- United States

- /

- Construction

- /

- NYSE:ACM

AECOM (ACM): Assessing Valuation Following Strategic Review, Dividend Hike, and Earnings Outlook Update

Reviewed by Simply Wall St

AECOM (NYSE:ACM) is drawing investor focus after revealing a review of strategic alternatives for its Construction Management business, which could include a sale. Management paired this move with updated earnings guidance and a sizable dividend increase.

See our latest analysis for AECOM.

Momentum around AECOM has faded in recent weeks, with a sharp 23.2% decline in its 1-month share price return following a slate of news that includes a major buyback update, rising dividends, and fresh earnings guidance. Despite short-term volatility, the company’s five-year total shareholder return of 109% shows that long-term holders have seen substantial gains. Near-term sentiment continues to reflect both uncertainty and anticipation surrounding its strategic review.

If you’re curious about what may be fueling growth in other corners of the market, it’s a great moment to discover fast growing stocks with high insider ownership

With shares now trading at a notable discount to analyst price targets and new strategic changes underway, investors are left to wonder if this is a window to buy AECOM at attractive value, or if the market has already accounted for the company’s growth plans.

Most Popular Narrative: 28% Undervalued

According to the most widely followed narrative, AECOM’s fair value has been set materially above the most recent closing price. This suggests that analysts see meaningful upside potential from current levels. Fresh profit margin upgrades and optimism around new project wins are key drivers shaping the bullish view behind the headline fair value.

Accelerating global and U.S. government-backed infrastructure spending, especially in transportation, water, energy, and data centers, provides multi-year revenue visibility and a record backlog. This should support top-line growth and backlog-driven earnings expansion. Intensifying investment and client demand for climate resilience, sustainability, and energy transition projects positions AECOM to win higher-margin advisory and environmental contracts. This supports margin expansion and higher average contract values.

How close is AECOM to unlocking the level of recurring earnings and margins usually seen in blue-chip consultancies? The narrative peels back the curtain on what bold, forward-looking assumptions justify its premium price target. Want to know which forecasts are quietly powering this bullish case and driving the price target much higher than where shares trade today? Dig deeper to see what’s really fueling this valuation.

Result: Fair Value of $143.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on government funding and rising competition from digital-first rivals could quickly pressure AECOM’s margins and disrupt its growth story.

Find out about the key risks to this AECOM narrative.

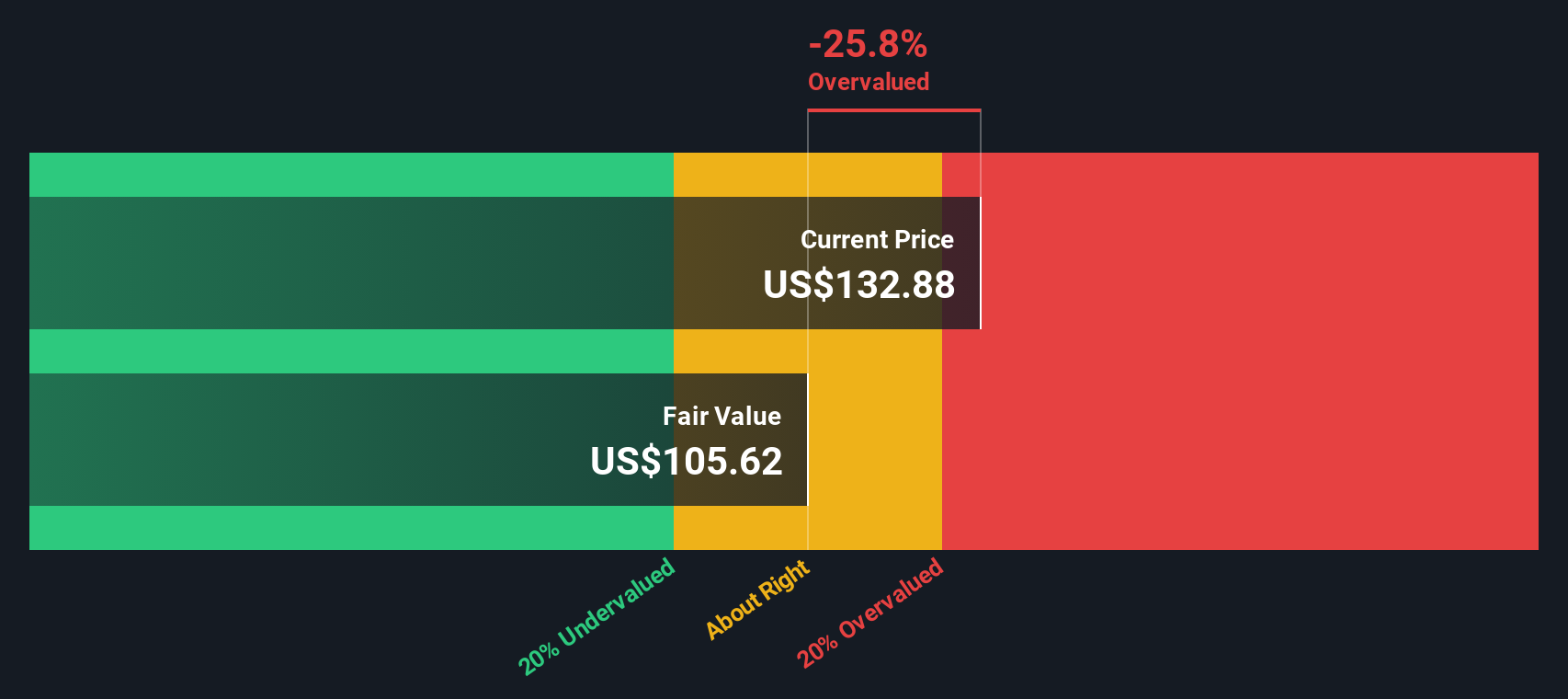

Another View: DCF Tells a Different Story

While analysts see fair value above today's price, our SWS DCF model suggests caution. According to this approach, AECOM is actually trading above its intrinsic value. This could indicate potential downside if cash flow estimates fall short. Will fundamentals eventually win out over optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AECOM for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AECOM Narrative

If you see the story differently, or value your own research, take a few minutes to shape your own view. It's quick, simple and you can Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding AECOM.

Looking for more investment ideas?

Act now to get ahead of the crowd. Don’t miss your chance to find stocks set for strong returns in the next market wave using these powerful tools:

- Tap into reliable income streams with companies boasting high yields by scanning these 15 dividend stocks with yields > 3% right now.

- Spot undervalued potential as you review these 916 undervalued stocks based on cash flows that could offer standout rewards based on robust cash flows.

- Seize the innovation edge by searching these 25 AI penny stocks for AI-driven disruptors that are rewriting industry playbooks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACM

AECOM

Provides professional infrastructure consulting services for governments, businesses, and organizations internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026