- United States

- /

- Machinery

- /

- NYSE:CMI

Hydrogen Engines, Data Center Power Demand Might Change The Case For Investing In Cummins (CMI)

Reviewed by Sasha Jovanovic

- Cummins recently reported a 2% third-quarter sales decline as softer North American truck demand was offset by solid global power generation and light-duty truck markets, while also advancing a prototype hydrogen-powered internal combustion engine for intercity buses with lower emissions.

- At the same time, rising interest in Cummins’ Accelera business, focused on green hydrogen and hybrid powertrains, reflects how cleaner power solutions and stricter environmental rules are becoming more central to the company’s growth story.

- Next, we’ll examine how strong data center-driven power demand and Cummins’ hydrogen engine progress interact with its existing investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Cummins Investment Narrative Recap

To own Cummins, you need to believe its core engine and components business can weather cyclical truck weakness while newer power systems and low‑carbon technologies gradually take on more weight. The latest results, with softer North American truck demand but resilient power generation and data center orders, do not materially change that narrative, though they highlight that ongoing truck softness remains the most immediate risk while power demand remains a key short term support.

The partnership to test a hydrogen powered internal combustion engine in an intercity bus ties directly into Cummins’ Accelera push into green hydrogen and hybrid powertrains, which is attracting fresh investor attention. This keeps the long term decarbonization catalyst in focus, even as Accelera is still not a meaningful profit contributor and faces the risk of slower growth and continued EBITDA losses if adoption of zero emission technologies falls short of expectations.

Yet for investors, the real concern may be how prolonged weakness in North American heavy truck demand could...

Read the full narrative on Cummins (it's free!)

Cummins' narrative projects $40.6 billion revenue and $4.3 billion earnings by 2028. This requires 6.4% yearly revenue growth and about a $1.4 billion earnings increase from $2.9 billion today.

Uncover how Cummins' forecasts yield a $510.05 fair value, in line with its current price.

Exploring Other Perspectives

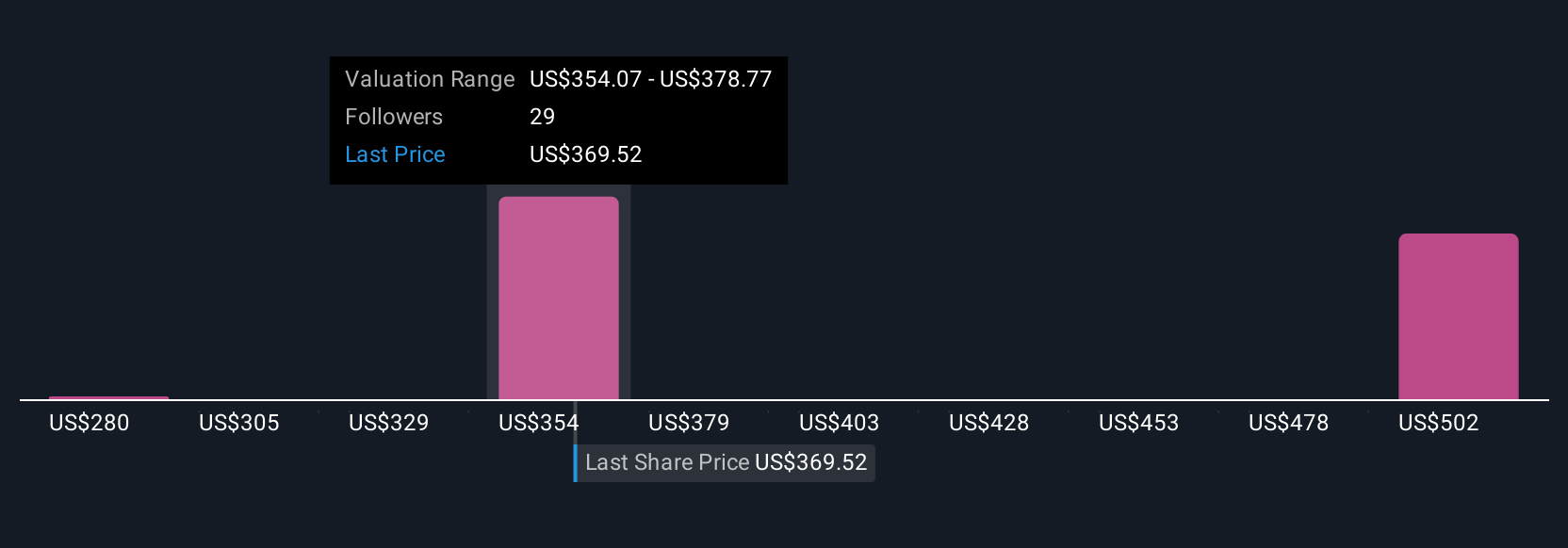

Five fair value estimates from the Simply Wall St Community span roughly US$280 to about US$639, showing how widely opinions on Cummins can differ. As you weigh those views, keep in mind that recent results again underline how weakness in North American heavy and medium duty truck demand remains a key swing factor for Cummins’ earnings and for how the market might reassess its core engine business.

Explore 5 other fair value estimates on Cummins - why the stock might be worth 45% less than the current price!

Build Your Own Cummins Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cummins research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Cummins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cummins' overall financial health at a glance.

No Opportunity In Cummins?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMI

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026