- United States

- /

- Building

- /

- NYSE:ALLE

Allegion (ALLE): Evaluating Valuation Following Launch of Industry-First Wi-Fi Access Control With Brivo

Reviewed by Simply Wall St

Allegion (ALLE) just announced a new partnership with Brivo, launching a Wi-Fi-enabled access control system for properties of all types. The collaboration leverages Allegion’s wireless lock technology and aims to cut installation costs and simplify security upgrades.

See our latest analysis for Allegion.

Allegion’s big move into Wi-Fi-enabled security appears to have struck a chord with investors, as the share price has climbed more than 30% year-to-date. While recent weeks saw a modest pullback, Allegion’s one-year total shareholder return of nearly 20% highlights the stock’s long-term momentum and optimism around its latest innovations.

If you’re watching how technology is reshaping security, now is a smart time to discover fast growing stocks with high insider ownership

With this wave of innovation and market enthusiasm, the question for investors remains clear: is Allegion’s strong run just beginning, or are future gains already reflected in the current share price?

Most Popular Narrative: 8.5% Undervalued

The latest narrative places Allegion’s fair value at $183.09, roughly 8.5% higher than the last close of $167.55. This sets the stage for a closer look at the analyst consensus and reasons the market may not have fully captured the company’s potential upside.

Bullish analysts note that the majority of Allegion's Americas non-residential market has rebounded from previous softness. This suggests improved stability and growth prospects in this key segment.

Want to peek behind Allegion’s rising valuation? The real focus in this narrative is on ambitious margin expansion targets and future profit multiples that are seldom seen outside high-growth tech. Curious which financial forecasts are driving the fair value estimate higher? Explore further to uncover the full story and the unexpected projections behind the headline figure.

Result: Fair Value of $183.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty remains if nonresidential markets stumble or if Allegion’s international segment continues to lag. This could pressure future growth projections.

Find out about the key risks to this Allegion narrative.

Another View: Pricing Based on Market Comparisons

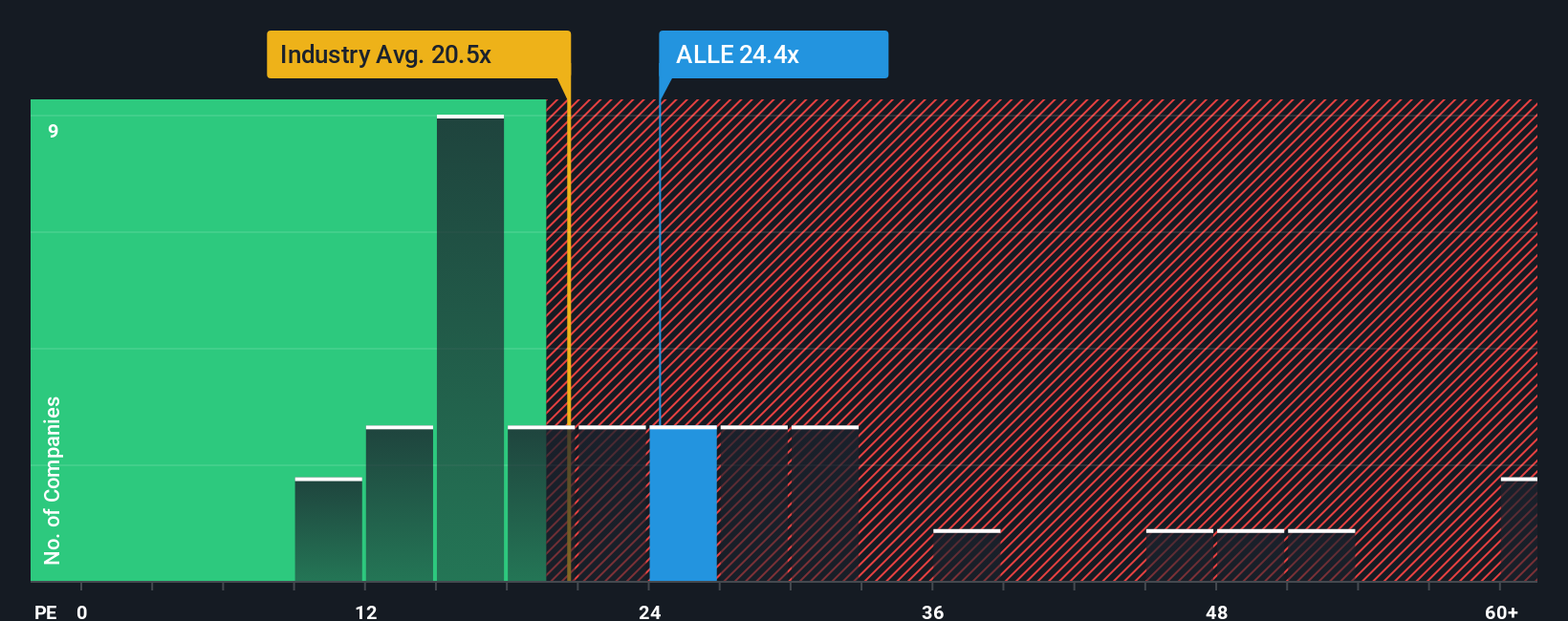

Taking a step back from future earnings forecasts, Allegion is currently priced richer than both its industry and peers. It is trading at 22.4 times earnings compared to the US Building industry average of 19.9 and a peer average of 19.5. Even when compared to the fair ratio of 22.2, there is little margin for error built into today’s market price. Does this higher multiple signal confidence in ongoing growth, or could it leave investors exposed if expectations falter?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Allegion Narrative

If you see things differently or want to dig into the numbers on your own terms, you can easily craft your own Allegion story in just minutes. Do it your way

A great starting point for your Allegion research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Winning Opportunities?

Don’t just watch from the sidelines while others spot lucrative stocks before they take off. Use the Simply Wall Street Screener to get ahead and stay confident in your next move.

- Secure better yields for your portfolio by checking out these 16 dividend stocks with yields > 3% with payouts above 3% and steady financials.

- Tap into the potential of state-of-the-art medicine and robotics as you see how these 32 healthcare AI stocks are transforming patient care and diagnostics.

- Catch the next wave of digital innovation by scanning these 82 cryptocurrency and blockchain stocks powered by blockchain and cryptocurrency breakthroughs reshaping financial networks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALLE

Allegion

Engages in the provision of security products and solutions worldwide.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives