- United States

- /

- Banks

- /

- NasdaqGS:GSBC

Undiscovered Gems in the US Market for December 2025

Reviewed by Simply Wall St

As the United States market navigates through a period of cautious optimism with major indices like the Dow Jones and S&P 500 ticking higher amidst anticipated Federal Reserve rate cuts, investors are keenly observing economic indicators such as job openings that suggest resilience in the labor market. In this dynamic environment, identifying stocks that offer potential growth opportunities often involves looking beyond well-trodden paths to uncover lesser-known companies with strong fundamentals and innovative strategies.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

NB Bancorp (NBBK)

Simply Wall St Value Rating: ★★★★★★

Overview: NB Bancorp, Inc. operates as a bank holding company for Needham Bank, offering a range of banking products and services in the Greater Boston area, with a market cap of $748.85 million.

Operations: NBBK generates revenue primarily through its thrift/savings and loan institutions, amounting to $189.48 million. The company has a market capitalization of approximately $748.85 million.

NB Bancorp, with total assets of US$5.4 billion and a net equity of US$737 million, demonstrates robust financial health. It has an appropriate level of bad loans at 0.2% and a substantial allowance for these at 379%. The bank's liabilities are primarily low-risk, with customer deposits making up 97% of them. Recently, NB Bancorp completed the acquisition of Provident Bancorp, enhancing its market position. The company repurchased over two million shares this year for US$34.76 million, reflecting confidence in its valuation with a price-to-earnings ratio of 12.9x compared to the US market's 18.7x average.

- Click here and access our complete health analysis report to understand the dynamics of NB Bancorp.

Assess NB Bancorp's past performance with our detailed historical performance reports.

Great Southern Bancorp (GSBC)

Simply Wall St Value Rating: ★★★★★★

Overview: Great Southern Bancorp, Inc. is a bank holding company for Great Southern Bank, offering various financial services across the United States with a market capitalization of approximately $690.55 million.

