- United States

- /

- Aerospace & Defense

- /

- NYSE:GD

Does US Navy's $1.7 Billion Oiler Contract Strengthen General Dynamics' (GD) Naval Growth Story?

Reviewed by Sasha Jovanovic

- General Dynamics, through its NASSCO division, has recently secured a US$1.7 billion contract to build two additional John Lewis-class fleet replenishment oilers for the U.S. Navy, reinforcing its position in naval shipbuilding.

- This contract not only extends General Dynamics' existing ship series but also supports workforce stability and highlights continued demand for advanced maritime logistical solutions.

- We'll examine how the recent US$1.7 billion Navy contract could influence General Dynamics' long-term revenue growth and investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

General Dynamics Investment Narrative Recap

Investors interested in General Dynamics often look for strong long-term US defense spending, robust government contract flows, and stability across its core segments, especially Marine Systems. The recent US$1.7 billion Navy contract adds to backlog visibility but does not materially change the immediate catalyst: the company's ability to efficiently deliver on its expanding defense order book while managing supply chain challenges. The most important risk remains operational setbacks in key shipbuilding programs, potentially affecting margins and financial predictability.

Of the latest announcements, the US$642 million contract extension for Virginia-class submarine production directly relates to the firm's Marine Systems momentum, reinforcing the link between continued government funding and segment growth. This aligns with the positive impact seen from recent large contract wins, highlighting the ongoing importance of timely contract execution and throughput for near-term performance.

However, investors should keep in mind that despite these wins, persistent supply chain delays and episodic setbacks in the Marine segment could...

Read the full narrative on General Dynamics (it's free!)

General Dynamics is projected to reach $55.8 billion in revenue and $5.1 billion in earnings by 2028. This outlook assumes a 3.6% annual revenue growth rate and an increase in earnings of $1.0 billion from the current $4.1 billion.

Uncover how General Dynamics' forecasts yield a $379.17 fair value, a 8% upside to its current price.

Exploring Other Perspectives

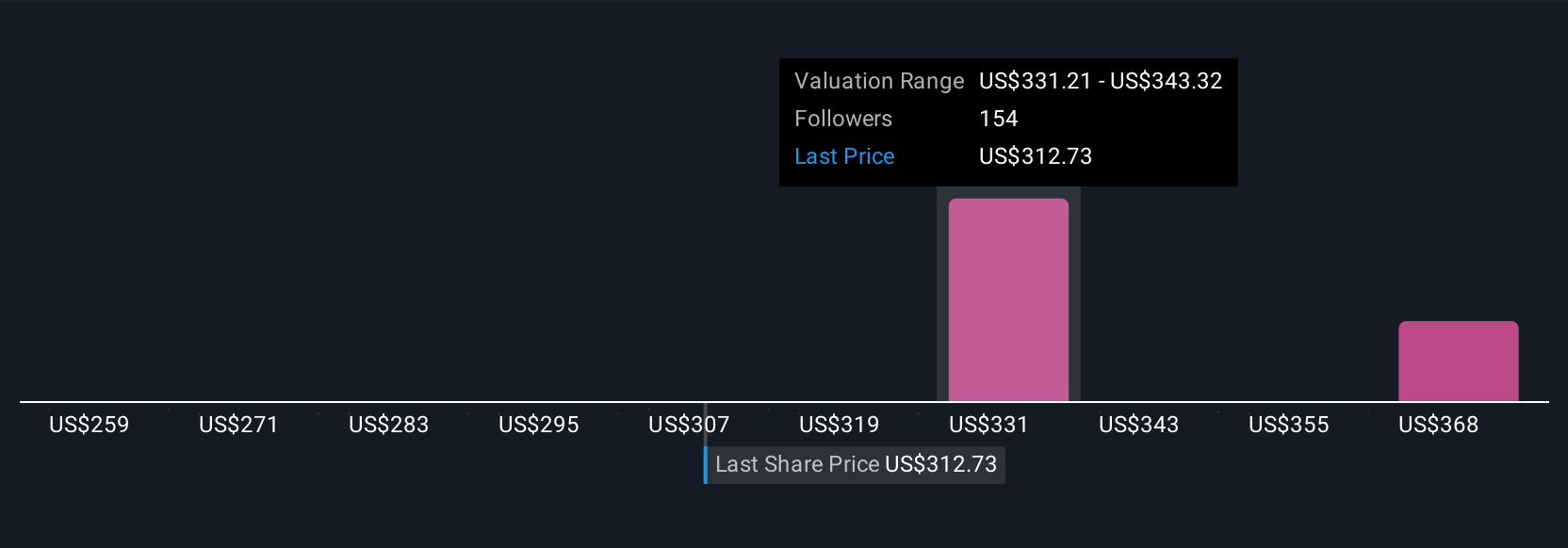

Six Simply Wall St Community fair value estimates for General Dynamics range from US$317.13 to US$379.17, showing a wide spread of views. Against this backdrop, continued supply chain stability remains a top concern for the company’s delivery and growth prospects, explore the spread of community insights for a broader view.

Explore 6 other fair value estimates on General Dynamics - why the stock might be worth as much as 8% more than the current price!

Build Your Own General Dynamics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your General Dynamics research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free General Dynamics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate General Dynamics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GD

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives