- United States

- /

- Aerospace & Defense

- /

- NYSE:ATI

ATI (ATI) Valuation Check as Veteran Insider J. Robert Foster Steps In as Future CFO

Reviewed by Simply Wall St

ATI (ATI) is shaking up its finance leadership, with longtime insider J. Robert Foster stepping in as Chief Financial Officer on January 1, 2026, as veteran CFO Don Newman transitions toward retirement.

See our latest analysis for ATI.

The CFO transition comes at a strong moment for ATI, with the share price at about $99.64 and an 81% year to date share price return, while the 5 year total shareholder return above 500% suggests momentum has been building rather than fading.

If ATI’s run has you thinking about what else could surprise to the upside, this is a good moment to scout other aerospace names through aerospace and defense stocks.

With earnings estimates climbing, a double digit discount to analyst targets, and a towering five year return, the bigger question now is whether ATI still trades below its true potential or if the market is already pricing in the next leg of growth.

Most Popular Narrative: 15.7% Undervalued

With ATI closing at $99.64 against a narrative fair value of $118.25, the spread reflects confidence that earnings power can keep compounding from here.

Discrete investments in advanced alloys production, process automation, and supply chain partnerships are already yielding step changes in manufacturing efficiency and output, evidenced by expanding High Performance Materials & Components margins (to >24%) and stronger incremental margin capture, accelerating EBITDA and free cash flow conversion.

Want to see what justifies that higher value? The narrative leans on rising margins, disciplined growth, and a future earnings multiple usually reserved for sector leaders.

Result: Fair Value of $118.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated reliance on a few major aerospace customers and ongoing heavy capex needs could quickly pressure margins if demand or execution falters.

Find out about the key risks to this ATI narrative.

Another Lens On Value

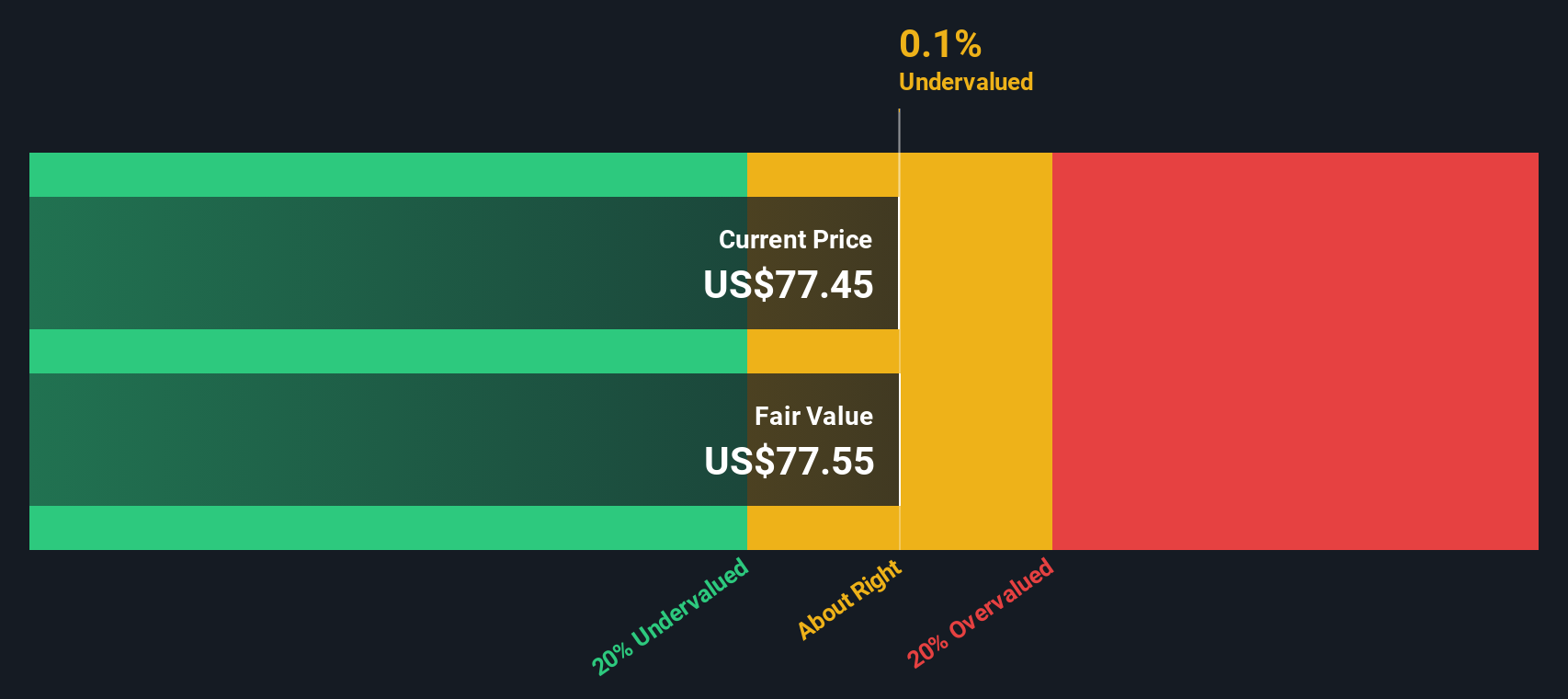

Our DCF model is less upbeat than the narrative fair value. It suggests that ATI’s shares at $99.64 sit modestly above an estimated fair value of about $94.63, which implies mild overvaluation rather than a clear bargain. Is the market now paying up for the story ahead of the numbers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ATI for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ATI Narrative

If you see the numbers differently or want to dive deeper into the data yourself, you can build a custom thesis in minutes with Do it your way.

A great starting point for your ATI research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If ATI has your attention, you may want to move quickly on other opportunities that match your strategy before the crowd catches on and prices reset.

- Capture momentum early by scanning these 27 AI penny stocks that are turning breakthroughs in artificial intelligence into revenue and earnings growth.

- Support your income stream by targeting these 15 dividend stocks with yields > 3% that combine regular payouts with balance sheets designed to withstand market shocks.

- Explore potential value opportunities by reviewing these 909 undervalued stocks based on cash flows trading at discounts to their estimated cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATI

ATI

Produces and sells specialty materials and complex components worldwide.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026