- United States

- /

- Electrical

- /

- NYSE:CHPT

ChargePoint (CHPT) Q3: Losses Narrow, Testing Bullish Profitability Narratives Despite Flat Revenue

Reviewed by Simply Wall St

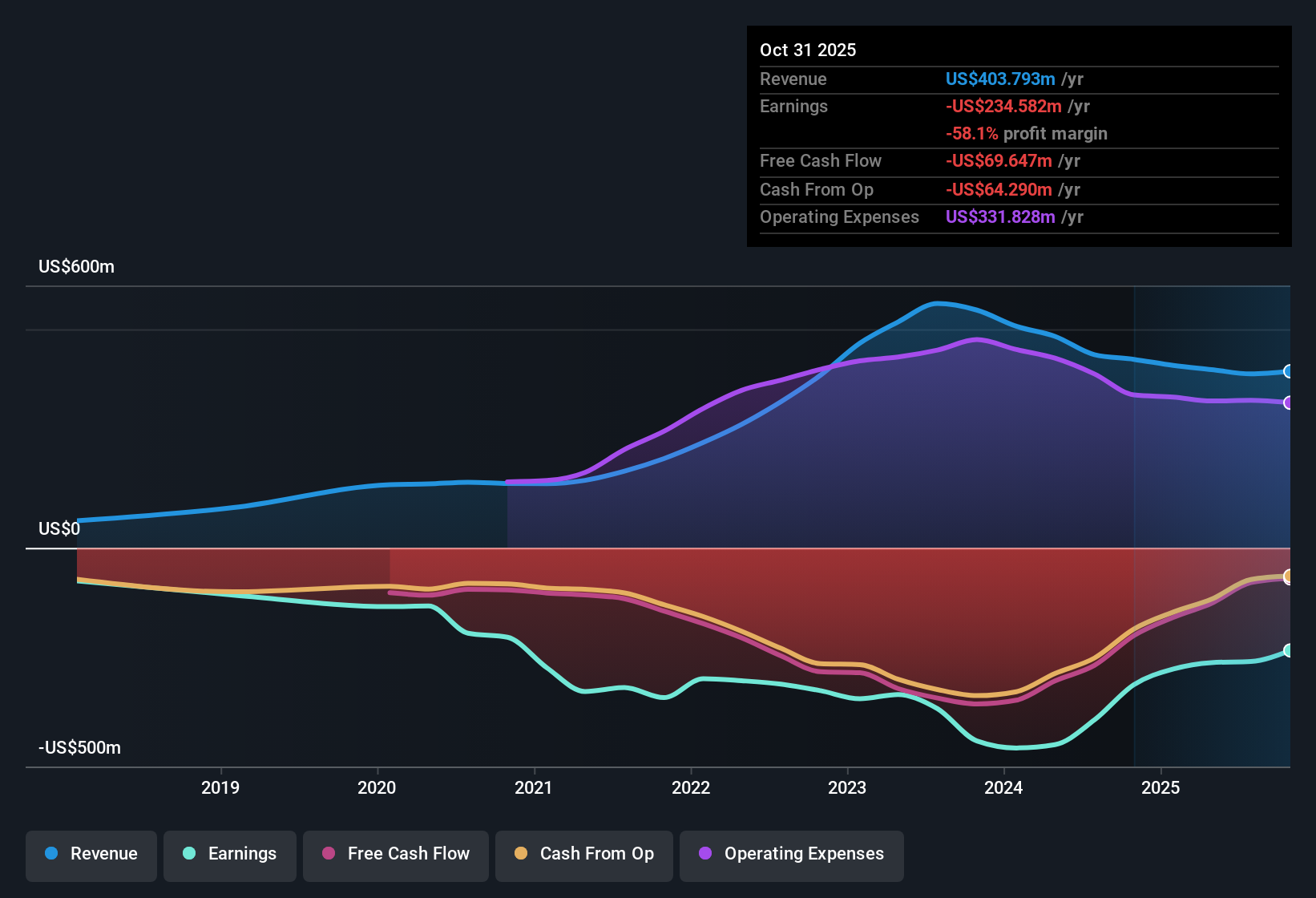

ChargePoint Holdings (CHPT) just posted Q3 2026 results with revenue of about $105.7 million and a basic EPS loss of $2.23, while trailing 12 month figures show revenue of roughly $403.8 million against a basic EPS loss of $10.19. The company has seen quarterly revenue hover in a tight band between about $97.6 million and $108.5 million over the past six quarters, while basic EPS losses have consistently sat in the negative $2.2 to $3.6 range and TTM net income remains deeply in the red. Investors are likely to read this update through the lens of improving scale alongside still heavily pressured margins.

