- United States

- /

- Electrical

- /

- NYSE:EMR

Investors Who Bought Emerson Electric (NYSE:EMR) Shares Three Years Ago Are Now Up 31%

Low-cost index funds make it easy to achieve average market returns. But in any diversified portfolio of stocks, you'll see some that fall short of the average. That's what has happened with the Emerson Electric Co. (NYSE:EMR) share price. It's up 31% over three years, but that is below the market return. At least the stock price is up over the last year, albeit only by 3.1%.

View our latest analysis for Emerson Electric

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

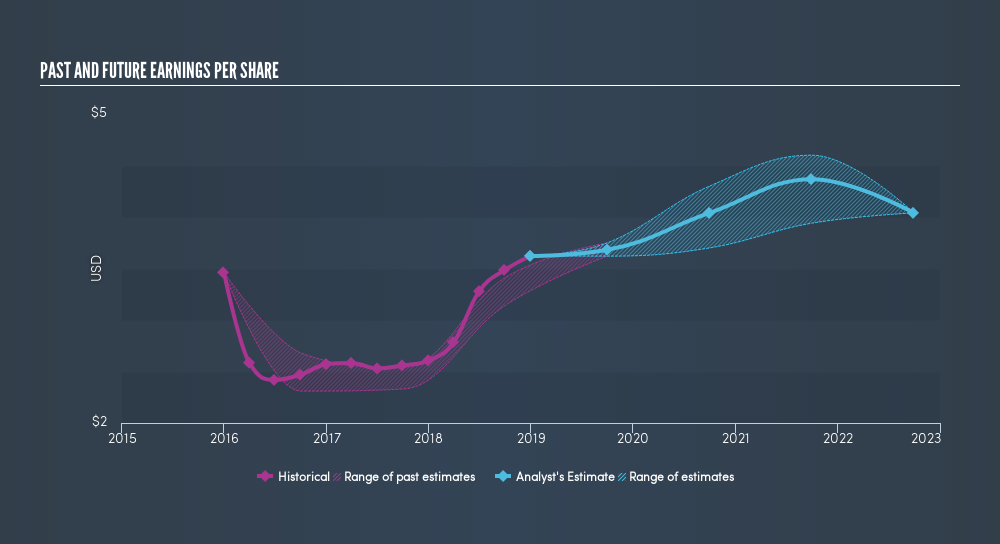

Emerson Electric was able to grow its EPS at 1.5% per year over three years, sending the share price higher. In comparison, the 9.3% per year gain in the share price outpaces the EPS growth. This suggests that, as the business progressed over the last few years, it gained the confidence of market participants. That's not necessarily surprising considering the three-year track record of earnings growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Emerson Electric has improved its bottom line lately, but is it going to grow revenue? You could check out this freereport showing analyst revenue forecasts.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Emerson Electric, it has a TSR of 44% for the last 3 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Emerson Electric shareholders are up 6.0% for the year (even including dividends). But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 4.2% over half a decade It is possible that returns will improve along with the business fundamentals. Before spending more time on Emerson Electric it might be wise to click here to see if insiders have been buying or selling shares.

Of course Emerson Electric may not be the best stock to buy. So you may wish to see this freecollection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:EMR

Emerson Electric

A technology and software company, provides various solutions in the Americas, Asia, the Middle East, Africa, and Europe.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives