- United States

- /

- Machinery

- /

- NYSE:DE

Did Lower Earnings and Cautious Guidance Just Shift Deere's (DE) Investment Narrative?

Reviewed by Sasha Jovanovic

- Deere & Company recently reported financial results for its fourth quarter and full year ended November 2, 2025, with sales, revenue, and net income all showing declines from the previous year.

- The company also issued fiscal 2026 earnings guidance projecting net income in the range of US$4.00 billion to US$4.75 billion, reflecting expectations for continued business challenges.

- We will explore how Deere’s lower full-year earnings and new guidance may shape its longer-term investment outlook.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Deere Investment Narrative Recap

To be a Deere shareholder, you need to believe in the company's ability to drive recovery in demand through precision agriculture and innovation, even as end-market volatility in North America tests its resilience. Deere’s recent results and 2026 guidance confirm persistent headwinds, but there is no immediate change to the central catalyst: adoption of high-value farm technology. The main near-term risk, sustained pressure on large ag equipment sales amid inventory and rate challenges, remains relevant and unchanged after these announcements.

Among the latest news, Deere’s updated fiscal 2026 net income guidance (US$4.00 billion to US$4.75 billion) most directly reflects the ongoing business challenges and uncertainty facing large equipment demand. This directly relates to near-term revenue pressure and margin headwinds as the company looks to navigate cyclical downturns while supporting its core technology adoption strategy.

But with continued volatility in key North American ag end-markets, investors should be aware of the risk that...

Read the full narrative on Deere (it's free!)

Deere's outlook anticipates $45.1 billion in revenue and $8.6 billion in earnings by 2028. This assumes a 0.7% annual decline in revenue and a $3.4 billion increase in earnings from the current $5.2 billion.

Uncover how Deere's forecasts yield a $525.78 fair value, a 12% upside to its current price.

Exploring Other Perspectives

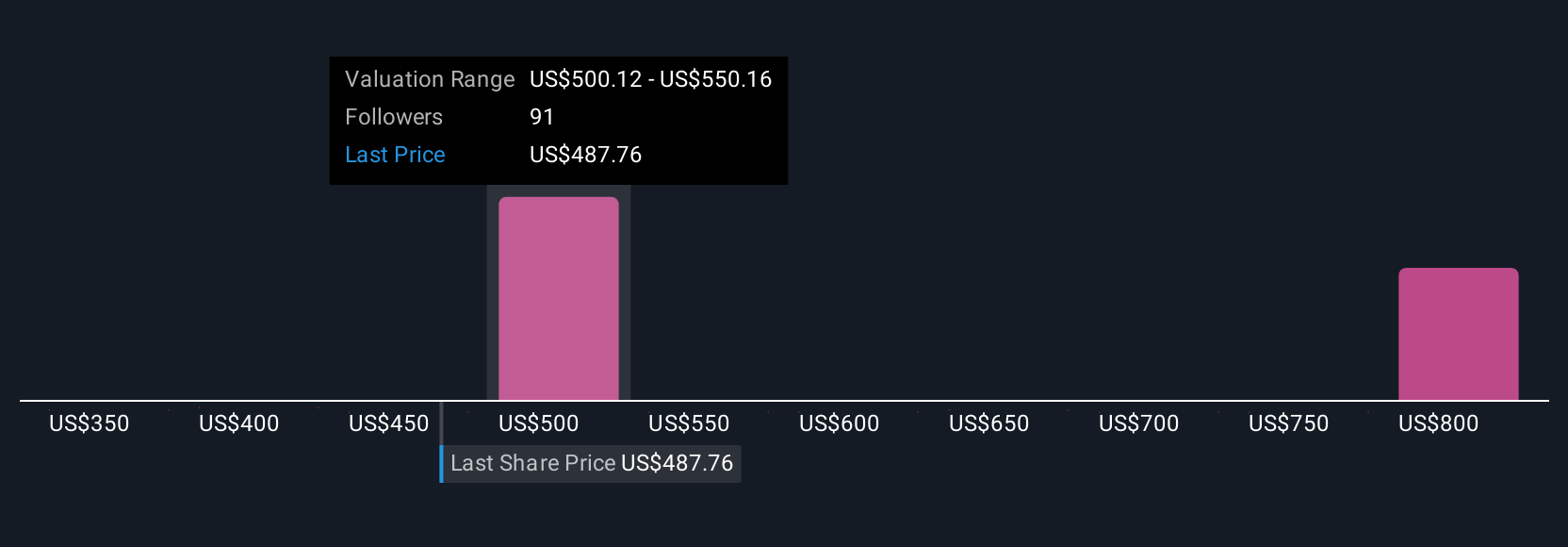

Five different Simply Wall St Community valuations for Deere place fair value between US$430 and US$625 per share. Many participants debate these expectations, especially given persistent uncertainties in end-market demand for large ag equipment.

Explore 5 other fair value estimates on Deere - why the stock might be worth 8% less than the current price!

Build Your Own Deere Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Deere research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Deere research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Deere's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DE

Deere

Engages in the manufacture and distribution of various equipment worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026