- United States

- /

- Machinery

- /

- NYSE:CAT

Caterpillar (NYSE:CAT) Unveils Game-Changing Energy Solution, Boosting Sustainability and Efficiency

Reviewed by Simply Wall St

Dive into the specifics of Caterpillar here with our thorough analysis report.

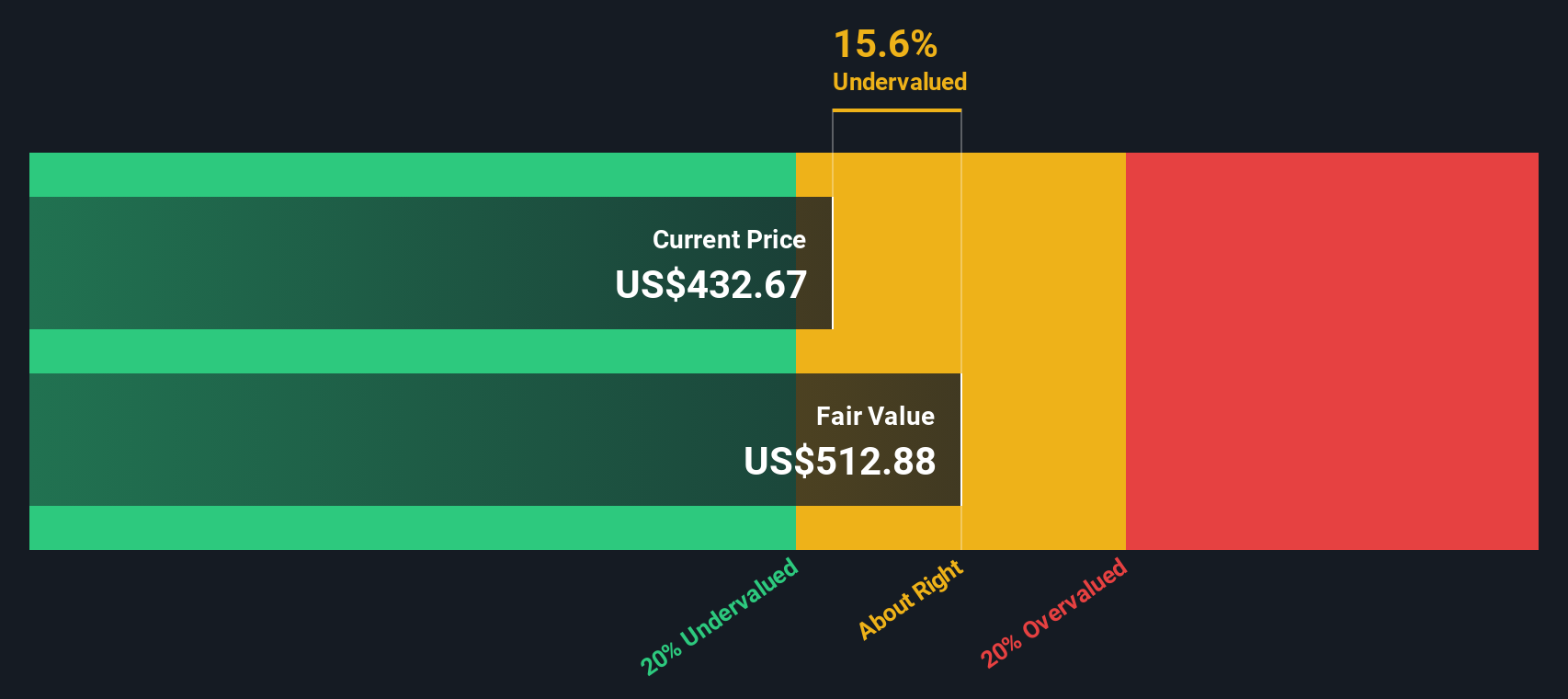

Strengths: Core Advantages Driving Sustained Success For Caterpillar

Caterpillar has demonstrated robust financial health, with a notable 31.7% earnings growth over the past year, surpassing the Machinery industry average of 10.9%. The company’s diverse end markets and strategic execution have led to record adjusted profit per share of $5.99, as highlighted by CEO Jim Umpleby. Additionally, Caterpillar's adjusted operating profit margin improved to 22.4%, reflecting disciplined cost management. The company’s commitment to shareholder returns is evident in its 8% dividend increase and consistent share repurchases. Furthermore, Caterpillar is considered good value based on its Price-To-Earnings Ratio (16.2x), which is below both the peer average (18.7x) and the US Machinery industry average (21.4x), but is currently trading above its estimated fair value of $295.31.

Weaknesses: Critical Issues Affecting Caterpillar's Performance and Areas For Growth

Despite its strengths, Caterpillar faces several challenges. Sales and revenues declined by 4% in the second quarter, slightly below expectations, as noted by Jim Umpleby. The company’s revenue growth forecast of 2.9% per year lags behind the US market average of 8.7% per year. Additionally, earnings are projected to decline by 1.8% annually over the next three years. The high level of debt skews Caterpillar's outstanding Return on Equity (64.2%). Furthermore, Caterpillar’s target price is lower than the current share price, indicating potential overvaluation. These issues highlight areas for improvement, particularly in market positioning and debt management.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Caterpillar is well-positioned to capitalize on emerging opportunities through its sustainability initiatives and innovative product developments. The company’s investment in new products and technologies, such as the Cat® Dynamic Energy Transfer (DET) system, supports its commitment to a reduced carbon future. This system enhances operational efficiency and machine uptime, providing a competitive edge. Additionally, the energy transition is expected to increase commodity demand, expanding Caterpillar’s total addressable market. The backlog growth to $28.6 billion, up $700 million from the previous quarter, further underscores the company’s potential for long-term profitable growth.

Threats: Key Risks and Challenges That Could Impact Caterpillar's Success

Caterpillar faces several external risks that could impact its growth and market share. Economic conditions, particularly in Europe and Asia/Pacific, have led to regional sales weaknesses. Competitive pressures are expected to moderate prices, as indicated by CFO Andrew R. Bonfield. Regulatory risks also pose challenges, although the supportive regulatory environment in North America offers some relief. Market volatility and customer capital discipline add to the uncertainty. Significant insider selling over the past three months and a high level of debt further exacerbate these risks, highlighting the need for strategic risk management and market adaptation.

Conclusion

Caterpillar's impressive financial health, marked by a 31.7% earnings growth and an operating profit margin of 22.4%, underscores its strong market position and effective cost management. However, challenges such as a 4% decline in sales and revenues, a modest revenue growth forecast of 2.9% per year, and high debt levels indicate areas for improvement. The company's strategic focus on sustainability and innovative technologies, coupled with a growing backlog, positions it well for future growth despite external economic and competitive pressures. While Caterpillar's Price-To-Earnings Ratio of 16.2x suggests it is a good value compared to peers, its current trading price above the estimated fair value of $295.31 necessitates careful monitoring of market conditions and strategic adjustments to ensure sustained success.

Taking Advantage

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:CAT

Caterpillar

Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in worldwide.

Solid track record with excellent balance sheet and pays a dividend.