- United States

- /

- Hospitality

- /

- NasdaqGS:SRAD

3 Stocks Estimated To Be Undervalued In December 2025

Reviewed by Simply Wall St

As the Federal Reserve meeting unfolds and major indices like the Dow Jones, S&P 500, and Nasdaq show modest gains, investors are keenly observing how potential interest rate cuts might influence market dynamics. In this environment of cautious optimism and strategic shifts, identifying undervalued stocks becomes crucial for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sportradar Group (SRAD) | $22.94 | $45.86 | 50% |

| Schrödinger (SDGR) | $17.76 | $35.43 | 49.9% |

| Pattern Group (PTRN) | $12.85 | $25.47 | 49.5% |

| Palomar Holdings (PLMR) | $115.43 | $224.09 | 48.5% |

| MoneyHero (MNY) | $1.20 | $2.40 | 50% |

| Lyft (LYFT) | $22.49 | $43.58 | 48.4% |

| Investar Holding (ISTR) | $26.17 | $51.21 | 48.9% |

| DexCom (DXCM) | $65.62 | $127.10 | 48.4% |

| Coeur Mining (CDE) | $15.31 | $29.97 | 48.9% |

| Clearfield (CLFD) | $29.49 | $58.68 | 49.7% |

Let's dive into some prime choices out of the screener.

Sportradar Group (SRAD)

Overview: Sportradar Group AG, along with its subsidiaries, offers sports data services to the sports betting and media sectors across various global regions including Switzerland, the United States, and others, with a market cap of approximately $6.86 billion.

Operations: The company's revenue is primarily derived from its Data Processing segment, which generated €1.23 billion.

Estimated Discount To Fair Value: 50%

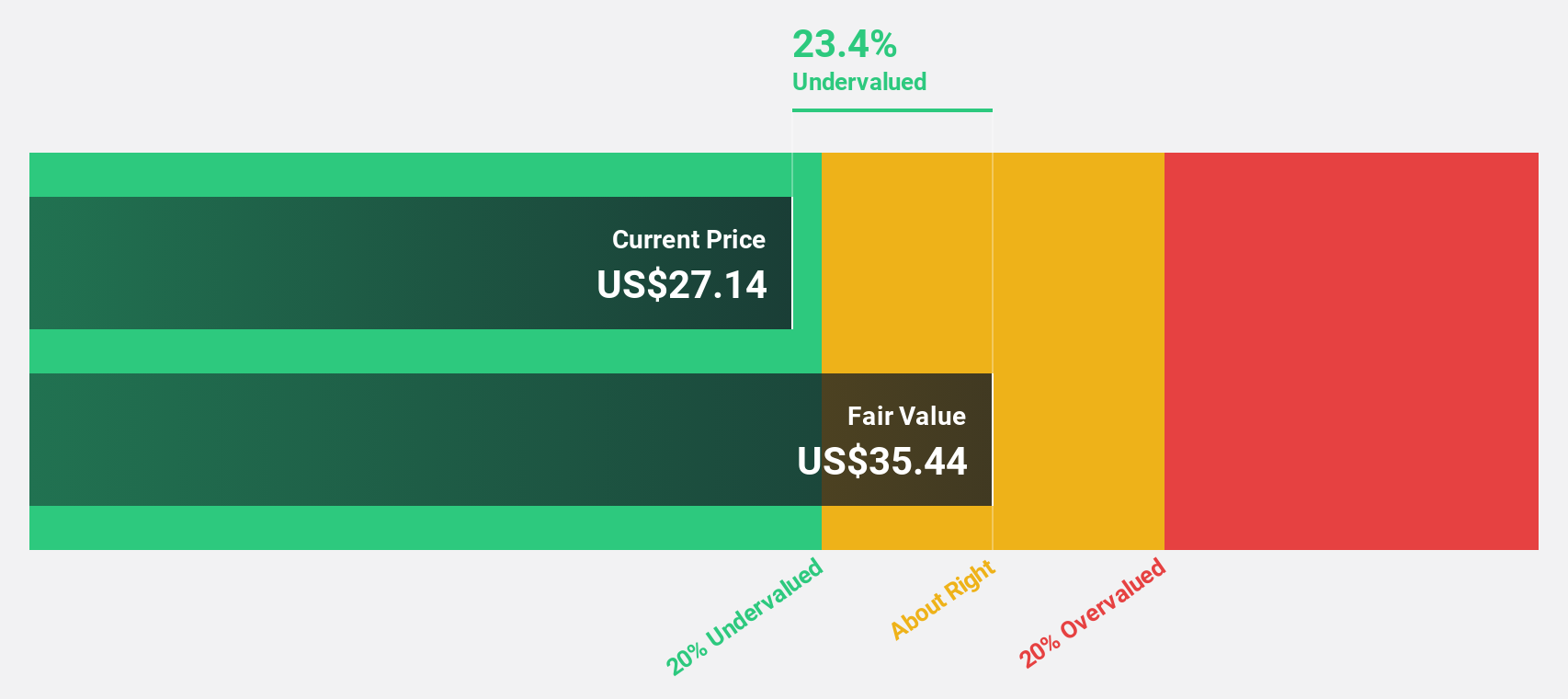

Sportradar Group's stock is trading at US$22.94, significantly below its estimated fair value of US$45.86, indicating potential undervaluation based on discounted cash flow analysis. The company's earnings are expected to grow significantly at 30.12% annually over the next three years, outpacing the broader market's growth rate. Recent developments include raised fiscal 2025 revenue guidance with projected growth of at least 17%, and a strategic partnership enhancing responsible gaming solutions in the U.S.