See our full analysis for ChargePoint Holdings.With the latest numbers on the table, the next step is to see how this revenue growth story and ongoing losses stack up against the dominant narratives around ChargePoint’s long term prospects and risk profile.

See what the community is saying about ChargePoint Holdings

Losses Narrow From 2025 Peak

- Net loss excluding extra items improved from about $77.6 million in Q3 2025 to roughly $52.5 million in Q3 2026, even as revenue stayed in the roughly $98 million to $106 million range.

- Consensus narrative points to cost discipline and higher margin software helping over time, and the recent move from a trailing 12 month loss of about $313.0 million in Q3 2025 to around $234.6 million in Q3 2026 fits that view. It still reminds investors that ChargePoint is a long way from the positive $64.3 million earnings scenario some forecasts model for around 2028.

- Trailing 12 month basic EPS has moved from roughly negative $19.12 to about negative $10.19, which lines up with talk of better gross margins but still reflects heavy ongoing spending.

- Analysts’ assumption that profit margins could one day improve toward an industry like 10.2 percent is not visible yet in the reported net losses, so the timing of that turnaround remains an open question.

15 percent Growth Story Vs. Persistent Red Ink

- Revenue is forecast to grow at about 15.4 percent a year, above the roughly 10.6 percent US market benchmark, while trailing 12 month revenue sits near $403.8 million alongside a trailing 12 month loss of about $234.6 million.

- Bears highlight that losses have widened over the last five years by roughly 1.5 percent annually and that forecasts still show ChargePoint unprofitable over the next three years. The current run of negative basic EPS between about negative $2.2 and negative $3.6 per quarter supports that concern even as subscription and software driven growth are expected to help margins over time.

- Analysts also expect the share count to grow by about 7 percent per year, which would spread any eventual profits over more shares if the company needs to keep raising capital.

- Recent insider selling over the past three months lines up with the cautious view that the path from today’s roughly negative $234.6 million trailing 12 month loss to a positive earnings profile is likely to be bumpy.

Low Sales Multiple And Large DCF Gap

- At a share price of $10.43 and a trailing 12 month revenue base of about $403.8 million, ChargePoint is trading on roughly 0.6 times sales, versus a peer average near 2.0 times and about 2.4 times for the broader US Electrical industry.

- Supporters of the bullish valuation angle point out that the stock also sits below a DCF fair value of roughly $30.76 and under an analyst price target of about $11.25. The combination of faster expected revenue growth around 15.4 percent and a price to sales discount versus peers is exactly what that upside thesis leans on, even though it must be weighed against the continued trailing 12 month loss of about $234.6 million.

- The gap between today’s price and the DCF fair value suggests the market is heavily discounting the risk that losses stay large or that growth undershoots forecasts.

- With revenue over the last six quarters stuck in a narrow band near $100 million per quarter, investors will want to see an acceleration before giving full credit to those long term value estimates.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ChargePoint Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use your own assumptions, pull together the key trends, and turn that into a custom narrative in just a few minutes: Do it your way.

A great starting point for your ChargePoint Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Despite healthy revenue growth and a low sales multiple, ChargePoint remains deeply loss making, with uncertain timing to profitability and ongoing dilution risks.

If persistent red ink and capital raises concern you, use our stable growth stocks screener (2087 results) to focus on companies already delivering consistent revenue and earnings progress rather than speculative turnarounds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHPT

ChargePoint Holdings

Provides electric vehicle (EV) charging networks and charging solutions in the North America and Europe.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026