- United States

- /

- Machinery

- /

- NYSE:HI

A Look at Hillenbrand’s Valuation Following Strong Profit Turnaround in Latest Financial Results

Reviewed by Simply Wall St

Hillenbrand (HI) just released its latest financial results, showing a major swing in profitability for both the fourth quarter and the full year. While overall sales declined, the company reported net income and earnings per share that turned sharply higher compared to last year.

See our latest analysis for Hillenbrand.

Shares of Hillenbrand have seen renewed momentum, climbing 25.4% over the past 90 days as investors responded positively to the company’s return to profitability. However, the 1-year total shareholder return remains negative at -2.96%, reflecting how recent gains are working to reverse a longer-term slide.

If you’re interested in expanding your search, now’s a great moment to discover fast growing stocks with high insider ownership.

With shares still trading at a small discount to analyst price targets and recent gains reversing a longer-term slide, the question remains: is Hillenbrand undervalued, or is the market already factoring in all the expected future growth?

Most Popular Narrative: 3.5% Undervalued

With Hillenbrand’s last close at $31.84 and the most widely followed narrative assigning fair value at $33.00, the gap signals modest upside based on long-term earnings strength, not just recent performance reversals.

Refocused portfolio and investments in automation, digital services, and R&D are expected to boost margins and drive stable, long-term earnings growth. Strong global demand trends and supply chain optimization position Hillenbrand to rebound with higher revenue and greater resilience amid macro uncertainties.

Wondering why analysts set their sights higher than current prices? Beneath this fair value is a blueprint involving rising margins, ambitious bottom-line targets, and bold new segment bets. The numbers fueling their optimism will surprise you. Find out exactly how much future earnings power and operational transformation is built into this $33.00 target.

Result: Fair Value of $33.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing global uncertainty and integration challenges could quickly undermine Hillenbrand’s recovery narrative, particularly if order volumes or margin improvements decline further.

Find out about the key risks to this Hillenbrand narrative.

Another View: Multiple-Based Valuation Raises Questions

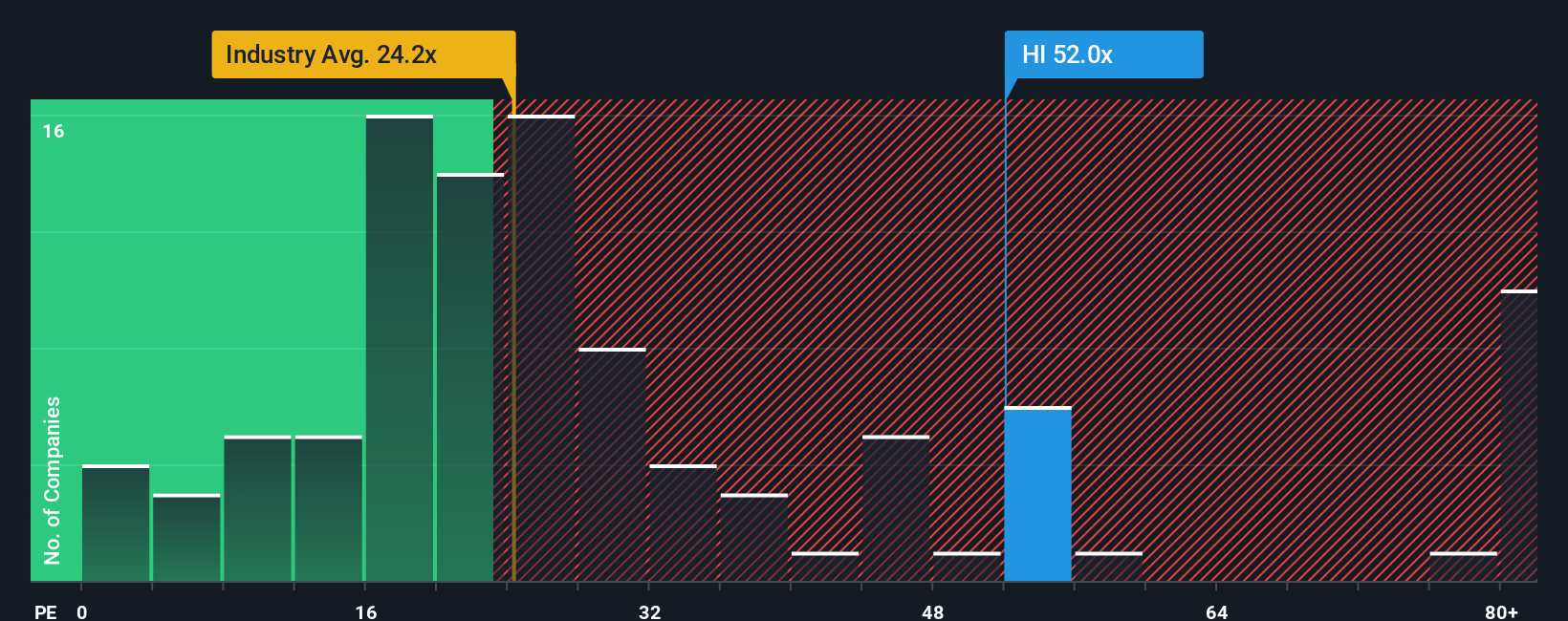

Looking at Hillenbrand's valuation using its price-to-earnings ratio provides a different perspective. The company trades at 52.1 times earnings, which is significantly higher than both its peers (33x) and the broader US Machinery industry average (24.8x). While this multiple suggests investors expect strong future growth, it also highlights the risk of overpaying if earnings do not accelerate as anticipated. Could this mean today's price already includes much of the optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hillenbrand Narrative

If you see things differently or want to dig deeper into the numbers, shaping your own narrative takes just a few minutes. Do it your way.

A great starting point for your Hillenbrand research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Opportunities do not wait around long. See what you might be missing by checking these handpicked stock ideas tailored to exciting market trends.

- Tap into untapped market potential by scanning these 3572 penny stocks with strong financials and catch smaller stocks that may offer growth potential before the crowd.

- Boost your portfolio’s income with stability by selecting from these 15 dividend stocks with yields > 3% offering reliable yields above 3%.

- Ride the surge in disruptive technology by exploring these 25 AI penny stocks that are powering breakthroughs in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hillenbrand might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HI

Hillenbrand

Operates as an industrial company, and processing equipment and solutions in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.