- United States

- /

- Construction

- /

- NYSE:EME

EMCOR Group (NYSE:EME) Reports Strong Earnings in 2024 and Eyes Acquisitions with US$14.6 Billion Annual Sales

Reviewed by Simply Wall St

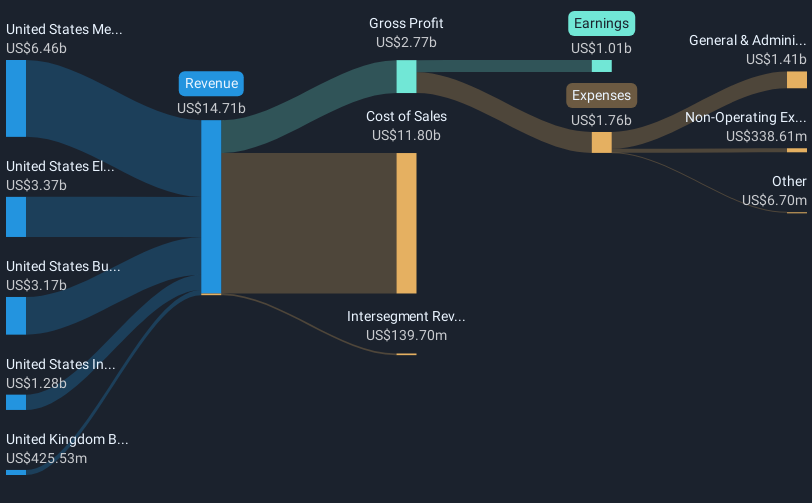

EMCOR Group (NYSE:EME) reported substantial earnings growth for the fourth quarter and full year 2024, with sales and net income both seeing significant year-over-year increases. Despite this performance and promising guidance for 2025, the company's shares experienced a 2% decline over the last month. This downward price movement occurred amid a mixed broader market environment, where the S&P 500 saw a 0.1% decline and the Nasdaq Composite dropped 0.6%, reflecting investor concerns over economic policies, including new tariff announcements by President Trump. With major indexes showing mixed performance and some tech stocks like Nvidia taking a hit, EMCOR's decline aligns with broader market sentiments rather than its strong financial results and strategic focus on acquisitions, such as the recent Miller Electric Company integration. Investors seem to have reacted cautiously, weighing broader economic uncertainty alongside EMCOR's robust quarterly achievements.

Navigate through the intricacies of EMCOR Group with our comprehensive report here.

Over the last 5 years, EMCOR Group delivered a total return of approximately 432.91%. This impressive performance can be attributed to several key factors. Notably, the company's continuous earnings growth, reaching an increased net income of US$1 billion in 2024, reflects effective management and operational strategies. In parallel, EMCOR's strategic acquisition of Miller Electric Company in early 2025 signals an ongoing commitment to expanding its capabilities and enhancing future growth prospects.

Further influencing shareholder value is the company's consistent dividend payouts and a robust share repurchase program. By October 2024, EMCOR repurchased 716,112 shares, investing US$256.4 million, contributing significantly to upward pressure on the share price. Additionally, being valued favorably compared to both the US construction industry and broader market benchmarks underlines EMCOR's competitive edge. Over the past year, EMCOR outperformed the US construction industry and the market, reinforcing investor confidence despite recent share price declines.

- Understand the fair market value of EMCOR Group with insights from our valuation analysis—click here to learn more.

- Analyze the downside risks for EMCOR Group and understand their potential impact—click to learn more.

- Already own EMCOR Group? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMCOR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EME

EMCOR Group

Provides construction and facilities, building, and industrial services in the United States and the United Kingdom.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives