- United States

- /

- Electrical

- /

- NYSE:ETN

Eaton (ETN): Evaluating Valuation on Strong Results, Upbeat Guidance, and New Seattle City Light Contract

Reviewed by Simply Wall St

Eaton, a US-based power management company, recently drew investor attention after reporting solid quarterly results and announcing new earnings guidance. The company also secured a key modernization contract with Seattle City Light. The combination of these newsworthy moments has shifted sentiment in a positive direction.

See our latest analysis for Eaton.

Eaton’s surge in investor optimism is reflected in its steady uptrend, with a year-to-date share price return of 14.34% and a remarkable 145% total shareholder return over three years. Momentum is clearly building, as recent quarterly gains and growing institutional interest suggest renewed growth potential.

If Eaton’s string of contract wins and positive momentum has you curious, now’s the perfect moment to discover fast growing stocks with high insider ownership

With strong momentum and new growth drivers on the horizon, investors are left wondering if Eaton’s impressive run has created fresh upside, or if the stock’s current price already reflects its future prospects.

Most Popular Narrative: 6.1% Undervalued

With Eaton’s narrative fair value landing at $404.21, about $25 above its last close, the valuation suggests additional upside is still on the table. Understanding what underpins this view, however, means looking past recent price moves and into the company’s evolving growth engine.

Strategic wins and technology leadership in the rapidly expanding data center end market are deepening Eaton's penetration and raising content per megawatt, with major partnerships (e.g., NVIDIA, Siemens Energy) and acquisitions (Fibrebond, Resilient Power) positioning Eaton as the go-to provider for next-generation high-density and AI-centric infrastructure. This supports outsized revenue growth and structurally higher margins due to a richer, more sophisticated product mix.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is bold earnings progress combined with ambitious projections for higher profitability. Curious about the metrics behind these expectations? Discover the surprising numbers and future assumptions that drive this fair value calculation in the complete narrative.

Result: Fair Value of $404.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent underperformance in vehicle and eMobility segments or delays in realizing acquisition synergies could challenge Eaton’s expected growth trajectory.

Find out about the key risks to this Eaton narrative.

Another View: Is the Market Paying a Premium?

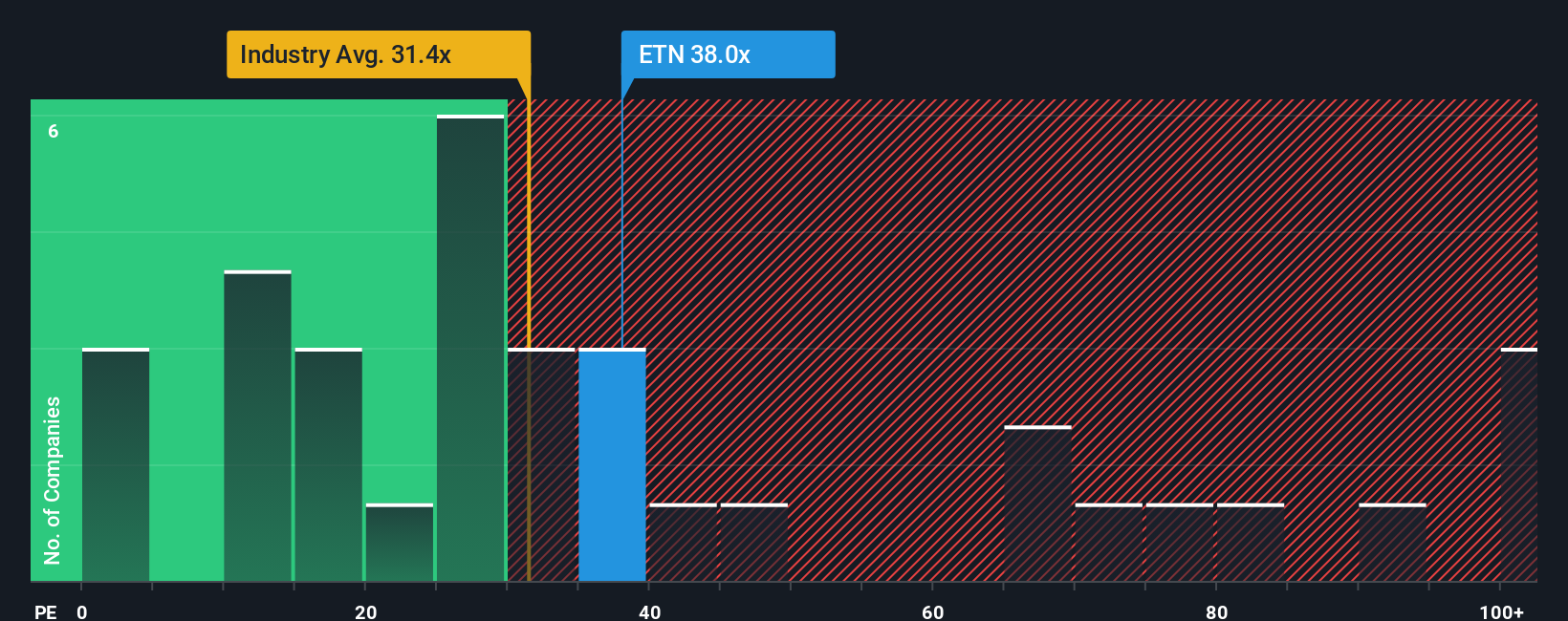

Looking at the price-to-earnings ratio tells a different story. Eaton is trading at 37.6 times earnings, higher than the US Electrical industry average of 30.2, but lower than its peer average of 45.8. Its ratio is in line with the fair ratio estimate of 38.6. This suggests investors might be paying up for quality or expecting more growth than the industry average. However, it also raises the risk that future returns could fall short if those expectations are not met. Are markets looking too far ahead, or is Eaton poised to deliver?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eaton Narrative

If you think you have a different take or would like to investigate for yourself, you can build your custom narrative in just a few minutes. Do it your way

A great starting point for your Eaton research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Ideas?

Thousands of investors are seizing fresh opportunities every day with tools that reveal under-the-radar leaders and tomorrow’s top performers. Why miss out on your next big move?

- Target steady income and shield your portfolio from volatility by uncovering companies with yields above 3% through these 16 dividend stocks with yields > 3%.

- Tap into the transformative healthcare revolution and spot rising stars shaped by artificial intelligence using these 32 healthcare AI stocks in your search.

- Position yourself ahead of market shifts by harnessing these 874 undervalued stocks based on cash flows to pinpoint stocks that offer compelling value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eaton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETN

Eaton

Operates as a power management company in the United States, Canada, Latin America, Europe, and the Asia Pacific.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives