- United States

- /

- Machinery

- /

- NYSE:CAT

Caterpillar (CAT) Valuation Spotlight as Analysts Boost Ratings Following $35B Backlog and Strong Margins

Reviewed by Kshitija Bhandaru

Shares of Caterpillar (CAT) jumped 4% after several investment firms boosted their outlooks. Analysts pointed to strong profit margins, steady demand, and a substantial $35 billion backlog as driving factors.

See our latest analysis for Caterpillar.

Caterpillar’s stock has enjoyed impressive momentum lately, notching a 19.7% share price return over the last month while handily outpacing industry peers and broader indices. A wave of upbeat analyst commentary and fresh product updates has fueled recent gains. With a 39% share price return year-to-date and 28.2% total shareholder return for the past year, sentiment is clearly on the upswing for both the short and long term.

If you’re interested in what else might be gaining ground, now is the perfect moment to broaden your horizons and explore fast growing stocks with high insider ownership

But with the stock’s rapid ascent and mixed analyst outlooks on near-term earnings, the question remains: Is Caterpillar still trading below its true value, or has the market already priced in the next phase of growth?

Most Popular Narrative: 6.9% Overvalued

With the most widely followed narrative assigning a fair value of $468, Caterpillar’s closing price of $500 sits noticeably above this mark. This raises questions about the optimism priced into shares and sets the scene for a closer look at what is driving analyst assumptions behind this narrative, including the role of global infrastructure demand and future margin improvements.

“Record backlog growth across all three primary segments, driven by strong global infrastructure demand (particularly in North America, Africa, and the Middle East), positions Caterpillar for above-trend sales growth in late 2025 and into 2026, supporting top-line revenue expansion. Robust order activity and continued demand from the data center (cloud/AI) buildout, especially in power generation, are driving capacity investments and throughput gains in Energy & Transportation. This sets the stage for further sales and operating profit growth as new capacity ramps up over 2026 and 2027.”

What are analysts betting on? Subtle but powerful shifts in revenue mix and segment growth underpin this price. The deeper story: bold projections about future operating margins and assumed repeat performance from order backlogs. Find out exactly which assumptions tip the balance in this valuation.

Result: Fair Value of $468 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff changes and persistent price competition could quickly erode margins. This introduces volatility that challenges even the most optimistic forecasts.

Find out about the key risks to this Caterpillar narrative.

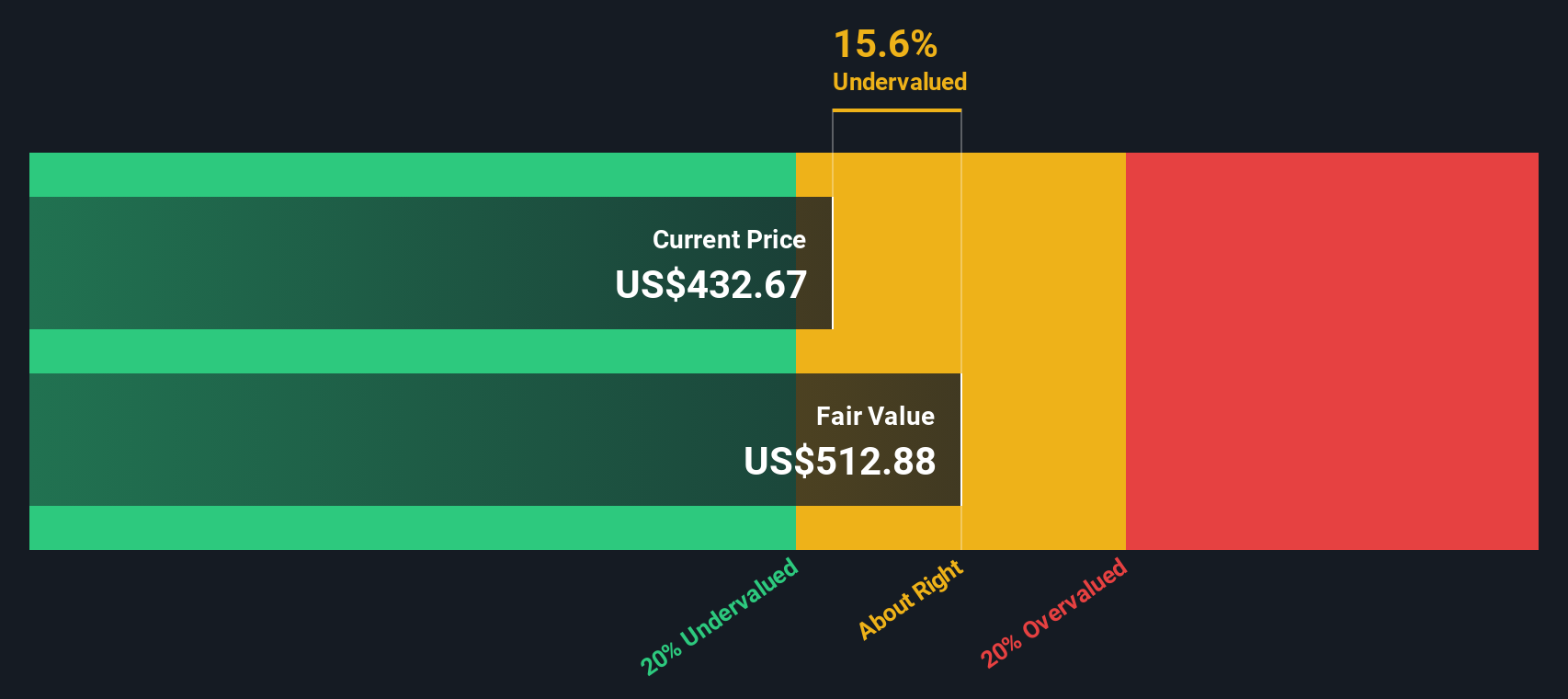

Another View: Discounted Cash Flow Suggests Undervaluation

Looking at our DCF model, Caterpillar’s shares appear to be trading roughly 2.1% below their estimated fair value of $511.29. This presents a subtle but meaningful contrast to the overvalued picture presented by multiples. Should investors trust the market-average price, or could intrinsic value rise further?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Caterpillar for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Caterpillar Narrative

If you want to put a different spin on the story, dive into the numbers yourself and shape your own perspective in just a few minutes, or Do it your way.

A great starting point for your Caterpillar research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop with Caterpillar. This is your moment to seize new opportunities and move ahead of the crowd by acting on market-changing investment themes.

- Unlock fresh growth by targeting game-changing trends using these 26 quantum computing stocks that highlight advances in quantum computing and leading-edge innovation.

- Boost your passive income stream when you scan these 18 dividend stocks with yields > 3% for companies offering stable dividends and high yields above 3%.

- Capitalize on undervalued opportunities by checking out these 888 undervalued stocks based on cash flows which pinpoint stocks trading below their cash flow potential right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAT

Caterpillar

Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives