- United States

- /

- Aerospace & Defense

- /

- NYSE:CW

Curtiss-Wright (CW): Assessing Valuation Following Expanded $2 Billion Buyback and Dividend Reaffirmation

Reviewed by Simply Wall St

Curtiss-Wright (CW) just announced a $416 million boost to its share repurchase plan, raising total buyback authorization to more than $2 billion. The company also reaffirmed its quarterly dividend.

See our latest analysis for Curtiss-Wright.

After this announcement, Curtiss-Wright’s momentum has clearly accelerated. Its share price return year-to-date stands at an impressive 60.61%, and the 1-year total shareholder return is just over 51%. The buyback boost and reliable dividend are adding fuel to a strong long-term trend, with total shareholder return of 216% over three years and 374% over five years.

If defense-sector moves like this are on your radar, it might be time to see what else is taking off. Discover See the full list for free.

But after such a powerful surge, is Curtiss-Wright still trading at an attractive valuation, or has the market already priced in years of growth ahead? Should investors consider this opportunity, or is caution warranted?

Most Popular Narrative: 7.2% Undervalued

The narrative sets Curtiss-Wright’s fair value above the latest closing price, suggesting analysts perceive some upside potential even after the recent rally. This view synthesizes growth expectations with the company’s robust business trends and recent buyback expansion.

Record backlog growth (up 12% year-to-date to $3.8B), strong book-to-bill ratios (1.2x in A&D), and a healthy order pipeline in both defense and nuclear align with management's confidence in posting 9 to 10% sales growth, 16 to 19% EPS growth, and over 100 basis points of margin expansion in 2025. This signals potential undervaluation if current pricing underappreciates forward visibility and operational leverage.

Want to know what’s fueling analyst conviction? The projected acceleration in growth, margin expansion, and record pipeline might surprise you. There is a bold thesis about future profitability and a price-to-earnings multiple typically seen in large companies. Curious which growth assumptions are most important for that verdict? The narrative’s full breakdown reveals more.

Result: Fair Value of $608.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, contract timing risk and changing defense technology preferences could quickly challenge the upbeat view. This could potentially make recent analyst optimism vulnerable.

Find out about the key risks to this Curtiss-Wright narrative.

Another View: Market Multiples Signal a Caution Flag

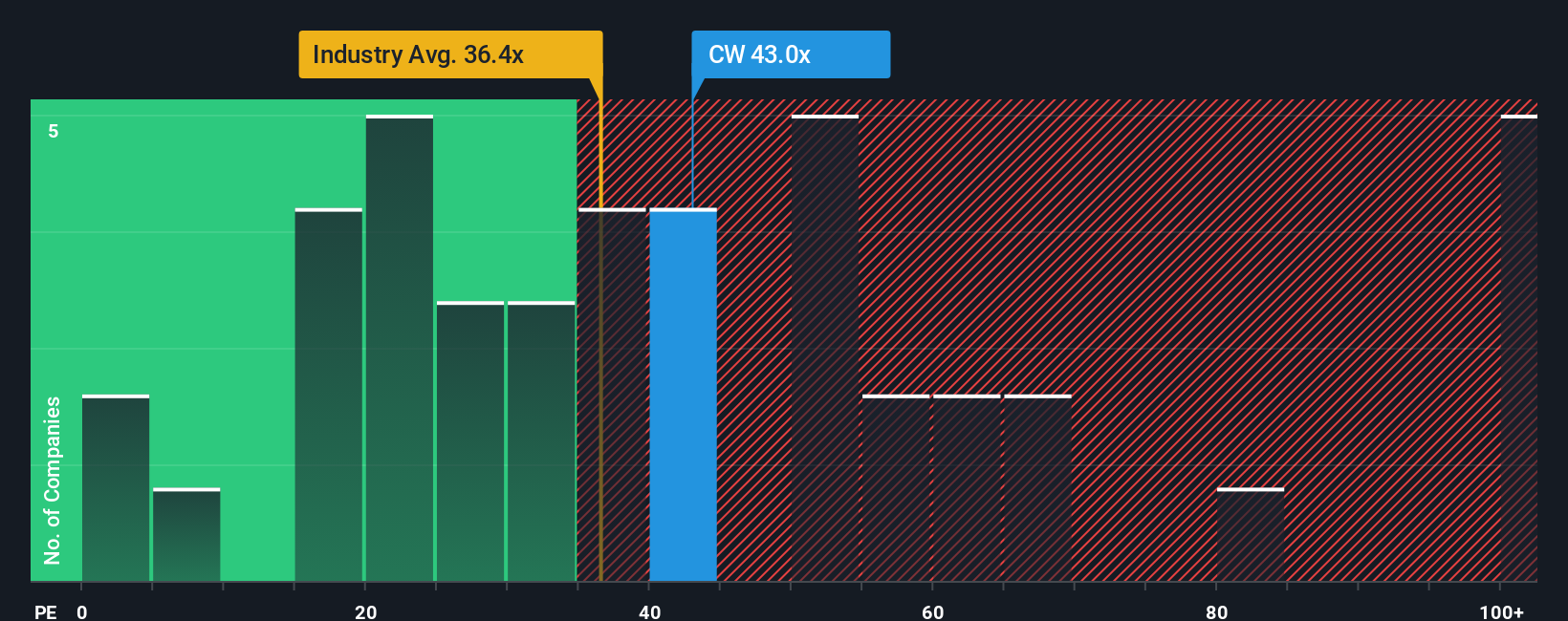

While the fair value estimate points to upside, another popular approach looks at how Curtiss-Wright is priced compared to its peers. The company trades at a price-to-earnings ratio of 44.7x, higher than both its industry average (38.3x) and the calculated fair ratio (27.2x). This kind of premium could mean shares are already factoring in a lot of future growth, which may leave less room for error if expectations slip. Are investors getting ahead of themselves, or does premium pricing reflect something more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Curtiss-Wright Narrative

Feel like you see the story differently or want to work through the numbers yourself? You can dive in and build your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Curtiss-Wright.

Looking for more investment ideas?

Smart investors never stop searching for the next edge. Don’t let your money sit idle when new trends and opportunities are just a click away on Simply Wall St.

- Start building passive income and maximize stability by checking out these 15 dividend stocks with yields > 3% offering attractive yields and consistent payouts.

- Unlock exposure to artificial intelligence breakthroughs by tapping into these 25 AI penny stocks where innovation is reshaping how the world works and communicates.

- Catalyze your portfolio’s potential with these 914 undervalued stocks based on cash flows filled with businesses trading below their intrinsic value before others spot their upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CW

Curtiss-Wright

Provides engineered products, solutions, and services mainly to aerospace and defense, commercial power, process, and industrial markets worldwide.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026