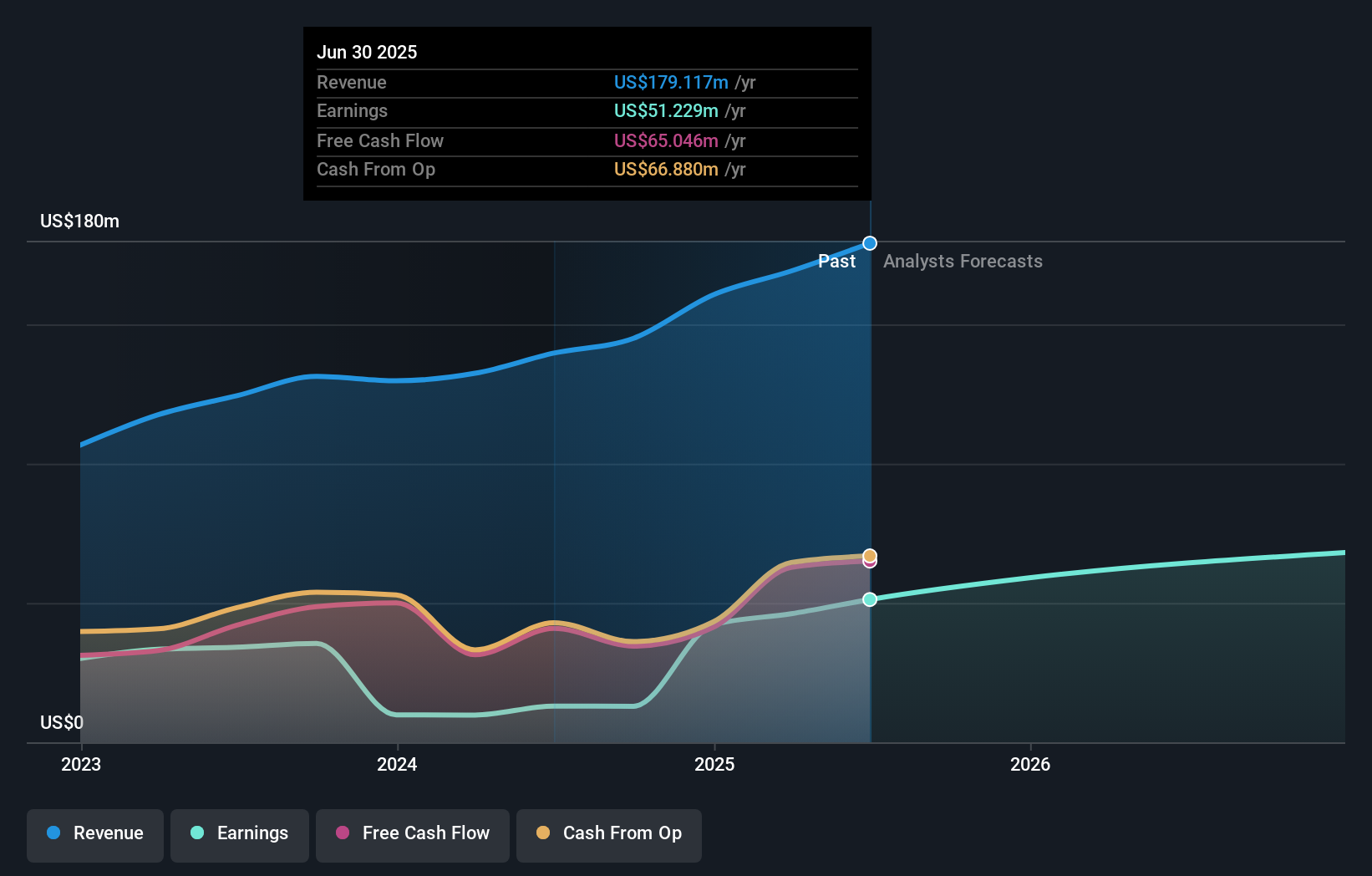

Operations: Great Southern Bancorp generates revenue primarily from its banking operations, totaling approximately $228.68 million. The company's financial performance includes a net profit margin that reflects its efficiency in managing costs relative to its revenue streams.

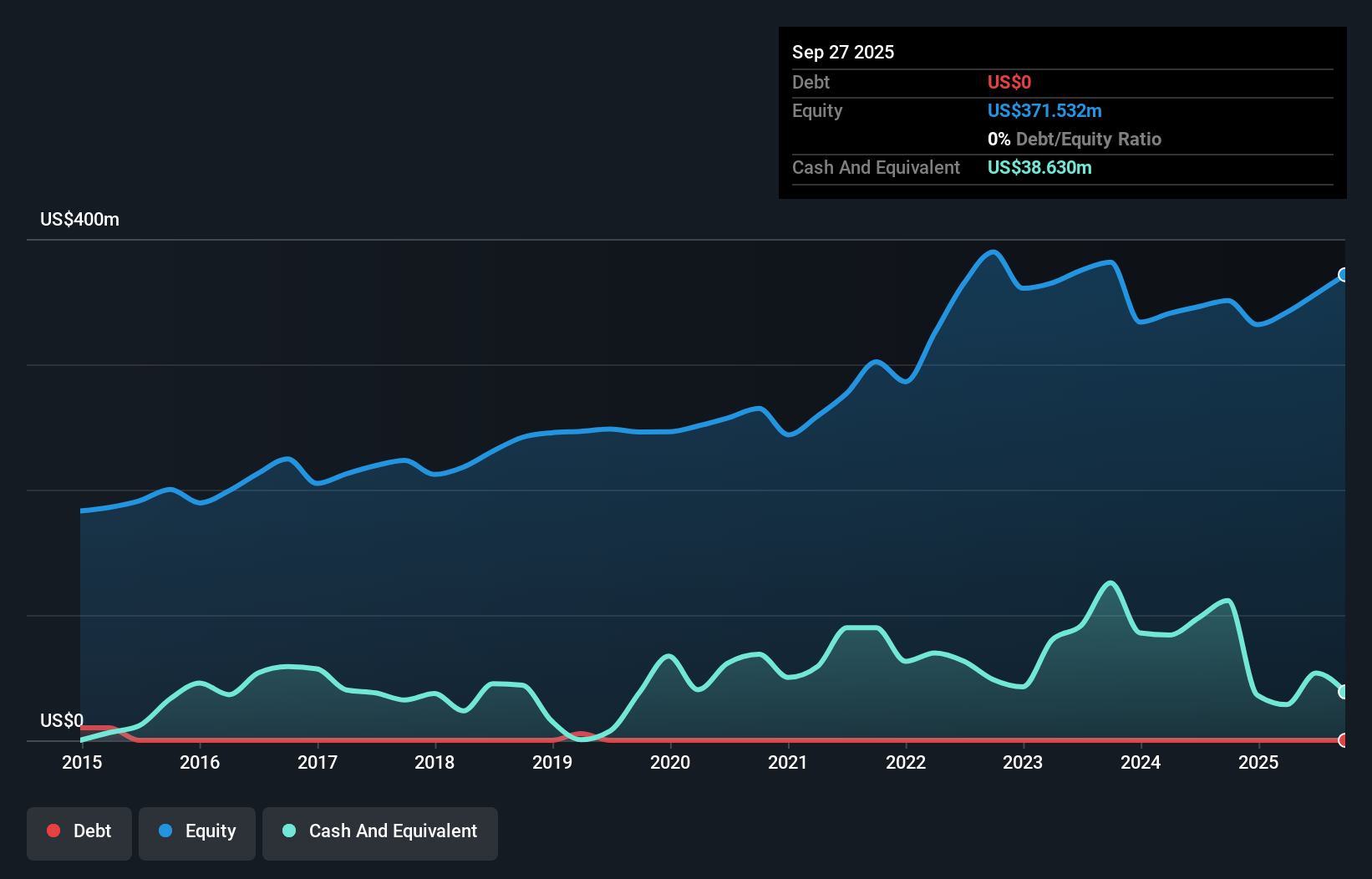

Navigating the competitive landscape, Great Southern Bancorp stands out with total assets of US$5.7 billion and equity of US$632.9 million, reflecting a robust balance sheet. The bank's net interest margin is 3.4%, supported by low-risk funding sources comprising 89% customer deposits, mitigating external borrowing risks. Despite challenges from fintech competition and regional economic dependencies, its conservative risk management keeps non-performing loans at an appropriate level of 0%. Recent buybacks totaled 1 million shares for US$54.2 million, indicating confidence in its valuation trading at a significant discount to fair value estimates while maintaining strong capital levels for growth resilience.

Insteel Industries (IIIN)

Simply Wall St Value Rating: ★★★★★★

Overview: Insteel Industries Inc., with a market cap of $614.92 million, manufactures and markets steel wire reinforcing products for concrete construction applications through its subsidiaries.

Operations: Insteel generates revenue primarily from its concrete reinforcing products, totaling $647.71 million. The company's gross profit margin is a key financial metric to consider when evaluating its performance.

Insteel Industries, a nimble player in the steel wire reinforcing market, has seen its earnings jump by 112% over the past year, outpacing the broader building industry. The firm is trading at 56.5% below estimated fair value and remains debt-free, ensuring no worries about interest payments. Recent strategic moves include repurchasing shares worth $7.64 million and announcing dividends totaling $1.03 per share for December 2025 payouts. Despite challenges like tariff uncertainties and reliance on imports, Insteel's strong liquidity and operational efficiency efforts position it well to leverage federal infrastructure funding for future growth.

Where To Now?

- Click here to access our complete index of 300 US Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GSBC

Great Southern Bancorp

Operates as a bank holding company for Great Southern Bank that provides a range of financial services in the United States.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026