- United States

- /

- Electrical

- /

- NYSE:AME

A Look at AMETEK (AME) Valuation Following Strong Q3 Growth and Margin Expansion

Reviewed by Simply Wall St

AMETEK delivered a strong third-quarter update, highlighting double-digit revenue growth and improved margins because of steady demand in aerospace, power, and automation. These results give investors plenty to consider for the months ahead.

See our latest analysis for AMETEK.

AMETEK’s recent period has seen a wave of positive momentum. Its strong third-quarter results, leadership transition announcements, and another quarterly dividend have all kept it in the spotlight. The shares have rallied with a 1-month share price return of nearly 8% and a 6.5% gain over the last quarter, while the 1-year total shareholder return sits just above breakeven. Over the long term, its three- and five-year total shareholder returns of 45% and 71% underscore solid compounding, making recent enthusiasm feel well-grounded.

If AMETEK’s blend of industrial innovation and steady execution has you curious about what else is trending, now is a great time to explore See the full list for free.

With strong financial results and rising analyst price targets, investors now face a central question: is AMETEK’s robust growth story still underappreciated by the market, or has the recent rally already captured expectations for future upside?

Most Popular Narrative: 9.1% Undervalued

With analysts’ fair value estimate at $216.53 and the most recent close at $196.79, the prevailing narrative argues AMETEK’s future has not been fully priced in despite the stock’s strong run. The detailed thesis hinges on the idea that expanding recurring revenue streams and margin improvements can drive further upside.

Adoption of digital reality, automation, and advanced metrology solutions is accelerating across key end markets such as aerospace, defense, and architecture. This trend was recently reinforced by the FARO Technologies acquisition, which expands AMETEK's addressable market and supports both revenue and margin growth through higher value, software-enabled recurring revenue streams.

Curious what’s pushing these ambitious projections? The narrative leans heavily on fast-evolving markets, efficiency breakthroughs, and expectations for earnings growth that could surprise even industry veterans. Uncover the full strategy and see what assumptions fuel this undervalued verdict.

Result: Fair Value of $216.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in key end markets or challenges integrating recent acquisitions could quickly undermine these optimistic expectations and change the outlook for AMETEK.

Find out about the key risks to this AMETEK narrative.

Another View: Looking Beyond the Fair Value Estimate

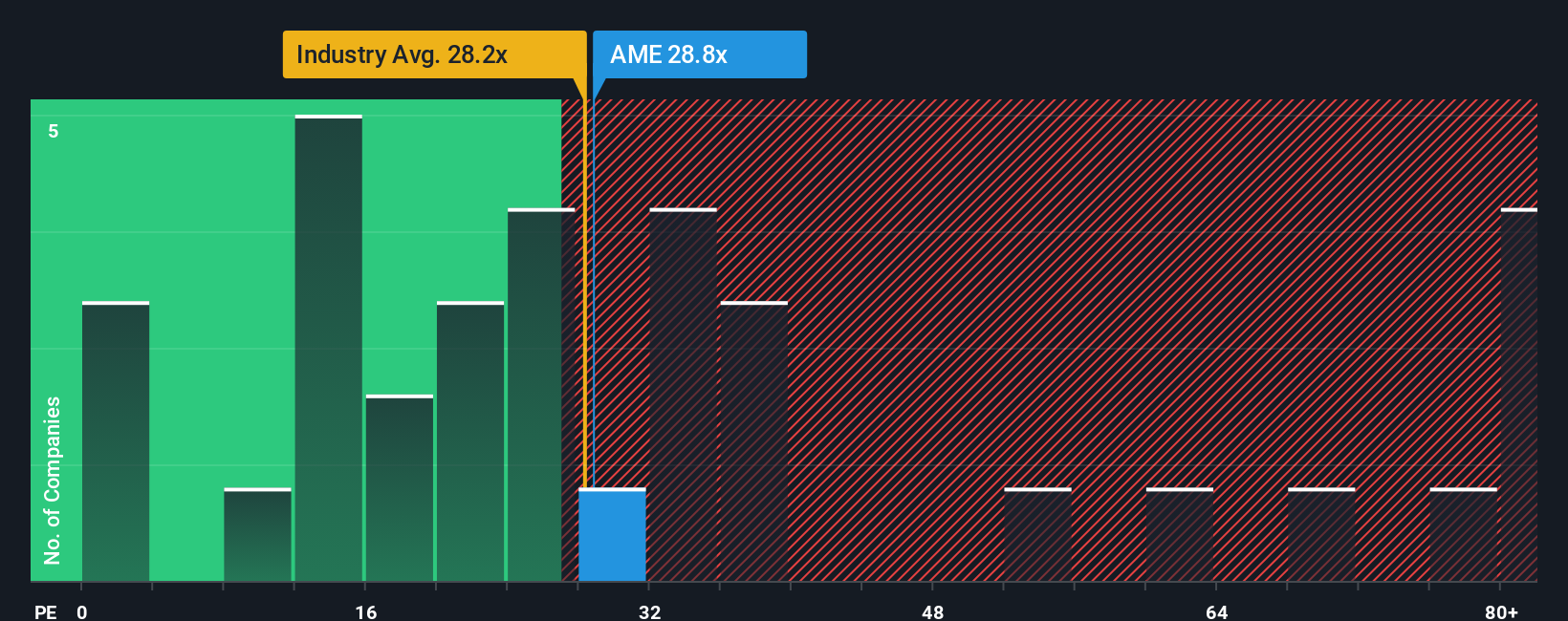

While analysts argue AMETEK is undervalued based on discounted future earnings, a closer look at its price-to-earnings ratio raises questions. The stock is trading at 30.8x earnings, higher than both the US Electrical industry average of 29.5x and its own fair ratio of 25.2x. That means much of the optimism might already be baked in, which could leave less room for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AMETEK Narrative

If you have a different perspective or want to dig deeper into AMETEK’s story, you can put together your own take in just minutes. Do it your way

A great starting point for your AMETEK research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors expand their strategies by tapping into hidden gems and untapped sectors. Don’t let unique opportunities slip by when so many market leaders are within reach.

- Capitalize on next-generation breakthroughs in artificial intelligence by seizing opportunities with these 25 AI penny stocks, which are driving automation, learning, and tech disruption.

- Secure reliable income by tracking high-yield picks through these 14 dividend stocks with yields > 3%, designed for those who value consistent payouts and long-term stability.

- Embrace the digital asset revolution and gain early exposure to financial innovation by evaluating these 82 cryptocurrency and blockchain stocks, which are pushing boundaries in blockchain and cryptocurrency solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AME

AMETEK

Manufactures and sells electronic instruments (EIG) and electromechanical (EMG) devices in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives