- United States

- /

- Trade Distributors

- /

- NYSE:GIC

How Investors May Respond To Global Industrial (GIC) Beating Expectations Across Earnings and Revenue

Reviewed by Sasha Jovanovic

- In the past quarter, Global Industrial (NYSE:GIC) reported results that exceeded analysts’ expectations for EPS, EBITDA, and revenue, standing out within the maintenance and repair distributors sector.

- Despite consistent strong returns on equity, the company had seen limited earnings growth in recent years, which has drawn industry analyst attention to forecasts of potential acceleration ahead.

- With Global Industrial’s quarterly performance surpassing forecasts, we’ll now explore how this earnings strength could affect the company’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Global Industrial Investment Narrative Recap

To be a shareholder in Global Industrial, you need to believe in its ability to capitalize on the ongoing shift toward specialized, higher-value customer segments and to expand its product range in the maintenance, repair, and operations market. The recent earnings beat underscores operational strength and may provide near-term support, but it does not materially offset the biggest immediate risk: potential gross margin compression if temporary benefits unwind and cost pressures persist in the supply chain.

Of the recent company announcements, the most relevant to this discussion is the July 29, 2025 Q2 earnings report, with sales and net income both up year over year. These stronger-than-expected results align with the company’s efforts to grow revenue from new product launches and a focus on more resilient, larger accounts, which are central to the current growth drivers, and are key considerations given potential headwinds to profitability in coming quarters.

However, against the backdrop of these gains, investors should be aware of lingering risks to gross margins if inventory and freight tailwinds reverse...

Read the full narrative on Global Industrial (it's free!)

Global Industrial's narrative projects $1.5 billion revenue and $102.1 million earnings by 2028. This requires 4.4% yearly revenue growth and a $36.7 million earnings increase from $65.4 million.

Uncover how Global Industrial's forecasts yield a $38.00 fair value, a 9% upside to its current price.

Exploring Other Perspectives

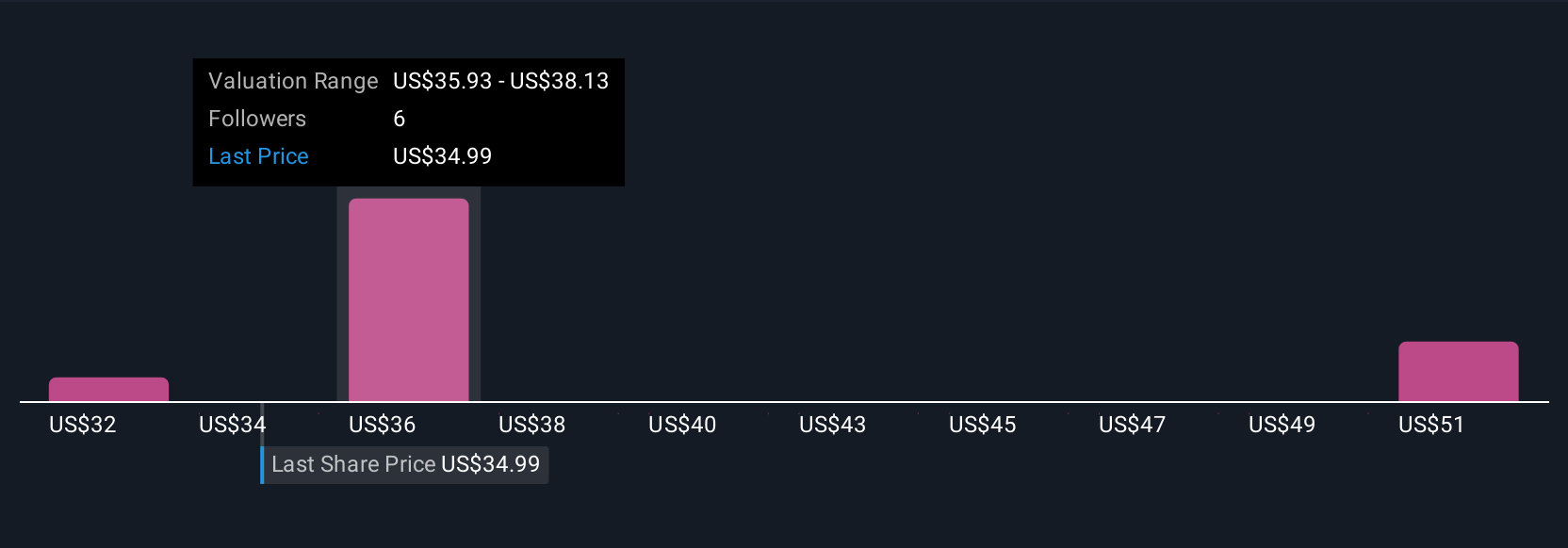

Three members of the Simply Wall St Community estimate Global Industrial’s fair value ranging from US$31.53 to US$53.81 per share. While opinions differ widely, many are watching closely how margin pressures could affect profit stability and longer-term expansion potential.

Explore 3 other fair value estimates on Global Industrial - why the stock might be worth as much as 54% more than the current price!

Build Your Own Global Industrial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Industrial research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Global Industrial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Industrial's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GIC

Global Industrial

Through its subsidiaries, operates as an industrial distributor of various industrial and maintenance, repair, and operation (MRO) products in the United States and Canada.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives