- United States

- /

- Machinery

- /

- NYSE:GGG

Graco (GGG): Valuation Check After New 15 Million Share Buyback and Dividend Increase

Reviewed by Simply Wall St

Graco (GGG) just doubled down on shareholder returns, rolling out authorization to repurchase up to 15 million shares alongside a 7% hike to its quarterly dividend, which signals management confidence.

See our latest analysis for Graco.

Those capital return moves land just as Graco’s share price, recently at $83.47, has cooled slightly with a negative 90 day share price return, even though the three year total shareholder return remains solidly positive. This suggests longer term momentum is still intact.

If this steady cash generator has caught your eye, it is also worth exploring other industrial names and seeing which ones screen well as fast growing stocks with high insider ownership.

Yet with shares trading slightly below analyst targets but not screamingly cheap on traditional metrics, the key question becomes: is Graco quietly undervalued today, or is the market already baking in its next leg of growth?

Most Popular Narrative: 9.7% Undervalued

With Graco closing at $83.47 versus a narrative fair value in the low $90s, the story leans toward upside if the growth path plays out.

The strategic decision to maintain a strong U.S. manufacturing footprint may give Graco an advantage over competitors who manufacture offshore, especially in light of ongoing trade tensions and tariffs, potentially improving net margins due to cost control and pricing power. The company is expecting benefits from the integration of the COROB acquisition, aiming to capture more revenue and expand its presence in North America, which should contribute to earnings growth.

Want to see why steady growth assumptions still support a premium earnings multiple here? The narrative quietly leans on rising margins, shrinking share count, and a surprisingly punchy profit trajectory. Curious which numbers need to fall into place for that to hold?

Result: Fair Value of $92.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if tariffs bite harder than expected or contractor segment margins stay under pressure, today’s seemingly modest discount could disappear quickly.

Find out about the key risks to this Graco narrative.

Another Angle on Valuation

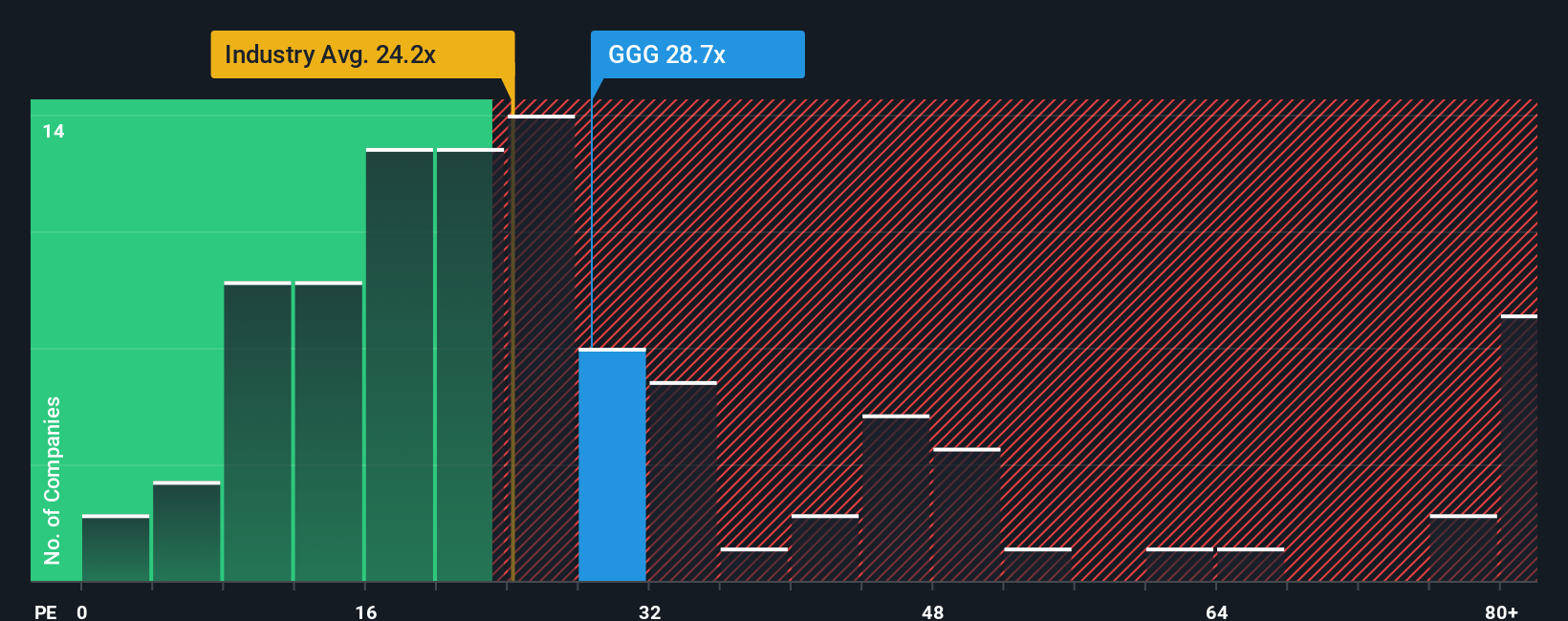

Look past that 9.7% upside narrative and the story shifts. On earnings, Graco trades at about 27.8 times profit, versus a fair ratio near 22.3 times and below peer and industry levels around 25 times, which hints at downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Graco Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a personalized view in minutes using Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Graco.

Looking for more investment ideas?

Before you move on, lock in your next opportunities by putting the Simply Wall St Screener to work for you and lining up potential ideas for tomorrow.

- Explore mispriced quality by checking out these 906 undervalued stocks based on cash flows where strong cash flows suggest the market may not fully reflect the available information.

- Focus on the next wave of innovation by targeting these 26 AI penny stocks that are involved in real world AI adoption.

- Consider your income potential through these 15 dividend stocks with yields > 3% that can help turn volatility into a more regular stream of portfolio cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GGG

Graco

Designs, manufactures, and markets systems and equipment used to move, measure, mix, control, dispense, and spray fluid and powder materials in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026