- United States

- /

- Aerospace & Defense

- /

- NYSE:GE

A Fresh Look at General Electric's Valuation After Strategic Aerospace Deal With Saudia Group

Reviewed by Simply Wall St

General Electric (GE) has landed a multi-year agreement through its GE Aerospace unit to provide GEnx-1B engines and comprehensive maintenance services for Saudia Group's expanding Boeing 787 fleet. The partnership also includes training programs to strengthen aviation expertise in Saudi Arabia, highlighting ongoing global interest in GE’s aerospace technology.

See our latest analysis for General Electric.

General Electric’s share price may have dipped 6.6% over the past month, but the momentum is hardly slowing down when you look at the bigger picture. The 71.1% year-to-date share price return, paired with an impressive 60.9% total shareholder return over the past year and multi-year gains well above 400%, signals building enthusiasm for GE’s transformation story and the market’s growing confidence in its long-term aerospace strategy.

If deals like this one have you watching the sector, this is the perfect opportunity to discover more innovative names using our aerospace and defense stocks screener: See the full list for free.

But with shares already posting massive gains this year, investors are left asking whether GE still trades at a bargain or if markets are fully pricing in its aerospace-driven future growth potential.

Most Popular Narrative: 14.9% Undervalued

With General Electric’s last close at $288.45 and the narrative fair value set at $339, current analyst consensus points to meaningful potential upside in the shares, driven by expectations of accelerating aerospace momentum and improved profitability. The gap between market price and narrative value puts the spotlight on the factors supporting GE’s bullish long-term case.

Expansion and maturation of the installed base (LEAP engine base tripling, GEnx doubling by 2030), combined with fleet aging and delayed retirements, is fueling a sustained wave of shop visit activity and parts demand. This is directly contributing to robust and recurring services revenue and higher net margins through the decade.

How are analysts justifying this enticing target? There is a major focus on game-changing engines, sweeping efficiency upgrades, and a bold bet on recurring services. The underlying assumptions are more aggressive than you might expect for an industrial giant. Discover the precise drivers and the financial moves behind these high-stakes projections. Ready to see how the math shakes out?

Result: Fair Value of $339 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, as heavy reliance on commercial aviation and ongoing supply chain challenges could quickly disrupt this upside narrative if conditions shift unexpectedly.

Find out about the key risks to this General Electric narrative.

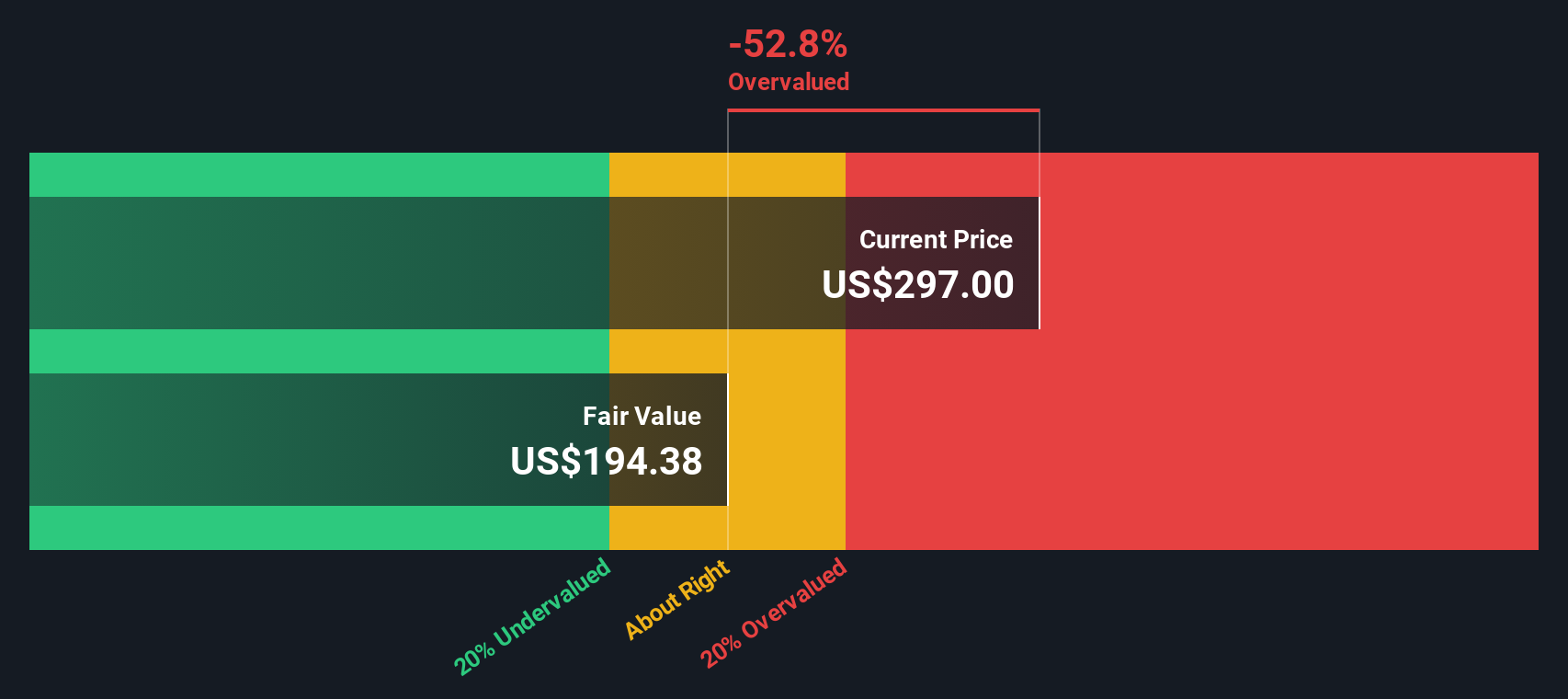

Another View: DCF Model Tells a Different Story

While analysts see upside based on aerospace momentum, our DCF model presents a more cautious perspective. It suggests GE is currently trading above its estimated fair value, which raises questions about how much future growth is already reflected in the price. Is the market overlooking potential risks, or simply placing significant confidence in transformation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out General Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own General Electric Narrative

If you see things differently or want to dive into the numbers firsthand, you can easily build your own story in just a few minutes. Do it your way

A great starting point for your General Electric research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

There is a world of potential beyond General Electric, and you will want to be first in line as new opportunities emerge. Do not wait to discover the investment themes everyone will be talking about next.

- Unlock fresh income potential and sort stocks yielding over 3% by using these 14 dividend stocks with yields > 3% to filter for high, reliable payouts.

- Capitalize on AI breakthroughs with these 25 AI penny stocks powering innovation across industries, from automation to data-driven healthcare.

- Seize the chance to pinpoint stocks trading well below their intrinsic value and start with these 923 undervalued stocks based on cash flows for the deepest bargains in the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GE

General Electric

General Electric Company, doing business as GE Aerospace, designs and produces commercial and defense aircraft engines, integrated engine components, electric power, and mechanical aircraft systems.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026