- According our earnings growth report, there's an indication that Sportradar Group might be ready to expand.

- Navigate through the intricacies of Sportradar Group with our comprehensive financial health report here.

Zscaler (ZS)

Overview: Zscaler, Inc. is a global cloud security company with a market cap of $38.70 billion.

Operations: The company generates revenue primarily through sales of subscription services to its cloud platform and related support services, amounting to $2.83 billion.

Estimated Discount To Fair Value: 15.1%

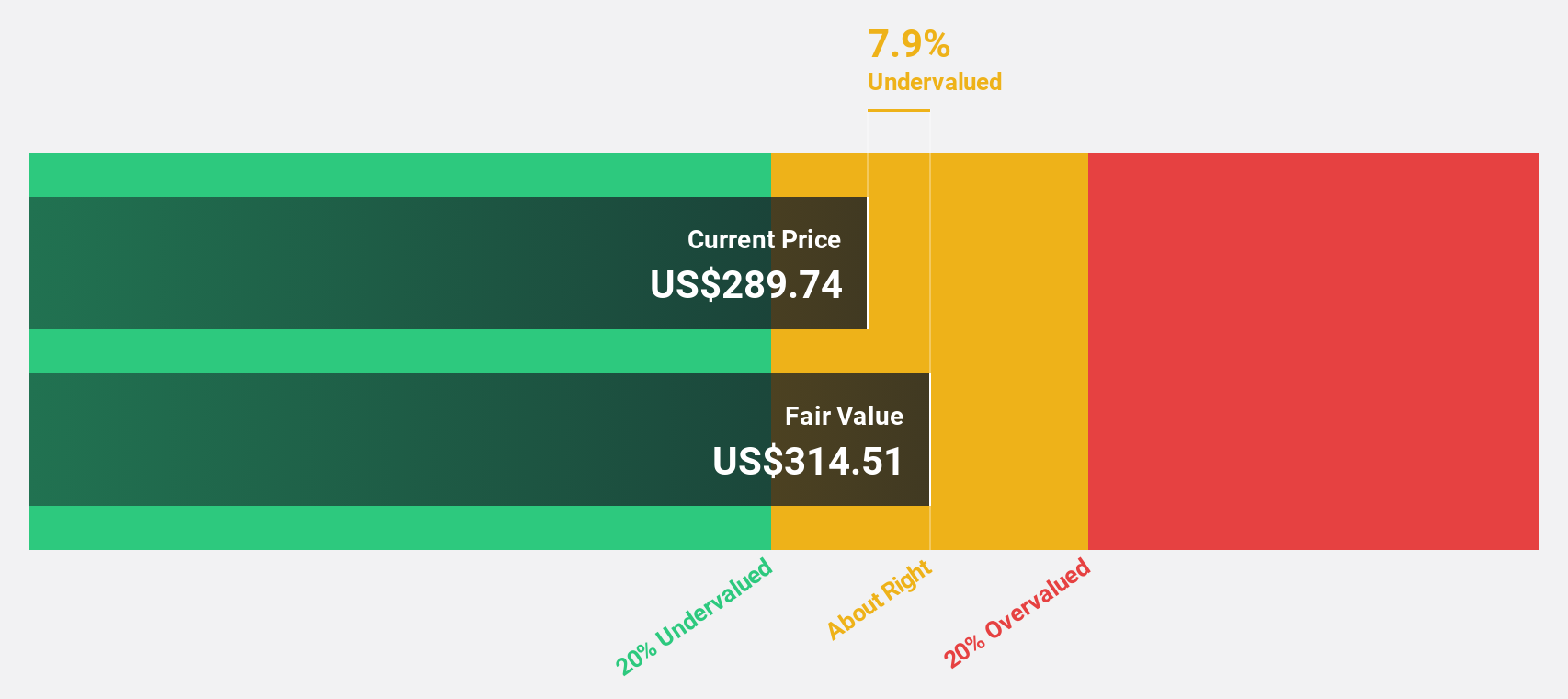

Zscaler is trading at US$244.88, below its estimated fair value of US$288.34, suggesting it may be undervalued based on cash flow analysis. The company anticipates strong revenue growth of 15.8% annually, exceeding the broader market's 10.7%. Recent strategic partnerships with Peraton and Orca Security enhance Zscaler's cybersecurity offerings and Zero Trust posture, potentially strengthening its market position as it aims for profitability within three years amidst growing sales figures.

- Our earnings growth report unveils the potential for significant increases in Zscaler's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Zscaler.

Hexcel (HXL)

Overview: Hexcel Corporation develops, manufactures, and markets carbon fibers, structural reinforcements, honeycomb structures, resins, and composite materials for commercial aerospace, space and defense, and industrial applications with a market cap of $6.10 billion.

Operations: Hexcel's revenue is primarily generated from its Composite Materials segment, which accounts for $1.58 billion, and its Engineered Products segment, contributing $381.70 million.

Estimated Discount To Fair Value: 18.3%

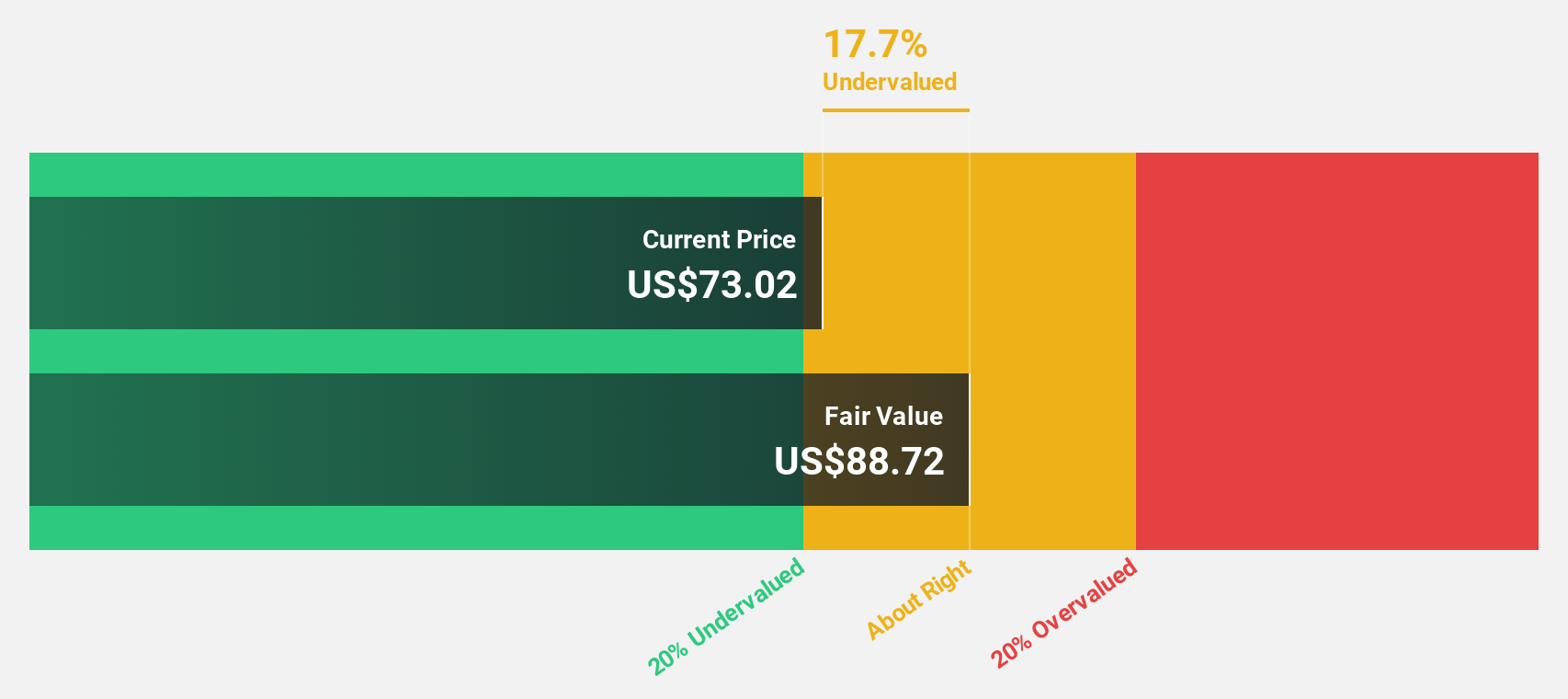

Hexcel, trading at US$78.61, is below its estimated fair value of US$96.24, reflecting potential undervaluation based on cash flow analysis. Despite a challenging year with declining profit margins and lower net income, Hexcel's earnings are forecast to grow significantly at 34.87% annually over the next three years. However, the company faces leadership changes with a new interim CFO and revised earnings guidance for 2025 sales around US$1.88 billion amidst high debt levels.

- Our comprehensive growth report raises the possibility that Hexcel is poised for substantial financial growth.

- Take a closer look at Hexcel's balance sheet health here in our report.

Seize The Opportunity

- Gain an insight into the universe of 208 Undervalued US Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRAD

Sportradar Group

Provides sports data services for the sports betting and media industries in Switzerland, the United States, North America, Africa, the Asia Pacific, the Middle East, Europe, Latin America, and the Caribbean.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026