- United States

- /

- Aerospace & Defense

- /

- NYSE:ACHR

Archer Aviation (ACHR): Evaluating Valuation as Tesla Rumors and Global Deals Spark Volatility

Reviewed by Kshitija Bhandaru

Archer Aviation (NYSE:ACHR) grabbed investor attention this week after releasing a video that featured its Midnight eVTOL alongside Tesla vehicles. This fueled merger speculation ahead of Tesla’s event. When no partnership materialized, Archer’s shares quickly reversed direction.

See our latest analysis for Archer Aviation.

While this week’s wild swings were sparked by Tesla rumors, Archer Aviation has built real momentum beneath the headlines, drawing global partners in Japan and the UAE and advancing its eVTOL ambitions. Although the share price tumbled 5.45% in the latest session, the 30-day share price return stands at an impressive 45.1%. Over the past year, long-term investors have seen a remarkable total shareholder return of nearly 289%. This shows that optimism continues to outweigh volatility as Archer secures new opportunities and pushes closer to commercialization.

If Archer’s breakout run has you curious about what else investors are chasing, now’s the perfect time to discover fast growing stocks with high insider ownership

After this stretch of big swings and bold global deals, is Archer Aviation’s current price still a bargain? Or has the market already accounted for all of its future growth potential?

Price-to-Book Ratio of 4.6x: Is it justified?

Archer Aviation’s price-to-book ratio stands at 4.6 times and exceeds the US Aerospace & Defense industry average. With shares trading at $11.97, this multiple signals a premium compared to sector peers.

The price-to-book ratio compares a company’s market value to its net assets. This is a common measure in asset-heavy industries such as aviation and manufacturing. For Archer, this ratio may reflect market optimism about future commercialization rather than current profitability.

Relative to the industry’s 3.5x average, Archer is priced well above established norms. However, when compared to a broader peer average of 10.2x, Archer could be viewed as more attractively valued among growth-oriented competitors. The market appears to recognize the bold ambitions and rapid advancements underpinning Archer’s valuation, even if current financials remain challenged.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 4.6x (OVERVALUED)

However, Archer Aviation’s uncertain path to profitability and reliance on future revenue growth mean investor optimism could fade if commercialization encounters unexpected delays.

Find out about the key risks to this Archer Aviation narrative.

Another View: Discounted Cash Flow Signals Deep Value

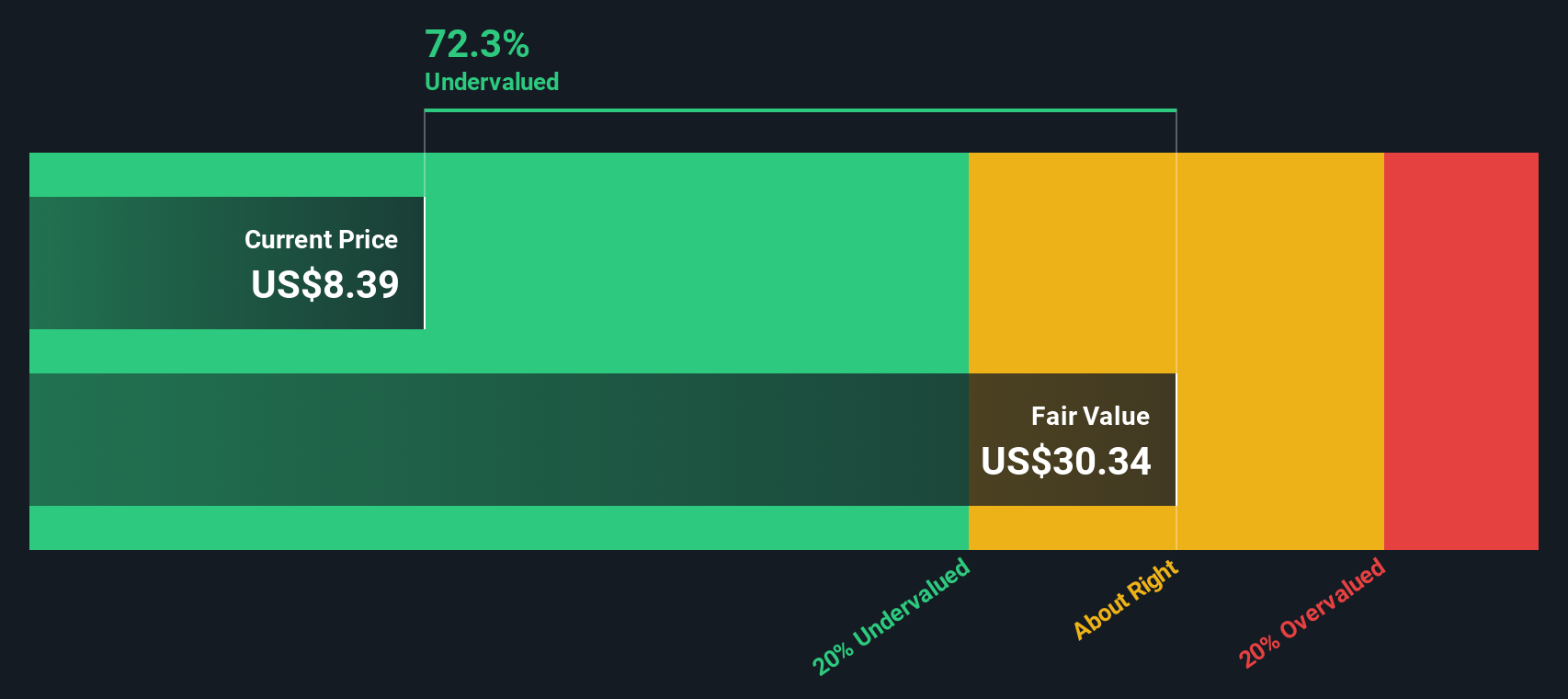

While the price-to-book ratio suggests Archer Aviation is overvalued relative to industry averages, a look at our DCF model provides a dramatically different perspective. The SWS DCF model estimates Archer’s fair value at $29.70 per share, which is nearly 60% above the current price. Is the market missing a major upside, or are expectations for future growth too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Archer Aviation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Archer Aviation Narrative

If you like to dig into the numbers yourself or want to chart your own take on Archer’s future, you can craft a personal analysis in just a few minutes. Do it your way

A great starting point for your Archer Aviation research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for last week’s headlines alone. Tomorrow’s winners are waiting in plain sight if you know where to look. Don’t let valuable opportunities slip away while others move first.

- Capture the growth potential of artificial intelligence by tapping into these 24 AI penny stocks before the next wave of innovations reshapes the market.

- Seize high-yield stability for your portfolio with these 19 dividend stocks with yields > 3%, focusing on companies delivering reliable income and strong fundamentals.

- Ride the momentum of digital finance by positioning yourself early with these 79 cryptocurrency and blockchain stocks leading major shifts in payments and blockchain solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACHR

Archer Aviation

Designs and develops aircraft and related technologies and services in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives