- United States

- /

- Electrical

- /

- NYSE:AMPX

A look at Amprius Technologies’ valuation after Nokia selects its batteries for next‑gen drone networks

Reviewed by Simply Wall St

Nokia’s decision to use Amprius Technologies (AMPX) SiCore cells in its next generation drone networks puts a real world spotlight on the battery maker’s technology and its positioning in advanced UAV markets.

See our latest analysis for Amprius Technologies.

The Nokia win lands at a time when momentum in Amprius’ share price has been powerful, with a 90 day share price return of 71.31 percent and year to date share price return of 325.87 percent. The 1 year total shareholder return of 494.15 percent underlines how quickly sentiment has shifted toward its growth story.

If this kind of real world adoption has caught your eye, it could be a good moment to explore other high growth tech and battery innovators with high growth tech and AI stocks.

With the stock up nearly 500 percent in a year but still trading at a steep discount to bullish analyst targets, is Amprius a rare underappreciated growth story, or are markets already pricing in its next leg of expansion?

Most Popular Narrative: 29% Undervalued

With the most followed narrative pointing to a fair value well above the last close at $12.18, the implied upside rests on aggressive growth and margin expansion assumptions.

Strong demand for advanced batteries, premium pricing, and key customer wins support robust revenue growth and margin outperformance.

Expansion into global manufacturing and automation reduces volatility, increases scale, and enhances visibility and stability of future earnings.

Want to see what kind of revenue surge, margin lift, and future earnings multiple are baked into that fair value line? The narrative spells out an ambitious scaling path, a sharp profit swing, and a valuation profile more typical of market darlings than early stage battery players. Curious how those moving parts combine into one price target trajectory? Dive into the full narrative to unpack the assumptions powering this upside case.

Result: Fair Value of $17.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could quickly fray if production scale up stumbles or key UAV customers delay orders, which could dent revenue visibility and margins.

Find out about the key risks to this Amprius Technologies narrative.

Another Lens on Valuation

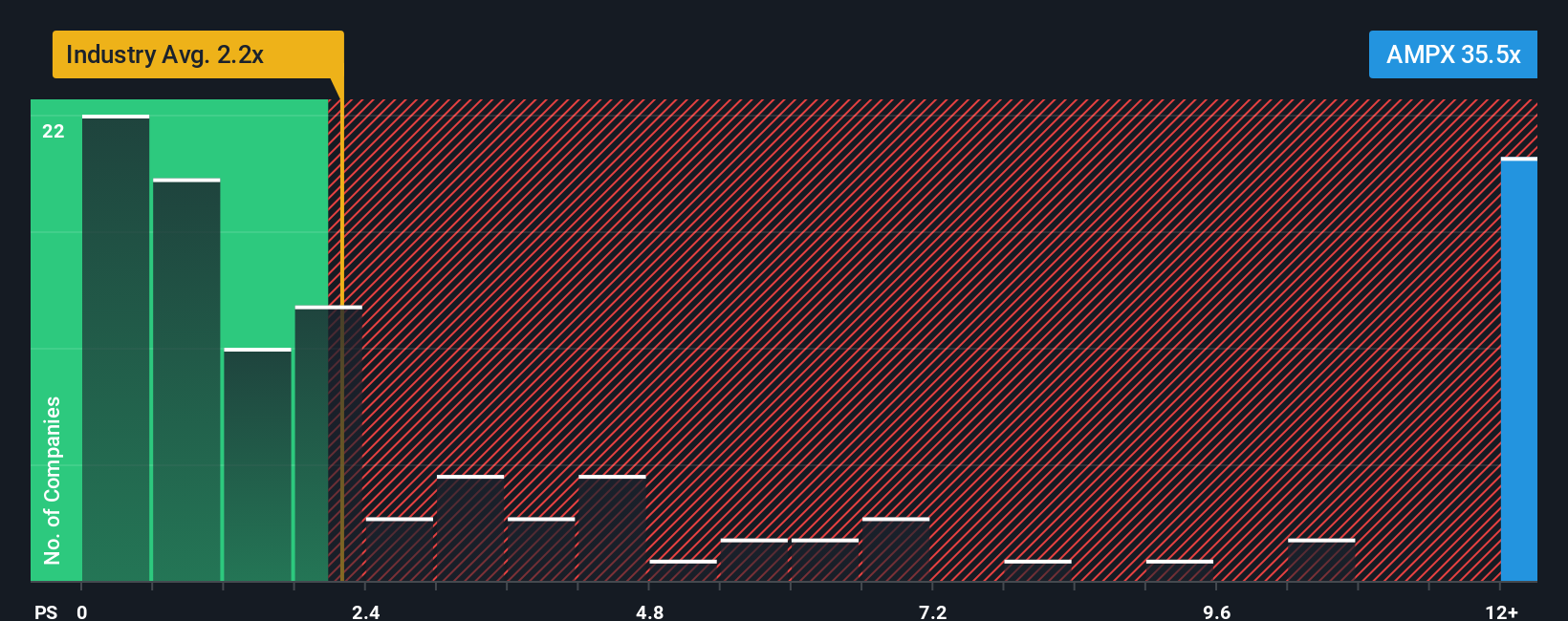

While the narrative fair value paints Amprius as materially undervalued, our look at its price to sales ratio tells a sharper story. At 27.2 times sales versus 2.2 times for the US electrical industry and 21.1 times for peers, it also sits far above its own 2.7 times fair ratio.

That gap suggests investors are already paying up heavily for future growth, leaving less margin for error if execution slips or sentiment cools. If the market drifts back toward that fair ratio, how much of today’s upside case would still feel comfortable?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amprius Technologies Narrative

If this view does not quite fit your outlook, or you would rather interrogate the numbers yourself, you can craft a custom narrative in minutes: Do it your way.

A great starting point for your Amprius Technologies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an information edge by using the Simply Wall St Screener to uncover fresh opportunities other investors may be overlooking.

- Target steady income growth by reviewing these 15 dividend stocks with yields > 3% that can help anchor your portfolio with reliable cash returns.

- Position yourself early in structural tech shifts by scanning these 26 AI penny stocks shaping the next wave of intelligent automation.

- Capitalize on mispriced potential with these 905 undervalued stocks based on cash flows that may offer substantial upside if market expectations catch up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMPX

Amprius Technologies

Develops, manufactures, and markets lithium-ion batteries for mobility applications.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026