- United States

- /

- Trade Distributors

- /

- NYSE:GWW

W.W. Grainger (GWW) Margin Tops Prior Year, Reinforcing Profitability Narrative as Growth Slows

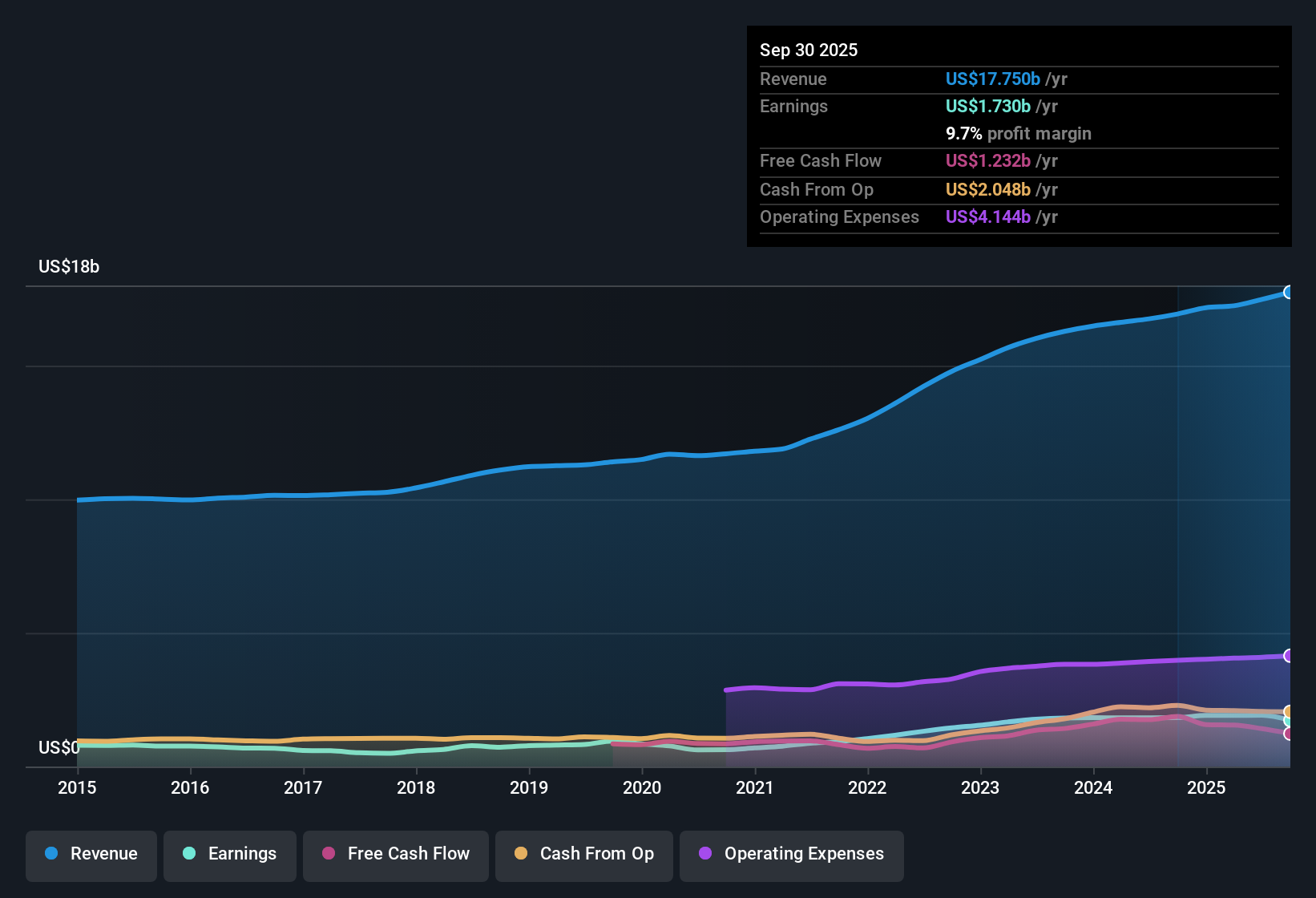

Reviewed by Simply Wall St

W.W. Grainger (GWW) finished the period with a net profit margin of 11%, a slight uptick from last year’s 10.9%. Over the past five years, the company’s earnings have grown at an average annual rate of 20.9%, though this most recent year saw growth slow to 5.7%. Looking ahead, projected annual earnings growth of 8.7% and revenue growth of 6.3% both trail the broader U.S. market rates. Shares trade at a Price-to-Earnings ratio of 24.4x, which is above peer and industry averages, while currently sitting above a discounted cash flow estimate of fair value. Investors are likely to view these results as a sign of a consistently profitable business with a strong historical track record, but with a more modest near-term growth outlook and valuation reflecting these tempered expectations.

See our full analysis for W.W. Grainger.The next section will examine how these headline numbers compare to the prevailing market narrative, highlighting where conventional wisdom stands firm and where this earnings release might offer a fresh perspective.

See what the community is saying about W.W. Grainger

Margin Strength Anchored by Digital and Private Label

- W.W. Grainger’s net profit margin remained steady at 11% this year, with analysts expecting it to dip only slightly to 10.9% over the next three years. This indicates strong underlying profitability despite industry headwinds.

- According to the analysts' consensus view, the company’s scale, expanding digital platforms, and growing mix of private label products are expected to offset margin pressure by:

- Enabling high-touch and automated supply chain solutions as B2B e-commerce grows. This allows Grainger to capture new revenue streams even as margin tailwinds soften.

- Supporting stable free cash flow, with ongoing investments in infrastructure and automation helping to counteract persistent inflation and tariff-related pressure on gross margins.

The consensus narrative highlights how Grainger’s margin resilience and focus on supply chain innovation are pivotal, especially as the sector shifts toward digital-led growth. 📊 Read the full W.W. Grainger Consensus Narrative.

Capital Allocation Bolsters Shareholder Returns

- Analysts expect Grainger to generate robust free cash flow and reduce shares outstanding by 1.78% per year over the next three years. This supports ongoing dividends and buybacks that enhance long-term earnings per share growth.

- Consensus narrative notes that the company’s investment in operational upgrades and its disciplined capital allocation are core to weathering near-term headwinds:

- Steady cash generation enables reliable shareholder payouts. This helps sustain EPS growth even if revenue and margin expansion slow during muted MRO market conditions.

- Ongoing upgrades and supply chain improvements position Grainger to reinforce its competitive advantage. However, potential pressure on free cash flow from rising capital costs requires careful execution to maintain this strategy.

Valuation Sits Above Industry and DCF Benchmarks

- Shares have recently traded at $979.00, which is above the DCF fair value estimate of $912.44 and higher than both peer and industry Price-to-Earnings ratios. This underscores a premium compared to sector norms.

- According to the consensus narrative, this premium valuation assumes that Grainger can deliver on analysts’ expectations for $2.3 billion in earnings by 2028 and maintain its current profitability:

- With the analyst price target at $1,051.43, just 7.4% above current levels, the market appears to be factoring in most of the anticipated steady growth and risk profile. This leaves less room for upside mispricing.

- This setup reinforces the need for investors to closely scrutinize both margin sustainability and ongoing top-line growth as key drivers behind the premium multiple.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for W.W. Grainger on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique angle on these figures? Share your insights and shape the conversation in just a few minutes. Do it your way

A great starting point for your W.W. Grainger research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite strong historical profitability, W.W. Grainger’s slowed earnings growth and premium valuation suggest limited upside compared to faster-growing peers.

For investors wanting more upside potential, discover high growth potential stocks screener (60 results) that could deliver stronger earnings growth over the next three years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W.W. Grainger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GWW

W.W. Grainger

Distributes maintenance, repair, and operating products and services primarily in North America, Japan, and the United Kingdom.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives