS

How Masco's (MAS) Earnings Miss and Tariff Risks May Influence Its Investment Story

Reviewed by Sasha Jovanovic

- Earlier this week, Masco reported third-quarter 2025 results that missed adjusted earnings and net sales estimates, largely due to underperformance in its Decorative Architectural Products segment, and lowered its full-year adjusted EPS outlook citing ongoing economic uncertainty and tariff risks.

- An interesting detail is that weakness in one business segment offset gains elsewhere, highlighting how segment diversity can impact overall financial outcomes for the company.

- We’ll now explore how Masco’s revised guidance and concerns over tariff-related risks may reshape its medium- and long-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Masco Investment Narrative Recap

To be a shareholder in Masco, it helps to believe in the ongoing demand for home improvement driven by an aging housing stock and the appeal of innovative, higher-margin home solutions. This week’s news, lowering full-year EPS guidance due to economic concerns and tariffs, hints that the most important short-term catalyst (a rebound in core product demand from repair and remodel) could be delayed, while the biggest risk, tariffs and input cost inflation, remains prominent and potentially material to near-term margins.

Among Masco’s recent actions, the update to its share repurchase program stands out. This quarter, Masco continued to buy back shares, signaling its focus on shareholder returns even during a period of weaker sales growth. Such buybacks are particularly relevant as they can help support EPS when operational headwinds, like those highlighted in the latest results, weigh on overall momentum.

By contrast, the ongoing risk of new or escalating tariffs is something investors should be alert to, as it could further impact...

Read the full narrative on Masco (it's free!)

Masco's narrative projects $8.7 billion revenue and $1.1 billion earnings by 2028. This requires 4.2% yearly revenue growth and a $295 million earnings increase from $805 million today.

Uncover how Masco's forecasts yield a $73.67 fair value, a 14% upside to its current price.

Exploring Other Perspectives

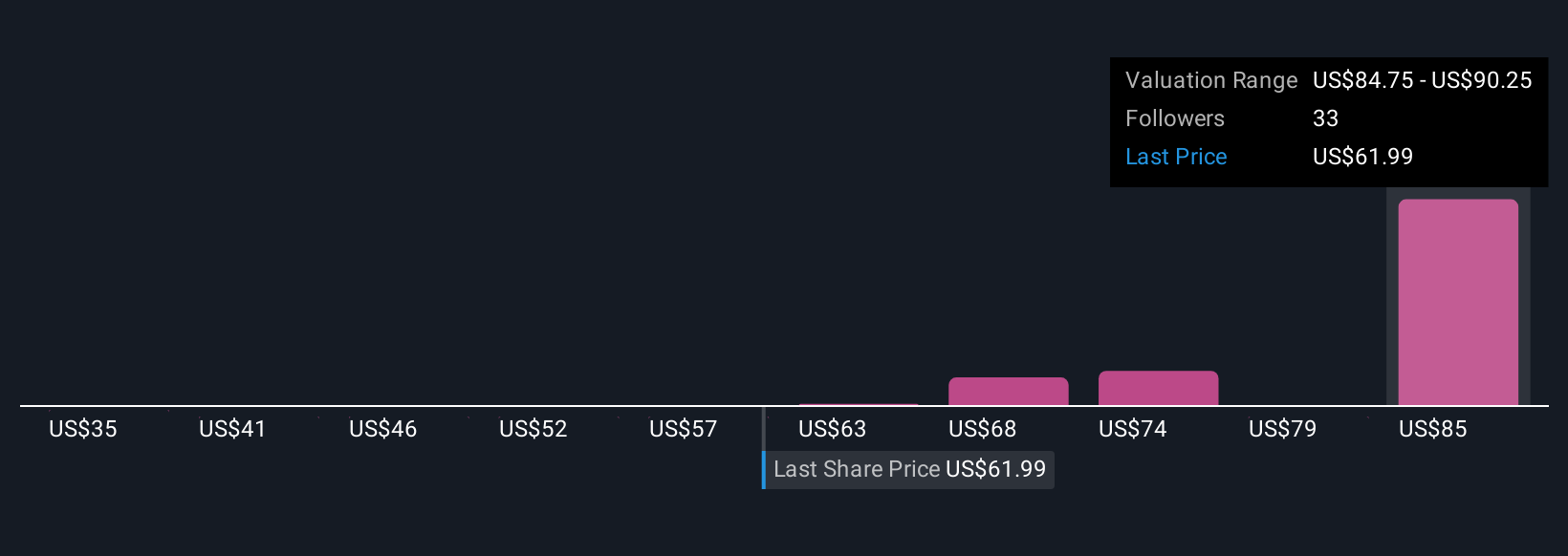

The Simply Wall St Community’s six fair value estimates for Masco range widely from US$35.27 to US$90.25 per share. With tariff risks and margin pressures looming, market participants clearly assess the future very differently, take a moment to compare these varying perspectives.

Explore 6 other fair value estimates on Masco - why the stock might be worth as much as 39% more than the current price!

Build Your Own Masco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Masco research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Masco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Masco's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAS

Masco

Provides home improvement and building products in North America, Europe, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026