- United States

- /

- Aerospace & Defense

- /

- NYSE:EVEX

Evaluating Eve Holding (NYSE:EVEX) Valuation After Overweight Rating and Fresh Strategic Developments

Reviewed by Simply Wall St

Cantor Fitzgerald has reaffirmed its Overweight rating on Eve Holding (NYSE:EVEX), highlighting the company’s lengthy customer pipeline, close alliance with Embraer, and new financing agreement for next-generation electric motors as important factors.

See our latest analysis for Eve Holding.

Eve Holding has seen renewed investor interest after the reaffirmed Overweight rating. The share price rallied over 5% in a single day and climbed 8% in the past week. While short-term excitement is building, the one-year total shareholder return still sits at -6%, pointing to persistent long-term challenges even as momentum picks up.

If Eve’s latest moves have you searching for other opportunities, this could be the perfect moment to find what’s ahead in aviation and travel with our See the full list for free.

With shares still trading at nearly a 50% discount to analyst targets and the business facing lingering losses, is Eve Holding flying under the radar with more upside ahead? Or is the market already accounting for future growth potential?

Price-to-Book Ratio of 7.5x: Is it justified?

Eve Holding’s stock is trading at a price-to-book ratio of 7.5x, which is significantly higher than its industry and peer averages despite the company’s current losses. The last close was $3.94, raising questions about whether investors are paying too much for the company’s net assets in light of its unprofitable status.

The price-to-book ratio compares the company’s market value to its book value, or net assets. It is frequently used for companies in the capital goods and aerospace sectors, where tangible assets play an important role in operations.

A ratio of 7.5x signals that the market is placing a substantial premium on Eve Holding compared to both the US Aerospace & Defense industry average (3.4x) and its peer average (4.1x). With no meaningful revenue and persistent losses, this high multiple appears difficult to justify at present.

Without a compelling growth track record or profitability, the market’s optimism seems to be well ahead of fundamentals when compared to sector norms. This disconnect could signal potential overvaluation unless Eve Holding achieves a notable business turnaround.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 7.5x (OVERVALUED)

However, ongoing negative net income and the absence of meaningful revenue may challenge bullish expectations and could limit near term investor enthusiasm.

Find out about the key risks to this Eve Holding narrative.

Another View: SWS DCF Model Suggests Undervaluation

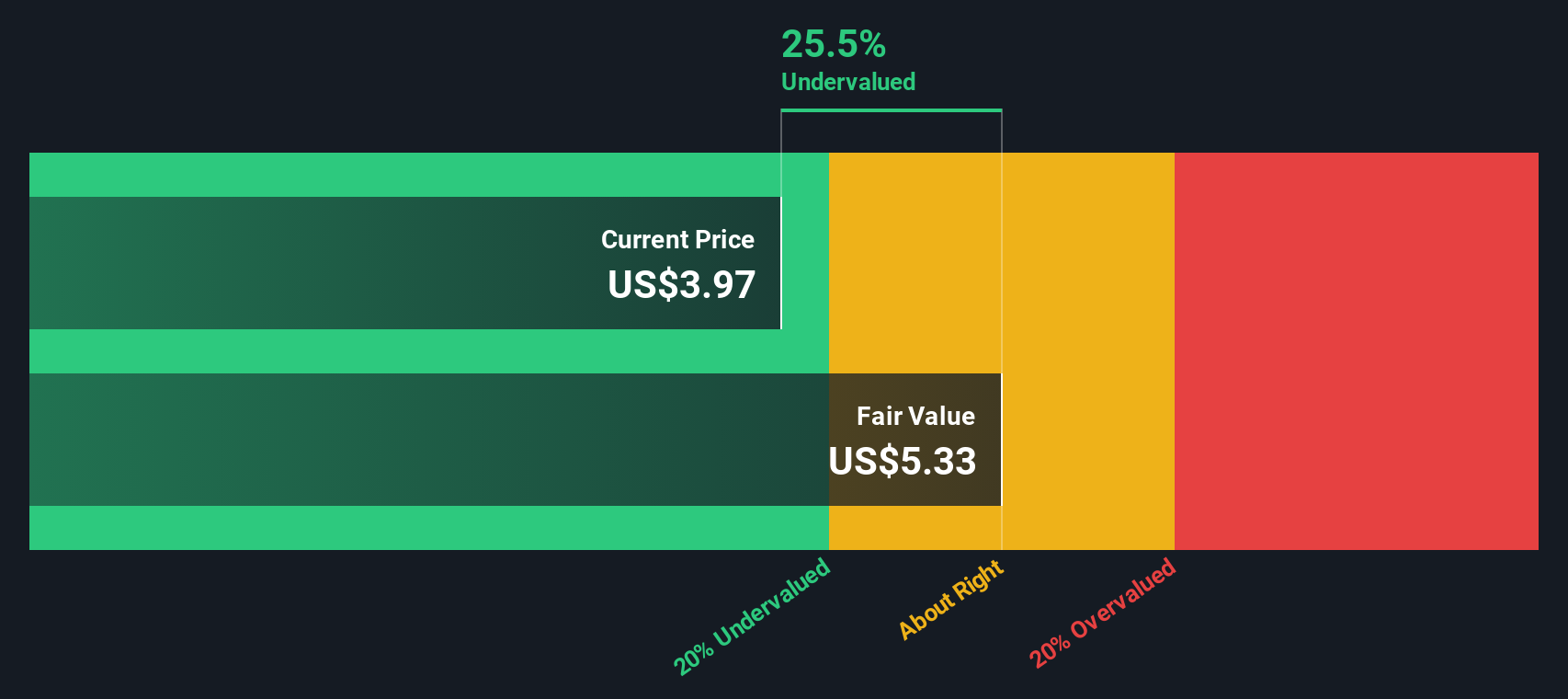

While the company’s high price-to-book ratio suggests Eve Holding may be overvalued by market multiples, our DCF model shows a different picture. According to SWS’s discounted cash flow analysis, shares are trading 12.9% below our fair value estimate. Could the market be overlooking future potential, or is this just a temporary disconnect?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eve Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eve Holding Narrative

If you have a different perspective or want to dive into the numbers yourself, you can quickly build your own view in just a few minutes. Do it your way

A great starting point for your Eve Holding research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss the chance to find stocks that fit your unique strategy. Simply Wall Street’s Screeners make spotting top opportunities quicker and more rewarding than ever. Act now and see where your portfolio could grow next.

- Jump on growth trends by scanning for strong yield potential with these 15 dividend stocks with yields > 3%. These offer returns above 3% and present fresh opportunities for income-focused investors.

- Catch the next wave in artificial intelligence by tapping into emerging companies at the forefront. Search through these 25 AI penny stocks to see who is driving innovation in this sector.

- Accelerate your search for true bargains by uncovering overlooked gems with cash flow strength using these 920 undervalued stocks based on cash flows and add value to your watchlist today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eve Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVEX

Excellent balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.