- United States

- /

- Machinery

- /

- NYSE:HLIO

Will Helios Technologies’ (HLIO) CFO Transition Shape Its Long-Term Financial Strategy?

Reviewed by Sasha Jovanovic

- Earlier in November 2025, Helios Technologies announced the departure of Executive Vice President Michael Connaway and appointed Jeremy Evans as the new Chief Financial Officer, effective immediately.

- Evans, who joined Helios in early 2024 and recently served as Chief Accounting Officer, brings more than two decades of operational and financial leadership to his new executive role.

- We’ll explore how Jeremy Evans’s leadership transition as CFO may influence Helios Technologies’ long-term operational focus and investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Helios Technologies Investment Narrative Recap

To be a shareholder in Helios Technologies, you generally need to believe in the company's ability to innovate beyond traditional hydraulic and mechanical systems, especially as end-markets move toward electrification and digital solutions. The recent CFO leadership change is not expected to materially impact the most important near-term catalysts, such as new product launches in automation and IoT; nor does it alter the primary risk of ongoing sector shifts affecting core demand.

Among recent events, the Q3 2025 earnings announcement stands out, reporting higher sales year-on-year and raising full-year guidance, despite a slight dip in net income and continued margin pressure. This update reinforces the company’s focus on operational efficiency, which ties into catalysts around cost rationalization and improved core brand performance.

But for investors, a key point to watch, despite stable leadership transitions, remains the risk that traditional product reliance could...

Read the full narrative on Helios Technologies (it's free!)

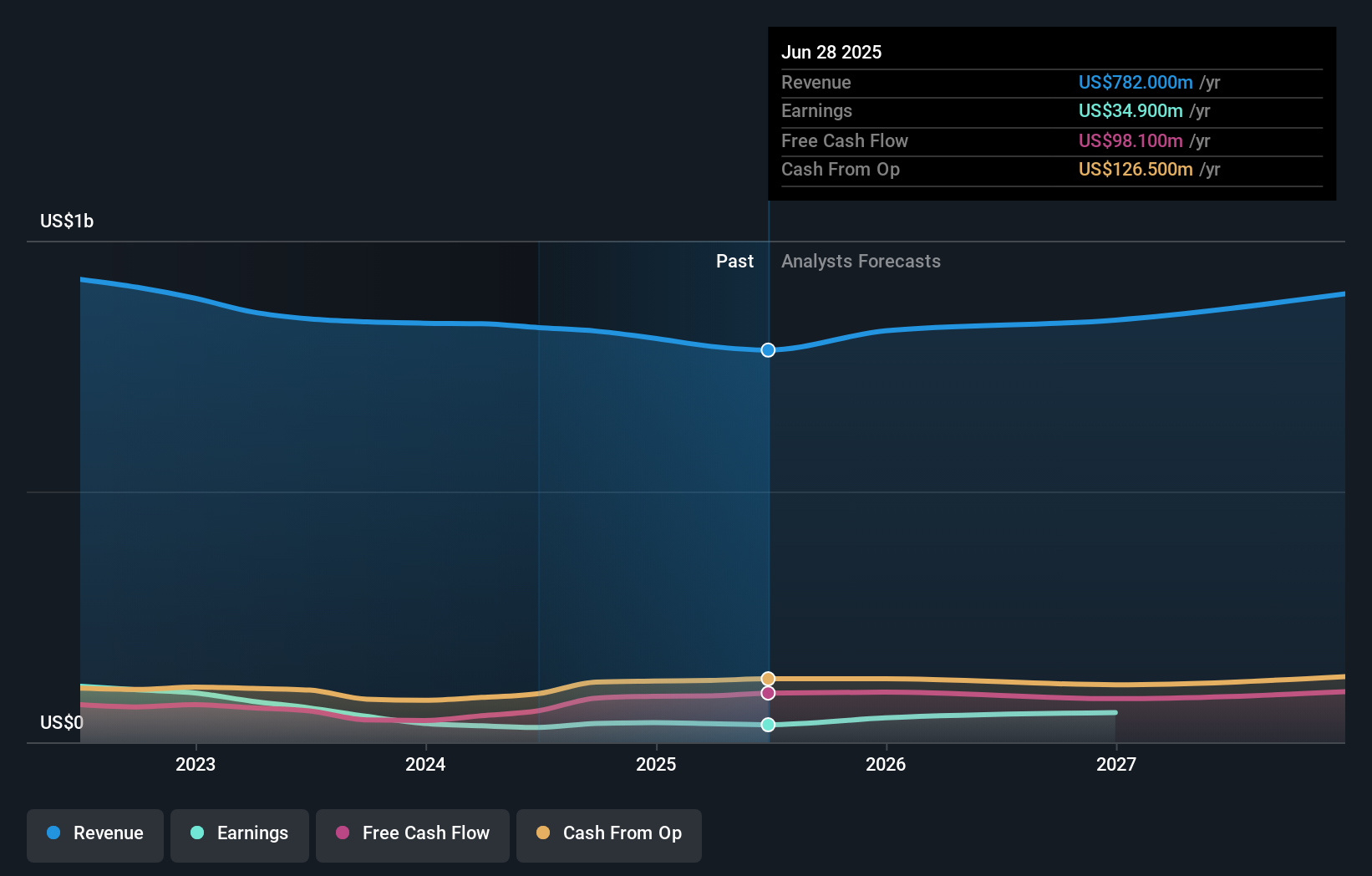

Helios Technologies' narrative projects $881.8 million revenue and $95.2 million earnings by 2028. This requires 4.1% yearly revenue growth and a $60.3 million earnings increase from $34.9 million today.

Uncover how Helios Technologies' forecasts yield a $65.20 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community contributors estimate Helios Technologies’ fair value between US$65.20 and US$71.13, based on two separate analyses. While optimism exists for growth from new product innovation, the ongoing sector shift toward electrification may affect long-term demand, giving plenty of room for differing viewpoints.

Explore 2 other fair value estimates on Helios Technologies - why the stock might be worth as much as 32% more than the current price!

Build Your Own Helios Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Helios Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Helios Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Helios Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helios Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLIO

Helios Technologies

Provides engineered motion control and electronic controls technology solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026