- United States

- /

- Construction

- /

- NYSE:FIX

Comfort Systems USA (FIX): Evaluating Valuation After Dividend Boost, Credit Expansion, and Strategic Partnership Moves

Reviewed by Kshitija Bhandaru

Comfort Systems USA (FIX) has drawn attention with a series of moves, including entering a strategic partnership to boost cost efficiency, expanding its credit facility to $1.1 billion, and announcing an increased dividend.

See our latest analysis for Comfort Systems USA.

Those strategic moves seem to have kept the momentum alive for Comfort Systems USA, with the stock's long-term total shareholder returns painting a compelling picture. The company achieved a 13.5% gain over five years, despite only a modest 1-year total return. Investors appear to be weighing the recent business wins and pipeline strength against valuation and market expectations, as the share price sits at $818.01.

If you’re open to discovering what else the market offers beyond FIX, now may be the perfect time to broaden your search and explore fast growing stocks with high insider ownership

But after such a strong run and management’s display of confidence, is the current share price offering a genuine buying opportunity? Or has the market already priced in Comfort Systems USA’s future growth?

Most Popular Narrative: 2% Overvalued

Comfort Systems USA's last close of $818.01 slightly exceeds the narrative’s fair value estimate of $800.20, suggesting the stock is just above what leading analysts consider its intrinsic worth after revising their targets upward.

Ongoing business momentum is seen as supporting further upside to revenue and earnings forecasts in both the near term and medium term. Elevated cash flow generation is expected to translate into higher earnings growth.

What’s fueling this analyst optimism? There are bold revenue and profit targets built into the narrative. Curious what kind of growth and margin expansion is expected? See the surprising set of assumptions powering the price target behind the scenes.

Result: Fair Value of $800.20 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor shortages and heavy reliance on technology sector projects could challenge Comfort Systems USA’s current growth trajectory if conditions shift unexpectedly.

Find out about the key risks to this Comfort Systems USA narrative.

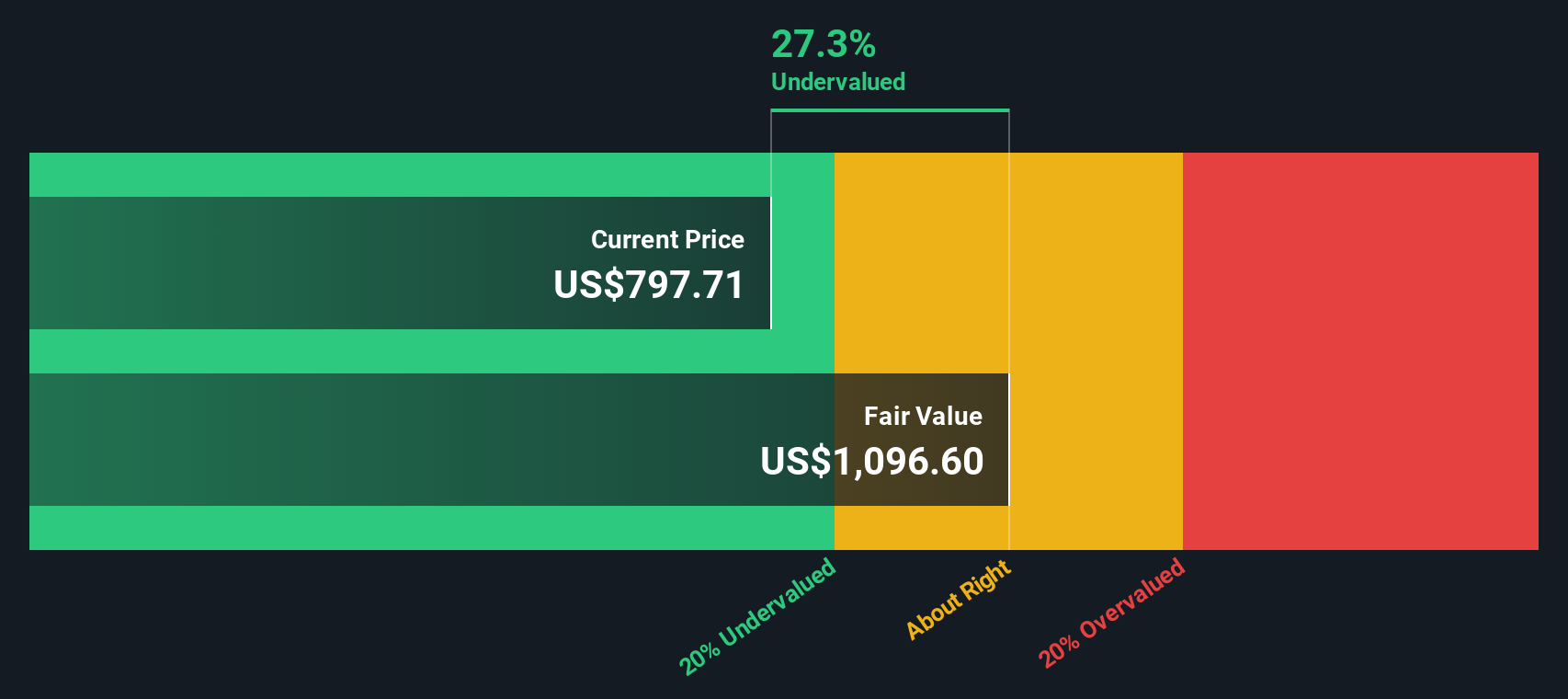

Another View: Discounted Cash Flow Analysis Says Undervalued

While the popular analyst price target points to Comfort Systems USA being just above fair value, our DCF model offers a different perspective. It suggests the shares are trading roughly 25% below their estimated intrinsic worth, which could indicate more upside than the market currently expects. Could this present an overlooked opportunity, or is the DCF model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Comfort Systems USA Narrative

If you have your own take on Comfort Systems USA's outlook or want to weigh the numbers yourself, you can assemble your own view quickly and easily, Do it your way

A great starting point for your Comfort Systems USA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always stay a step ahead by scanning fresh opportunities. Don’t limit yourself; boost your portfolio with powerful stock ideas chosen for their standout trends and future potential.

- Generate reliable income by tapping into these 19 dividend stocks with yields > 3% with yields above 3%. This approach can suit those who want steady returns in any market cycle.

- Catch the momentum in artificial intelligence by targeting innovation leaders through these 24 AI penny stocks, giving you a front-row seat to the next big wave in tech growth.

- Capitalize on value opportunities with these 885 undervalued stocks based on cash flows, where stocks trade below their cash flow potential, offering entry points many investors miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIX

Comfort Systems USA

Provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives