- United States

- /

- Machinery

- /

- NYSE:CAT

How Caterpillar’s (CAT) Earnings Beat and Insider Stock Sale Could Shape Its Investment Narrative

Reviewed by Sasha Jovanovic

- In recent days, Caterpillar reported strong third-quarter 2025 financial results, with earnings and revenue surpassing forecasts, and group president De Lange sold US$8.2 million in company stock across multiple trades.

- Following the earnings beat, major analysts highlighted Caterpillar’s volume growth and strength in key segments as drivers of their more optimistic outlooks.

- To understand how Caterpillar’s better-than-expected earnings could influence its outlook, we’ll assess the potential impact on its investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Caterpillar Investment Narrative Recap

Caterpillar attracts investors who believe in the long-term demand for infrastructure, mining, and energy equipment, relying on strong backlogs and global project pipelines to support future growth. While the recent Q3 earnings beat and positive analyst reactions reflect ongoing strength in segment volumes, these results do not fundamentally change the most important short-term catalyst, continued backlog conversion, nor do they materially reduce the exposure to major risks like potential new tariffs on equipment sales.

Of recent announcements, Caterpillar’s commitment to share buybacks remains especially relevant, providing ongoing support for per-share metrics and signaling shareholder alignment amid broader earnings fluctuations. The company’s Q3 2025 repurchase of approximately US$360 million in shares bolsters returns and may help offset earnings volatility, linking management’s capital allocation to the underlying growth catalysts from backlog and segment momentum.

On the other hand, investors should also be aware of ongoing tariff uncertainties that could impact margins if new trade actions are implemented and...

Read the full narrative on Caterpillar (it's free!)

Caterpillar's outlook anticipates $74.0 billion in revenue and $13.5 billion in earnings by 2028. This is based on an annual revenue growth rate of 5.5% and a $4.1 billion increase in earnings from the current $9.4 billion.

Uncover how Caterpillar's forecasts yield a $559.22 fair value, in line with its current price.

Exploring Other Perspectives

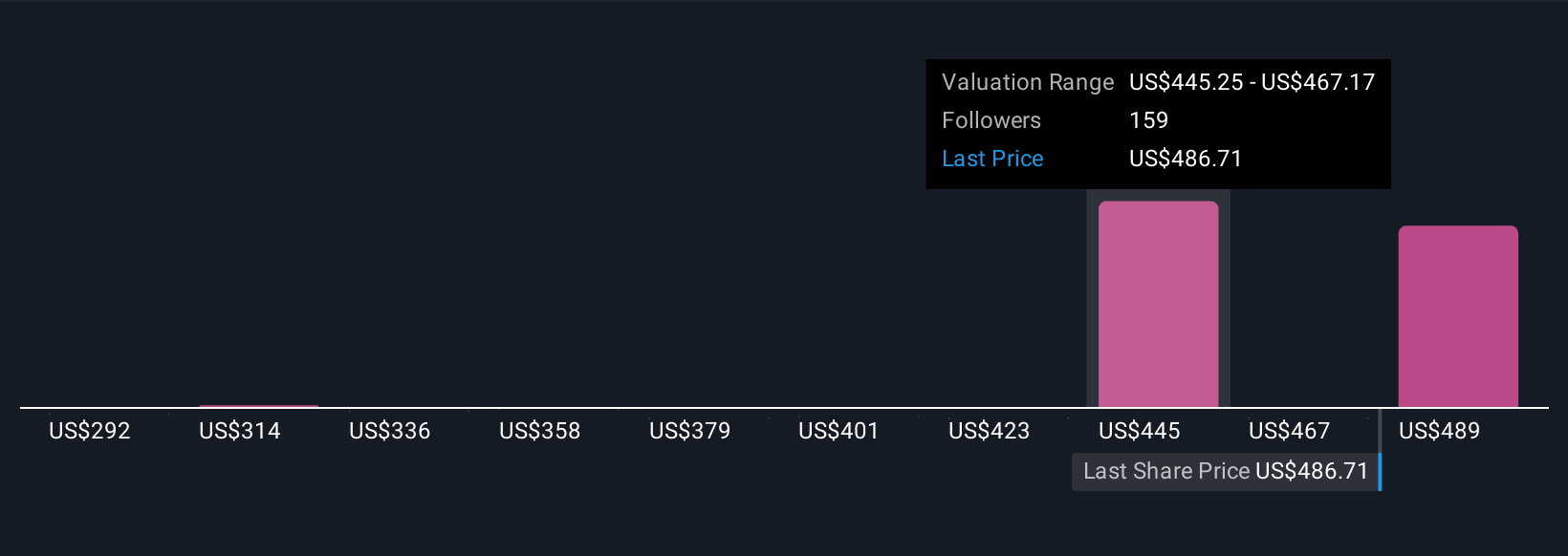

Eighteen different fair value estimates from the Simply Wall St Community span US$291.79 to US$559.22 per share. While community outlooks vary widely, headline risks such as significant new tariffs stand to influence earnings stability and investor confidence going forward.

Explore 18 other fair value estimates on Caterpillar - why the stock might be worth as much as $559.22!

Build Your Own Caterpillar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Caterpillar research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Caterpillar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Caterpillar's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAT

Caterpillar

Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives