- United States

- /

- Electrical

- /

- NYSE:GEV

How Investors Are Reacting To GE Vernova (GEV) Expanding Asset Control and Accelerating Power Infrastructure Projects

Reviewed by Sasha Jovanovic

- In November 2025, GE Vernova began operations at the Jafurah Cogeneration ISPP in Saudi Arabia and announced it would acquire the remaining 50% ownership of Prolec GE, highlighting its global expansion and asset control. Industry attention has also turned to GE Vernova’s critical role in supplying infrastructure for nuclear and gas power, reinforced by ongoing supply constraints and demand from sectors such as data centers and artificial intelligence.

- These milestones underscore GE Vernova’s strengthening position in advancing energy infrastructure and highlight the importance of supply chain management amid accelerating demand for reliable power equipment.

- Now, we’ll explore how GE Vernova’s full acquisition of Prolec GE and new project launches may alter its investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

GE Vernova Investment Narrative Recap

For shareholders in GE Vernova, the big-picture thesis centers on delivering reliable, high-value infrastructure for energy transition and electrification, especially in nuclear and gas power, as global demand accelerates. While the Jafurah Cogeneration launch and Prolec GE acquisition reinforce the company’s reach and asset control, these recent developments are unlikely to materially change the most immediate catalyst, expanding the grid and meeting power equipment demand, nor do they eliminate risk from large project delays or cancellations, which can disrupt earnings visibility.

The announced full acquisition of Prolec GE stands out as especially relevant to the supply chain and asset management focus underpinning current growth catalysts. By gaining full control, GE Vernova consolidates its position in critical electrical components, which could be vital as order activity in grids and decarbonization accelerates and as supply constraints persist across the sector.

However, it is important to recognize that, despite these advances, the unpredictable timing of large infrastructure projects still poses a risk that investors should be aware of, particularly if...

Read the full narrative on GE Vernova (it's free!)

GE Vernova's outlook envisions $48.0 billion in revenue and $5.8 billion in earnings by 2028. This is based on a 9.5% annual revenue growth rate and a $4.6 billion increase in earnings from the current $1.2 billion.

Uncover how GE Vernova's forecasts yield a $678.93 fair value, a 22% upside to its current price.

Exploring Other Perspectives

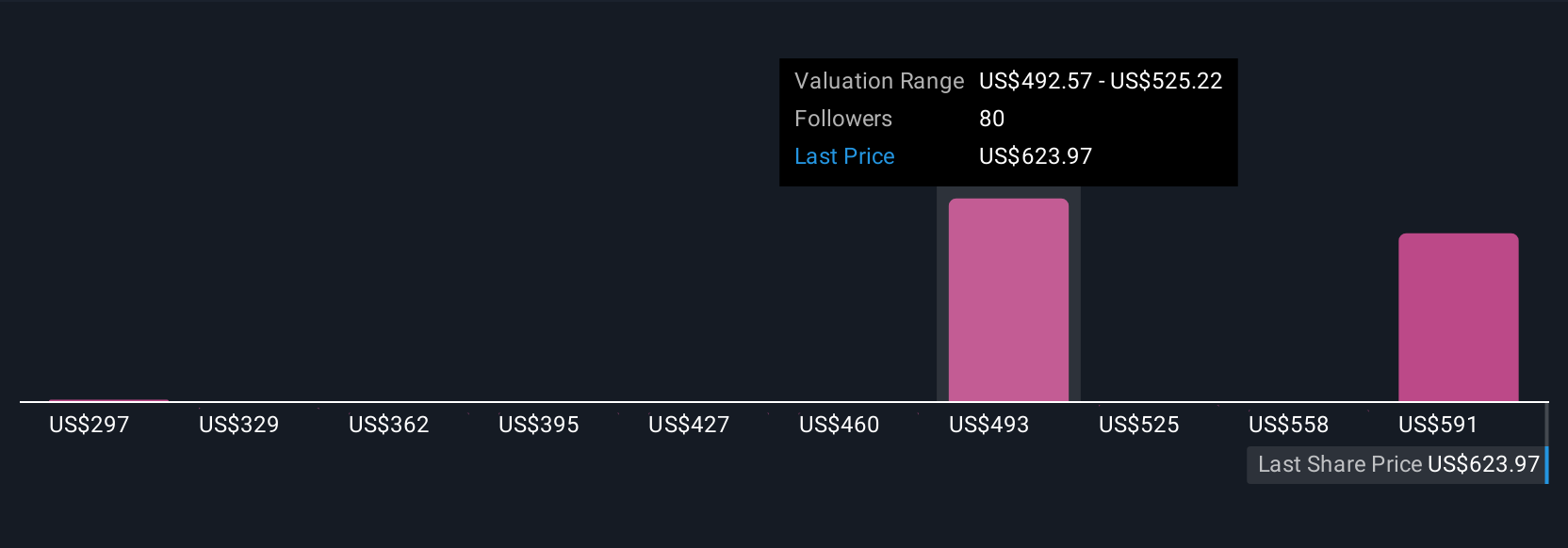

Eighteen fair value views from the Simply Wall St Community span from US$359.90 to US$760 per share, showing high diversity in outlook. While some are optimistic, the risk of project delays or volatile orders remains crucial for anyone considering the company’s future performance.

Explore 18 other fair value estimates on GE Vernova - why the stock might be worth as much as 36% more than the current price!

Build Your Own GE Vernova Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GE Vernova research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free GE Vernova research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GE Vernova's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives