- United States

- /

- Construction

- /

- NYSE:FLR

Will Fluor's (FLR) Long‑Dated Texas Highway Win Reshape Its Backlog‑Driven Investment Narrative?

Reviewed by Sasha Jovanovic

- Fluor Corporation recently secured a lead role on a major State Highway 6 improvement project in Texas, upgrading a 12‑mile stretch from four to six lanes and targeting completion by 2030, with Knife River awarded a US$112 million asphalt and paving subcontract.

- This long‑dated infrastructure engagement highlights Fluor’s continuing access to large public works projects in the US, reinforcing the scale and visibility of its transportation portfolio.

- We’ll now explore how this long‑term Texas highway contract interacts with Fluor’s cash‑focused strategy and backlog‑driven investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Fluor Investment Narrative Recap

To own Fluor, you need to believe its backlog of complex EPC and infrastructure work can translate into steady cash generation despite project risk and lumpier earnings. The SH‑6 award is positive for long term visibility but does not materially change the short term focus on improving operating cash flow and managing delays and cost pressures that have recently weighed on results.

The SH‑6 project sits alongside newer wins like the LanzaJet Project Speedbird front end engineering contract in the UK, underscoring Fluor’s mix of traditional infrastructure and energy transition work. Together, these types of awards feed the backlog that underpins the company’s cash and earnings focused strategy, even as project timing and client decision delays remain key swing factors.

But while the Texas highway work adds visibility, investors should still be aware of Fluor’s recent negative operating cash flow and what that could mean for...

Read the full narrative on Fluor (it's free!)

Fluor's narrative projects $19.6 billion revenue and $511.6 million earnings by 2028. This requires 6.2% yearly revenue growth and an earnings decrease of about $3.6 billion from current earnings of $4.1 billion.

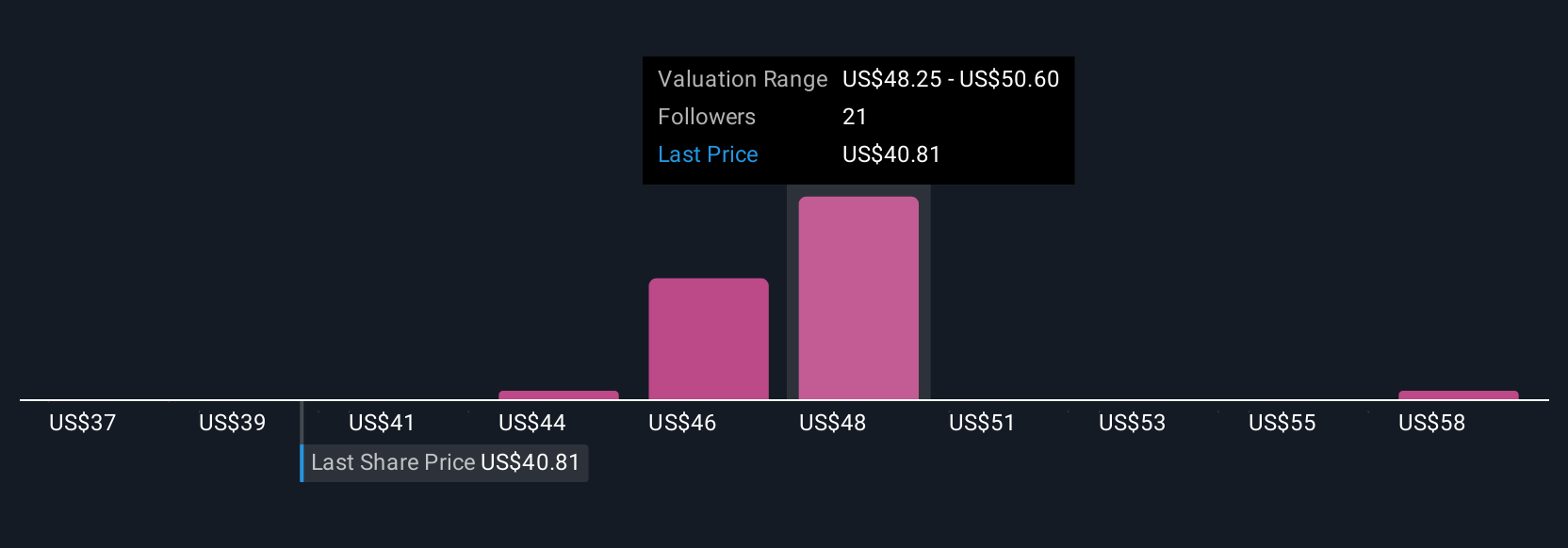

Uncover how Fluor's forecasts yield a $51.00 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly US$44.80 to US$65.50 per share, showing how far apart views can be. When you set those opinions against Fluor’s recent project delays and cost sensitivities among clients, it becomes even more important to weigh several different perspectives on how reliably the backlog can convert into cash and earnings.

Explore 8 other fair value estimates on Fluor - why the stock might be worth as much as 49% more than the current price!

Build Your Own Fluor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fluor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fluor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fluor's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLR

Fluor

Provides engineering, procurement, and construction (EPC); fabrication and modularization; and project management services worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026