- United States

- /

- Trade Distributors

- /

- NYSE:AIT

How Strong Q1 Results and Updated Guidance at Applied Industrial Technologies (AIT) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Applied Industrial Technologies recently reported first quarter results showing increased sales to US$1,199.52 million and net income of US$100.81 million, along with a modest raise in fiscal 2026 earnings guidance and the completion of a US$98.74 million share repurchase program.

- The company also reaffirmed its dividend and highlighted a strong focus on M&A, with an active pipeline and substantial balance sheet flexibility, pointing to ongoing investment in growth initiatives.

- We'll explore how Applied Industrial Technologies' earnings growth and updated guidance may shape the outlook in its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Applied Industrial Technologies Investment Narrative Recap

For investors considering Applied Industrial Technologies, the core story centers on whether its focus on disciplined acquisitions and technical service expansion can offset muted demand across several industrial markets. The latest quarterly results showed rising sales and net income, a slightly raised earnings outlook, and completion of a US$98.74 million share buyback program, none of which materially change the near-term catalyst of margin improvement, nor the persistent risk from potential integration challenges tied to ongoing M&A activity.

Among the announcements, management's reaffirmation of M&A as a central priority for fiscal 2026 is particularly relevant: with an active pipeline and robust balance sheet flexibility, Applied continues to bet on acquisitions as a growth lever, directly influencing both its opportunities and integration risks. As such, any stumbles in realizing anticipated synergies or integrating new businesses could become magnified when organic growth is more limited.

In contrast, what most investors may underestimate is the risk if acquisition integration falls short...

Read the full narrative on Applied Industrial Technologies (it's free!)

Applied Industrial Technologies’ outlook anticipates $5.3 billion in revenue and $475.0 million in earnings by 2028. This scenario assumes annual revenue growth of 4.9% and an $82 million increase in earnings from the current $393.0 million.

Uncover how Applied Industrial Technologies' forecasts yield a $303.33 fair value, a 17% upside to its current price.

Exploring Other Perspectives

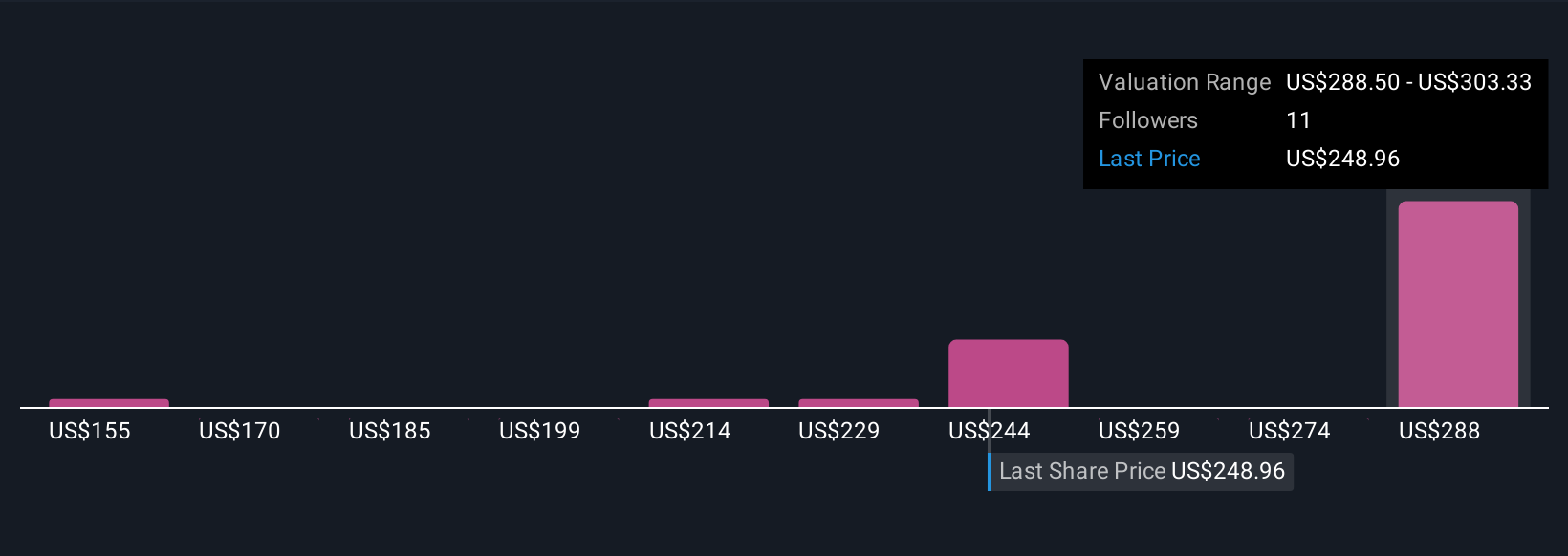

Five individual fair value estimates from the Simply Wall St Community range from US$155 to US$303 per share, reflecting broad variance. While acquisition-driven expansion remains a core focus, participants should consider how risks around integration and execution may play a more prominent role than price targets alone suggest.

Explore 5 other fair value estimates on Applied Industrial Technologies - why the stock might be worth 40% less than the current price!

Build Your Own Applied Industrial Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Industrial Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Applied Industrial Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Industrial Technologies' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIT

Applied Industrial Technologies

Distributes industrial motion, power, control, and automation technology solutions in the United States, Canada, Mexico, Australia, New Zealand, Singapore, and Costa Rica.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives