- United States

- /

- Electrical

- /

- NYSE:ENS

Is EnerSys' (ENS) Aggressive Buyback Pace a Hint at Undervaluation or a Shift in Strategy?

Reviewed by Sasha Jovanovic

- Earlier this month, EnerSys reported second quarter revenue of US$951.29 million and announced the completion of two share repurchase tranches, buying back nearly 1.6 million shares for a combined US$104.25 million, while also affirming its next quarterly dividend of US$0.2625 per share and providing net sales guidance of US$920 million to US$960 million for the third quarter of fiscal 2026.

- EnerSys leadership confirmed M&A remains a core focus, with available capital reserved for acquisitions, and emphasized their intent to deploy cash toward high-quality investments or additional share buybacks when shares are considered undervalued.

- With active capital deployment through M&A exploration and share repurchases, we'll explore what these actions mean for EnerSys' evolving investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

EnerSys Investment Narrative Recap

Owning shares in EnerSys means believing in both the long-term demand for advanced energy storage and the company's ability to grow through well-executed acquisitions alongside efficiency initiatives. The recent confirmation of ongoing M&A focus and disciplined capital deployment supports the company's multi-year transformation, but doesn't materially shift the short-term catalyst around margin improvement, or alleviate the primary risk from potential underperformance of future acquisitions.

The update on share buybacks, especially the completion of over 1.6 million shares repurchased for about US$104.25 million, is highly relevant as it demonstrates active capital management during a period when acquisition-driven growth remains central to the investment story. This capital allocation can complement, but not replace, the need for sustained organic growth and successful integration of future acquisitions.

Yet, with recent M&A ambitions in focus, investors should not overlook the risk if new acquisitions stall or fail to deliver meaningful benefits...

Read the full narrative on EnerSys (it's free!)

EnerSys' narrative projects $3.9 billion revenue and $394.7 million earnings by 2028. This requires 1.9% yearly revenue growth and a $43.6 million earnings increase from $351.1 million today.

Uncover how EnerSys' forecasts yield a $144.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

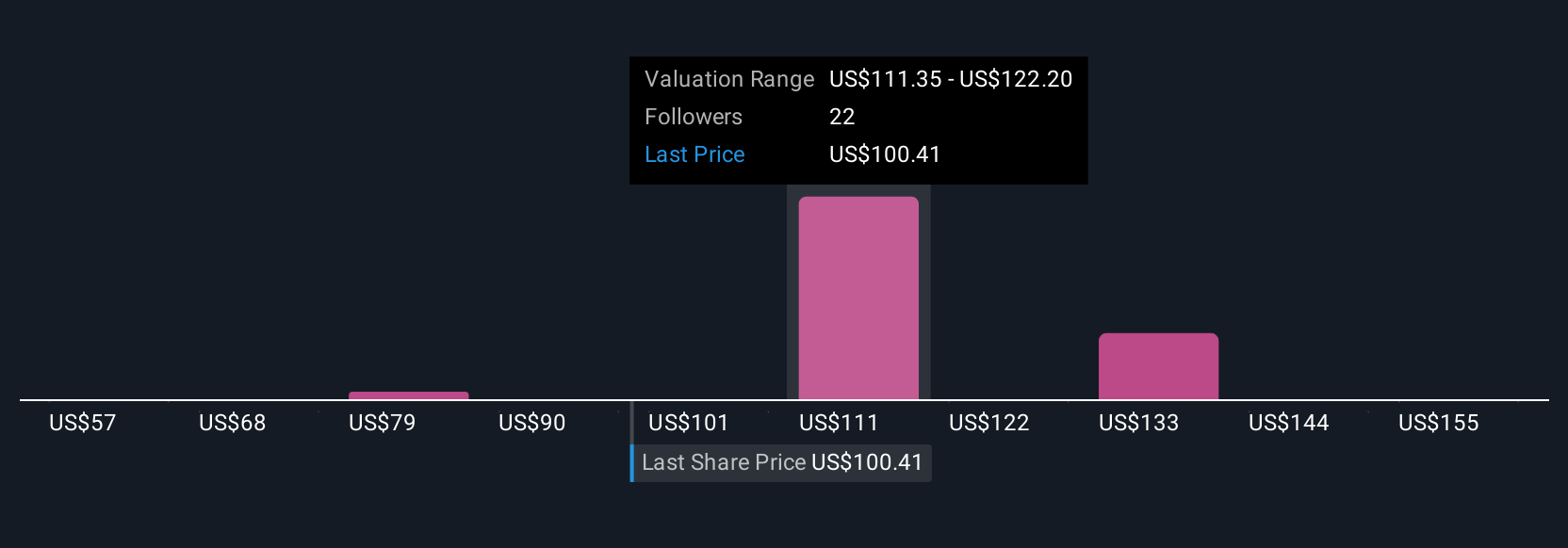

Six community fair value estimates for EnerSys range from US$57.47 to US$175.26, reflecting sharply varied growth outlooks among Simply Wall St Community members. While many expect acquisition-driven expansion, this diversity underlines the importance of weighing risks tied to overreliance on deals and the challenge of sustaining organic growth.

Explore 6 other fair value estimates on EnerSys - why the stock might be worth less than half the current price!

Build Your Own EnerSys Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EnerSys research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EnerSys research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EnerSys' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EnerSys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENS

EnerSys

Engages in the provision of stored energy solutions for industrial applications worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives