- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

Is Boeing’s Share Price Justified After 7% Drop and 737 MAX Production Issues?

Reviewed by Bailey Pemberton

- Curious whether Boeing is flying high enough to justify its current share price? If you have ever wondered if this stock is a bargain or overhyped, you are in the right place.

- Boeing's shares have seen some turbulence lately, dipping 1.4% over the last week and falling 7.4% in the past month. They are still up an impressive 13.6% year to date and 34.5% over the last year.

- News headlines have focused on ongoing production challenges for Boeing's 737 MAX jets, along with shifts in defense contract awards that have added both uncertainty and new opportunities. Ongoing supply chain issues and renewed travel demand also continue to shape the company's prospects and investor expectations.

- Boeing passes all our main value checks with a valuation score of 6/6. As we dive into traditional and alternative valuation approaches, keep in mind there might be an even more insightful way to judge its true worth coming up at the end of this article.

Approach 1: Boeing Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. This approach is widely used to determine how much a business is truly worth, based on the cash it is expected to generate over time.

For Boeing, the latest reported Free Cash Flow is negative at $5.91 Billion. However, analysts expect a significant turnaround, with projections for cash flow to reach $13.16 Billion by the end of 2029. Looking out over ten years, Simply Wall St's extended projection suggests Boeing could reach $22.24 Billion in annual Free Cash Flow by 2035. It is important to note that while analysts provide detailed forecasts for the next five years, estimates further out are extrapolated based on industry trends and company history.

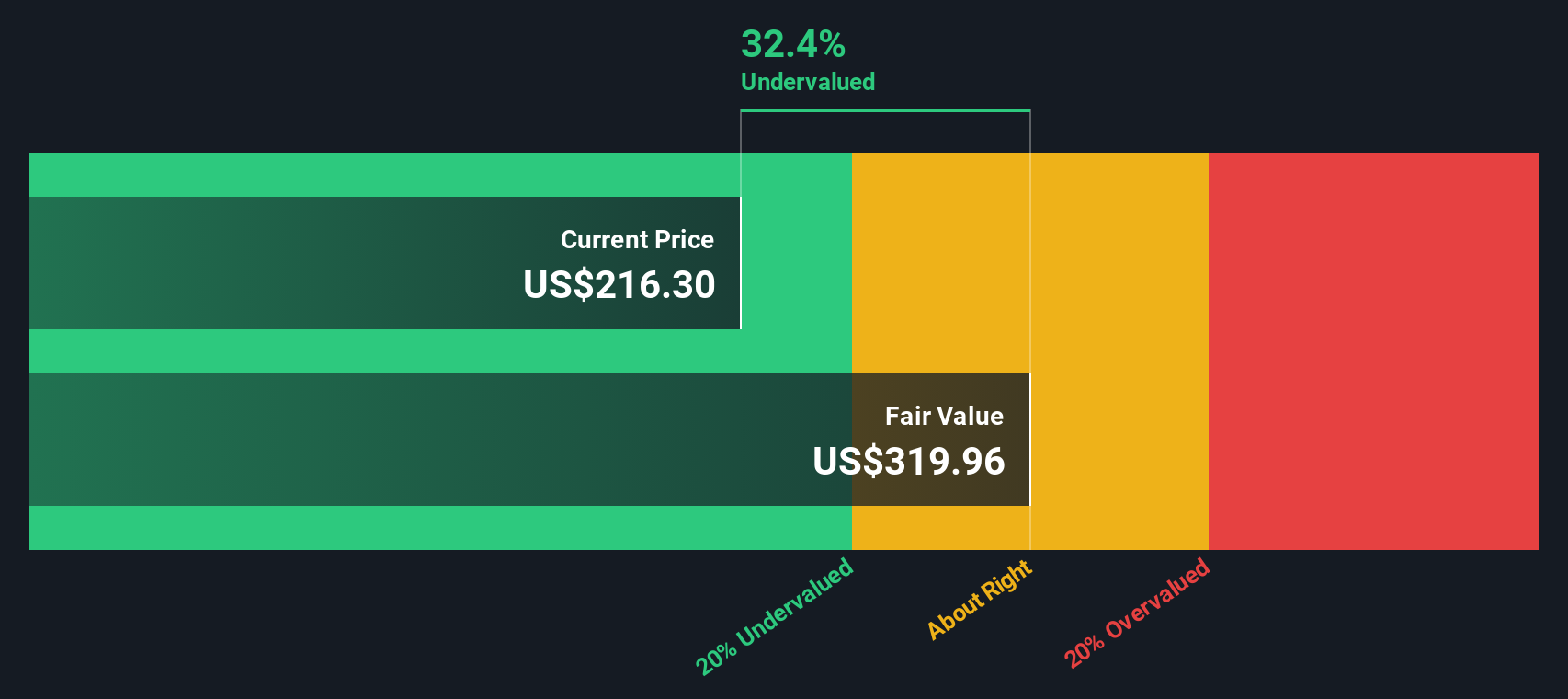

Based on these projections and the 2 Stage Free Cash Flow to Equity model, Boeing's estimated intrinsic value comes to $385.37 per share. With the current share price trading at a 49.3% discount to this estimate, the DCF model considers Boeing to be significantly undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Boeing is undervalued by 49.3%. Track this in your watchlist or portfolio, or discover 857 more undervalued stocks based on cash flows.

Approach 2: Boeing Price vs Sales (P/S)

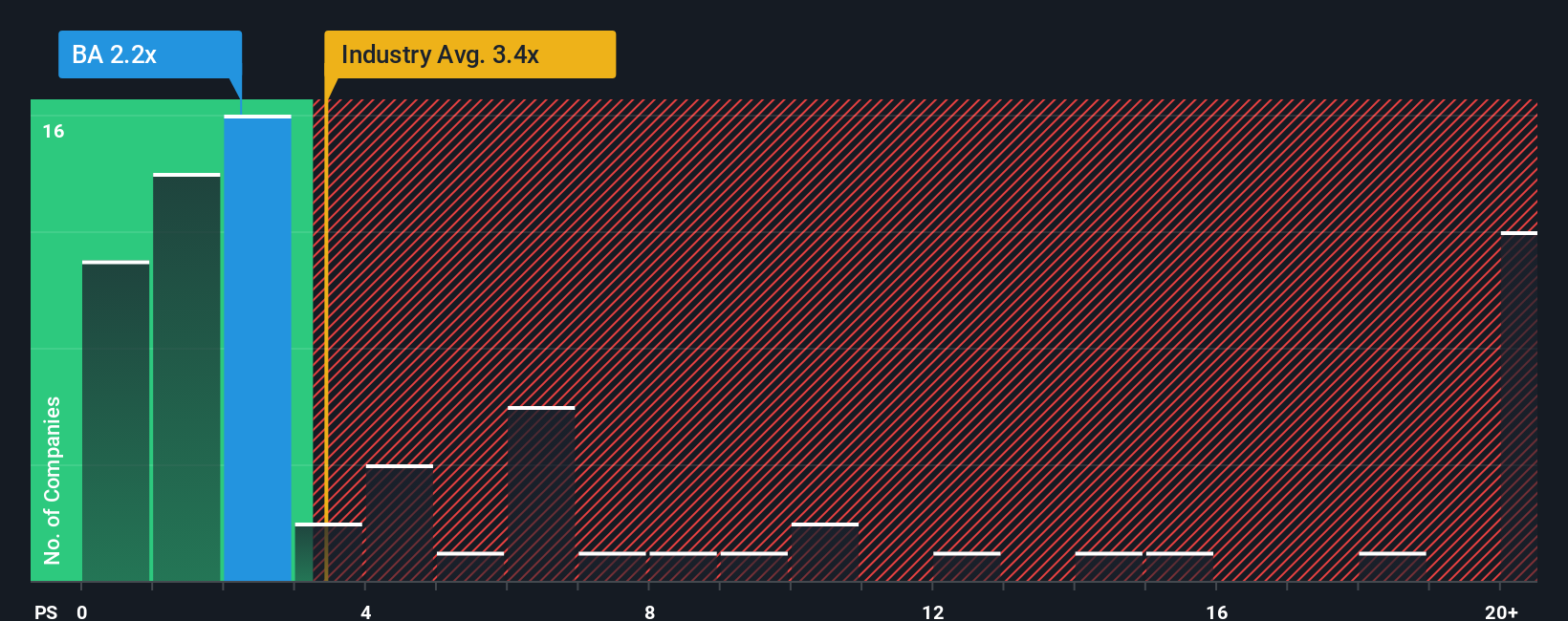

For companies like Boeing that have inconsistent or negative profitability right now but substantial revenues, the Price-to-Sales (P/S) ratio is often the best yardstick for valuation. The P/S multiple helps investors judge how much they are paying for every dollar of sales, making it especially useful when net earnings are volatile or temporarily negative.

The level at which a P/S ratio is considered "normal" or "fair" will depend on the company’s growth prospects, profit margins, industry trends, and risk profile. Generally, higher growth expectations or stronger margins can justify a higher multiple. On the other hand, bigger risks or slower growth point to a lower one.

Boeing is currently trading on a P/S ratio of 1.84x. For context, the average for its Aerospace & Defense industry is 2.99x, while its peer group trades around 2.01x. This indicates Boeing is on the lower end of the spectrum compared to its industry and peers.

Simply Wall St calculates a “Fair Ratio” for Boeing at 1.98x, which accounts for factors like its predicted growth, profit outlook, size, and sector-specific risks. Using the Fair Ratio is an upgrade over simple industry or peer comparisons because it customizes the benchmark to reflect Boeing’s specific opportunities and challenges, not just broad averages. This way, investors can gauge value relative to what should be expected for Boeing, not just for any aerospace company.

With Boeing’s current P/S of 1.84x sitting very close to its Fair Ratio of 1.98x, the stock is priced about where it should be on this metric.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1367 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Boeing Narrative

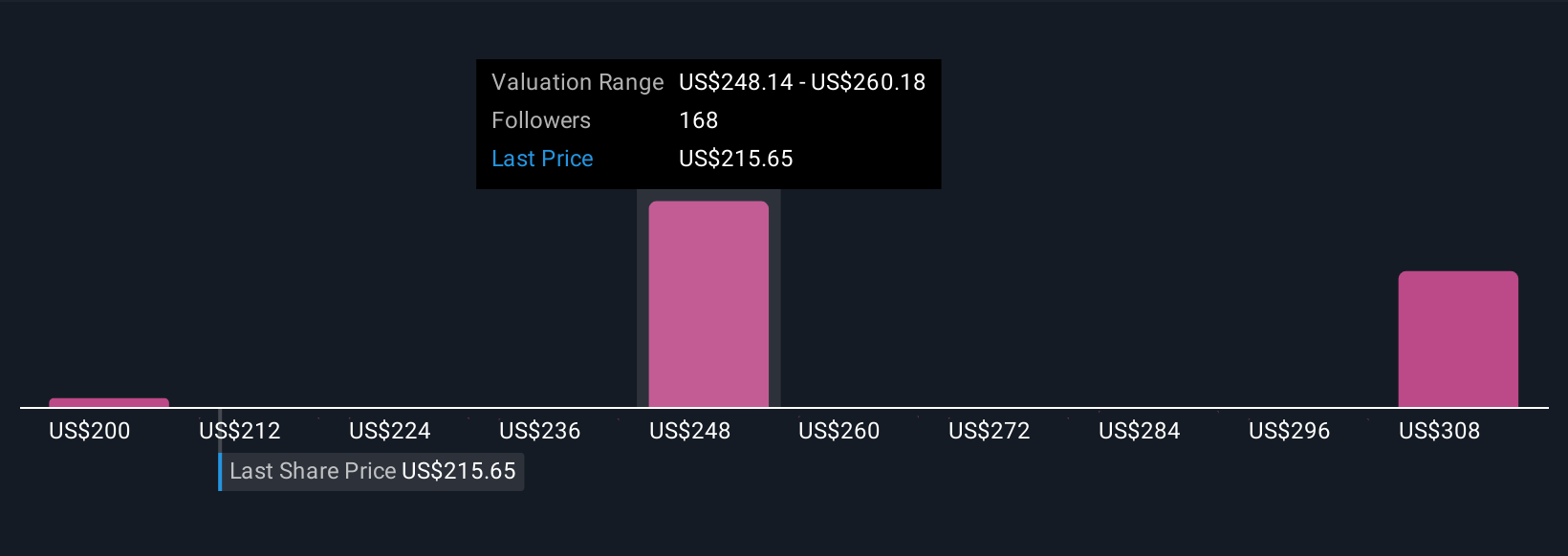

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your perspective on a company's future, backed by the story you believe in, including the reasons behind your assumptions and forecasts for things like revenue, earnings, and margins. Narratives connect what you know about Boeing, such as the demand for air travel, supply chain progress, order backlog, or challenges, with a financial forecast, turning that story into an estimated fair value for the stock.

Available directly on Simply Wall St's Community page and used by millions of investors, Narratives make it easy for you to frame your investment view, compare it with others, and adjust as information changes. All of this is possible without needing a finance degree. When news headlines shift or earnings results drop, Narratives update dynamically, helping you see in real time how Fair Value estimates stack up against the current share price and supporting more timely buy or sell decisions.

For instance, some users build bullish Narratives for Boeing based on strong aircraft demand and a record $500 billion backlog, resulting in higher fair values. Others remain cautious, focusing on ongoing production delays or high debt, which leads to more conservative estimates. Narratives empower you to invest using your own story, informed by the latest facts.

Do you think there's more to the story for Boeing? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives