- United States

- /

- Aerospace & Defense

- /

- NYSE:AIR

Assessing AAR (AIR) Valuation After Strong Multi‑Year Share Price Gains

Reviewed by Simply Wall St

AAR (AIR) has quietly rewarded patient investors, with the stock up about 36% this year and roughly 81% over the past 3 years, as aviation demand and defense-related services continue to support its fundamentals.

See our latest analysis for AAR.

The latest leg higher has been helped by steady contract wins in aviation services and resilient defense demand. The $83.79 share price reflects building momentum rather than a sudden rerating, supported by an 11.27% 3 month share price return and strong multi year total shareholder returns.

If AAR’s run has you thinking more broadly about aerospace and defense, this could be a good moment to explore aerospace and defense stocks for other ideas on your watchlist.

With shares up sharply and analysts still seeing some upside, the real question now is whether AAR’s valuation leaves meaningful room for further gains, or if the market is already pricing in the next leg of growth.

Most Popular Narrative Narrative: 9.2% Undervalued

Compared to the last close at $83.79, the most followed narrative sees AAR’s fair value notably higher, setting up a case for moderate undervaluation.

AAR's strong growth in new parts Distribution (25%+ organic, significantly above market) directly aligns with increasing demand for resilient supply chains and more diversified inventory management from both commercial and government customers, indicating sustained future revenue expansion and potential for higher margins.

Want to know how steady revenue growth, expanding margins, a future earnings surge, and a deliberately lower valuation multiple all combine to justify that upside case?

Result: Fair Value of $92.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in Trax or intensifying OEM competition in aftermarket services could quickly erode the margin expansion that this bullish case depends on.

Find out about the key risks to this AAR narrative.

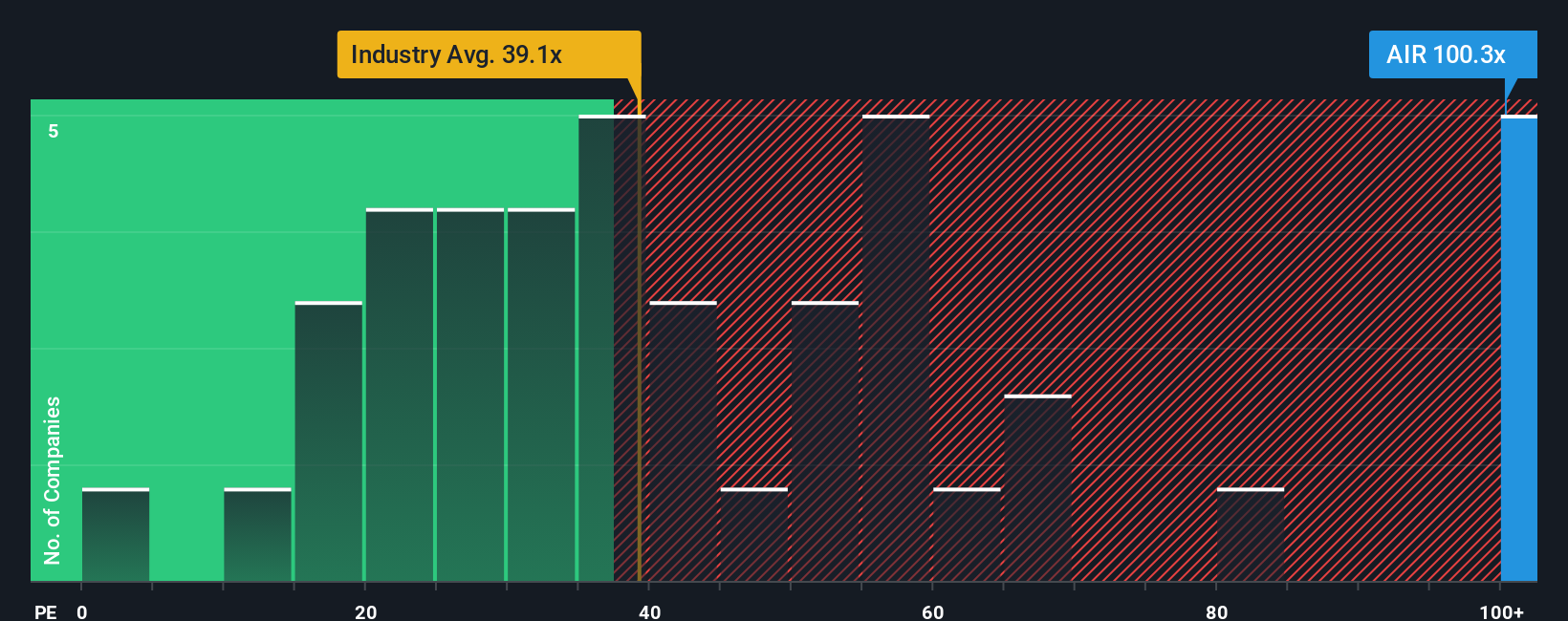

Another View: Rich on Earnings Multiples

While the narrative points to upside, AAR’s current price tells a different story when you look at earnings. The stock trades on a P/E of 114.7x, far above the US Aerospace and Defense average of 37.4x, the peer average of 54.9x, and even its fair ratio of 53.1x. That gap suggests investors are already paying up heavily for future growth, so how much margin of safety is really left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AAR Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view of AAR in just a few minutes, Do it your way.

A great starting point for your AAR research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may wish to consider using the Simply Wall Street Screener to uncover focused, data backed stock ideas aligned with your strategy.

- Explore potentially mispriced opportunities by scanning these 913 undervalued stocks based on cash flows that may appear attractive relative to their cash flows.

- Explore innovation themes by targeting these 26 AI penny stocks that are involved in advances in artificial intelligence.

- Support an income strategy by filtering for these 15 dividend stocks with yields > 3% with payout histories that may help with long term return objectives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIR

AAR

Provides products and services to commercial aviation, government, and defense markets in North America, Europe, Africa, Asia, and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026