- United States

- /

- Machinery

- /

- NYSE:ALSN

Is Allison Transmission's (ALSN) Increased Buybacks and Low NOx Launch Signaling Shifts in Its Long-Term Strategy?

Reviewed by Simply Wall St

- Allison Transmission Holdings recently reported second quarter 2025 results, declared a US$0.27 per share dividend for the third quarter, and updated its share buyback progress, having repurchased 1,088,028 shares for US$102.49 million between April and June 2025.

- The company also announced the availability of its CARB low NOx compliant Allison 4000 Series transmission with PACCAR’s MX-13 engine for Kenworth and Peterbilt trucks, marking an expansion into compliant vehicle solutions with industry-leading OEM partners.

- To understand the implications for Allison’s long-term investment case, we’ll examine how its continued shareholder returns signal operational confidence and evolving market leadership.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Allison Transmission Holdings Investment Narrative Recap

To be a shareholder in Allison Transmission Holdings, you generally need to believe in the company's ability to generate consistent cash flows from drivetrain solutions, maintain leadership with OEM partners, and return capital through dividends and buybacks. The recent news, including steady dividends, continued share repurchases, a CARB-compliant product launch, and slightly revised guidance, does not materially change the immediate catalyst, which remains the integration and performance of the Dana Off-Highway acquisition. The key risk continues to be a slowdown in the North America On-Highway segment.

The announcement of Allison’s CARB low NOx compliant 4000 Series transmission for PACCAR’s MX-13 engine stands out, as it reflects Allison's move to address emissions standards and meet demand for compliant commercial vehicles. This product update ties back to evolving regulatory risks and growing pressure for traditional drivetrain providers to adapt, which could be a supporting factor for Allison’s reputation with OEMs and influence short-term sales trends.

However, investors should be aware that, despite this progress, the persistent softness in North America On-Highway demand still looms as a...

Read the full narrative on Allison Transmission Holdings (it's free!)

Allison Transmission Holdings' outlook anticipates $3.6 billion in revenue and $818.6 million in earnings by 2028. This is based on an expected annual revenue growth rate of 3.6% and a $56.6 million increase in earnings from the current $762.0 million.

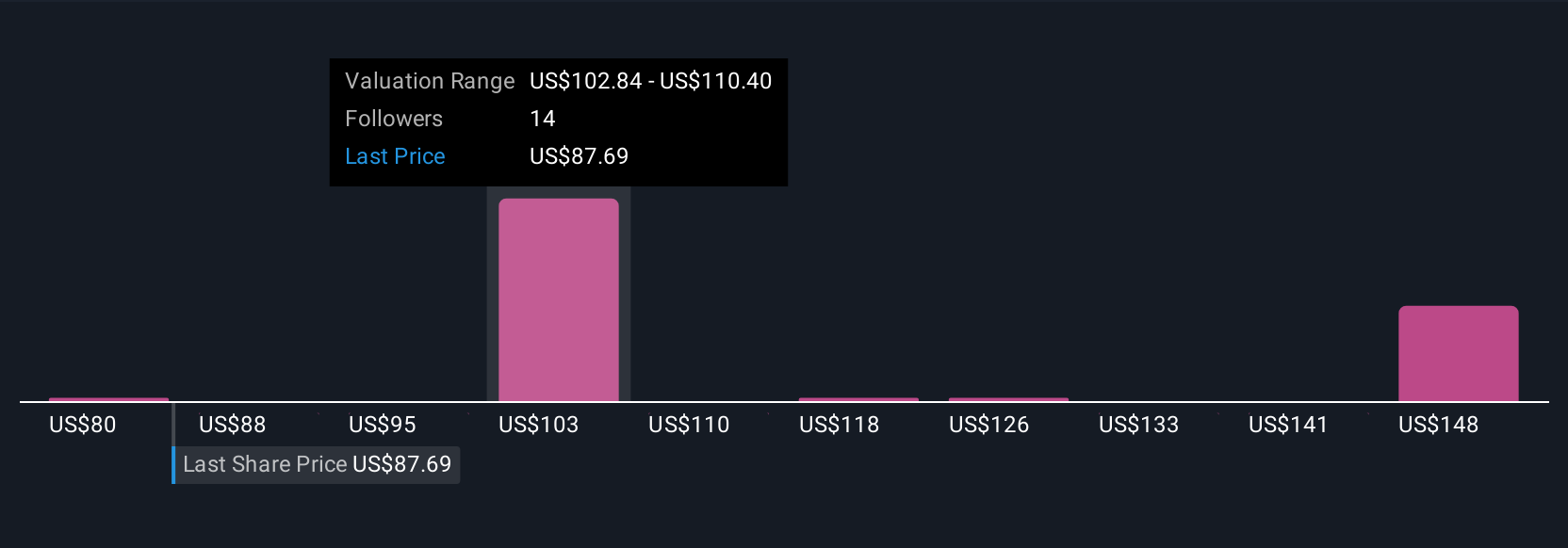

Uncover how Allison Transmission Holdings' forecasts yield a $102.11 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community shared US$80.18 to US$263.46 as their fair value for Allison Transmission Holdings. In contrast, continued OEM production cuts in North America may weigh on short-term earnings, so consider multiple views as you form your outlook.

Explore 6 other fair value estimates on Allison Transmission Holdings - why the stock might be worth 9% less than the current price!

Build Your Own Allison Transmission Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allison Transmission Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Allison Transmission Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allison Transmission Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALSN

Allison Transmission Holdings

Designs, manufactures, and sells fully automatic transmissions for medium- and heavy-duty commercial vehicles and medium- and heavy-tactical U.S.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives