- United States

- /

- Aerospace & Defense

- /

- NYSE:EVEX

Eve Holding (EVEX) Is Up 23.1% After Selecting BETA Motors For eVTOL Fleet Scale-Up

Reviewed by Sasha Jovanovic

- Eve Air Mobility recently selected BETA Technologies to supply electric pusher motors for its conforming prototypes and production eVTOL aircraft, supporting a backlog of 2,800 vehicles and a potential US$1.00 billion supply opportunity over 10 years.

- This agreement materially strengthens Eve’s propulsion architecture and supply chain as it works toward bringing its next-generation eVTOLs into commercial service.

- We’ll now examine how partnering with BETA Technologies for electric motors shapes Eve’s investment narrative and future commercialisation prospects.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Eve Holding's Investment Narrative?

To own Eve, you really have to believe eVTOLs will move from prototypes and LOIs to certified, commercially viable aircraft at scale, and that Eve’s ecosystem approach around Embraer support will matter. In the near term, the big swing factors remain test milestones, certification progress and how the company funds its growing losses, with year‑to‑date net loss already above US$160 million and no meaningful revenue yet. The BETA Technologies motor deal looks incrementally positive for de‑risking propulsion and supply chain execution, which helps the story around Eve’s 2,800‑aircraft backlog and could justify some of the recent share price strength. That said, it does not change the core risk that Eve is still an early‑stage, loss‑making business likely to require more capital before any commercial operations begin.

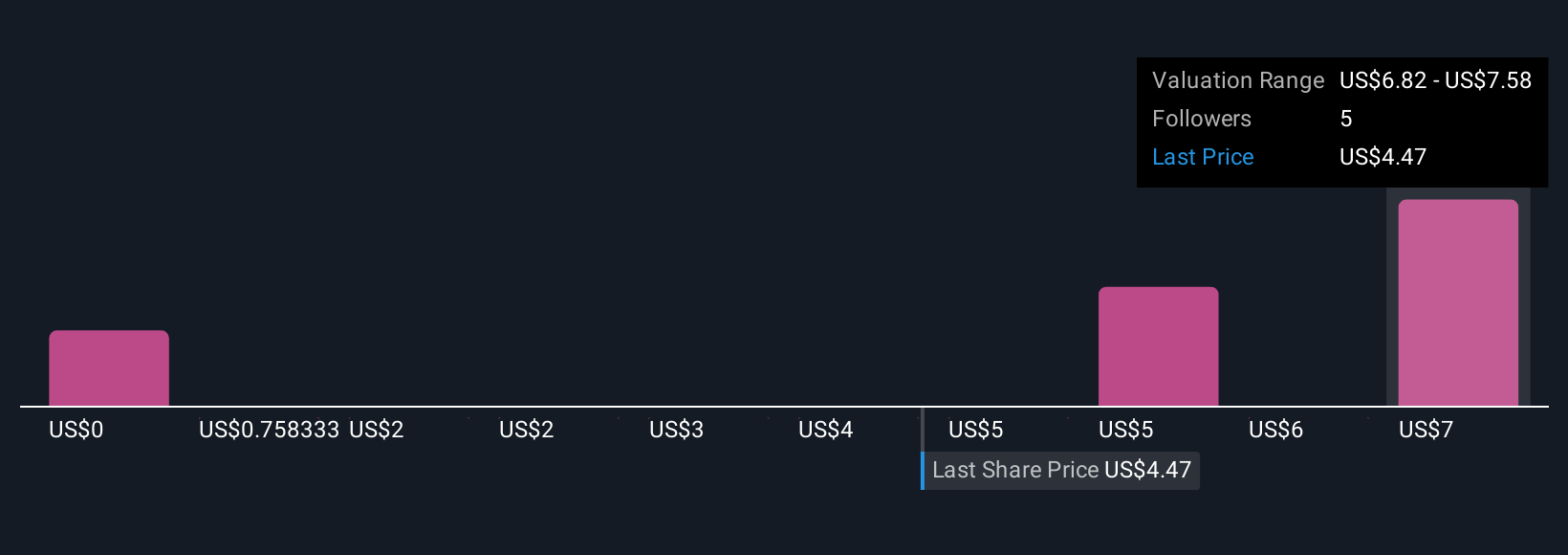

However, investors should not overlook how future funding needs could affect existing shareholders. Eve Holding's shares are on the way up, but they could be overextended by 6%. Uncover the fair value now.Exploring Other Perspectives

Explore 4 other fair value estimates on Eve Holding - why the stock might be worth as much as 51% more than the current price!

Build Your Own Eve Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eve Holding research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Eve Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eve Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eve Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVEX

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026