- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:WWD

Woodward (WWD) Valuation Check After Strong Earnings Beat, Upgraded Guidance, and Rising Investor Optimism

Reviewed by Simply Wall St

Woodward (WWD) lit up investor screens after a strong fourth quarter, healthier full year numbers, and an upbeat 2026 outlook, all backed by rising earnings estimates and ongoing momentum in the stock.

See our latest analysis for Woodward.

The stock is clearly in an upswing, with a 1 month share price return of 15.68% and a 1 year total shareholder return of 69.71%. This reinforces the view that momentum is building as Woodward leans into growth investments and selective M&A.

If Woodward’s run has you thinking about the broader aerospace and defense space, this could be a good moment to explore aerospace and defense stocks for other potential ideas.

With the stock hovering just below analyst targets after a powerful run and guidance that points to solid double digit growth, is Woodward still trading at a reasonable entry point, or are markets already pricing in the next leg higher?

Most Popular Narrative Narrative: 4.3% Undervalued

With Woodward last closing at $303.45 against a narrative fair value of $317.13, the most followed storyline points to modest upside from here.

The analysts have a consensus price target of $285.875 for Woodward based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $335.0, and the most bearish reporting a price target of just $245.0.

Curious how steady revenue expansion, rising margins, and a richer future earnings multiple combine to support that upside view, and where expectations quietly stretch the most? Dig in to see the full playbook behind this valuation call.

Result: Fair Value of $317.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy capital spending and execution risk on new facilities, alongside potential pressure on high margin legacy platforms, could quickly challenge that upside thesis.

Find out about the key risks to this Woodward narrative.

Another View: Rich Valuation on Earnings

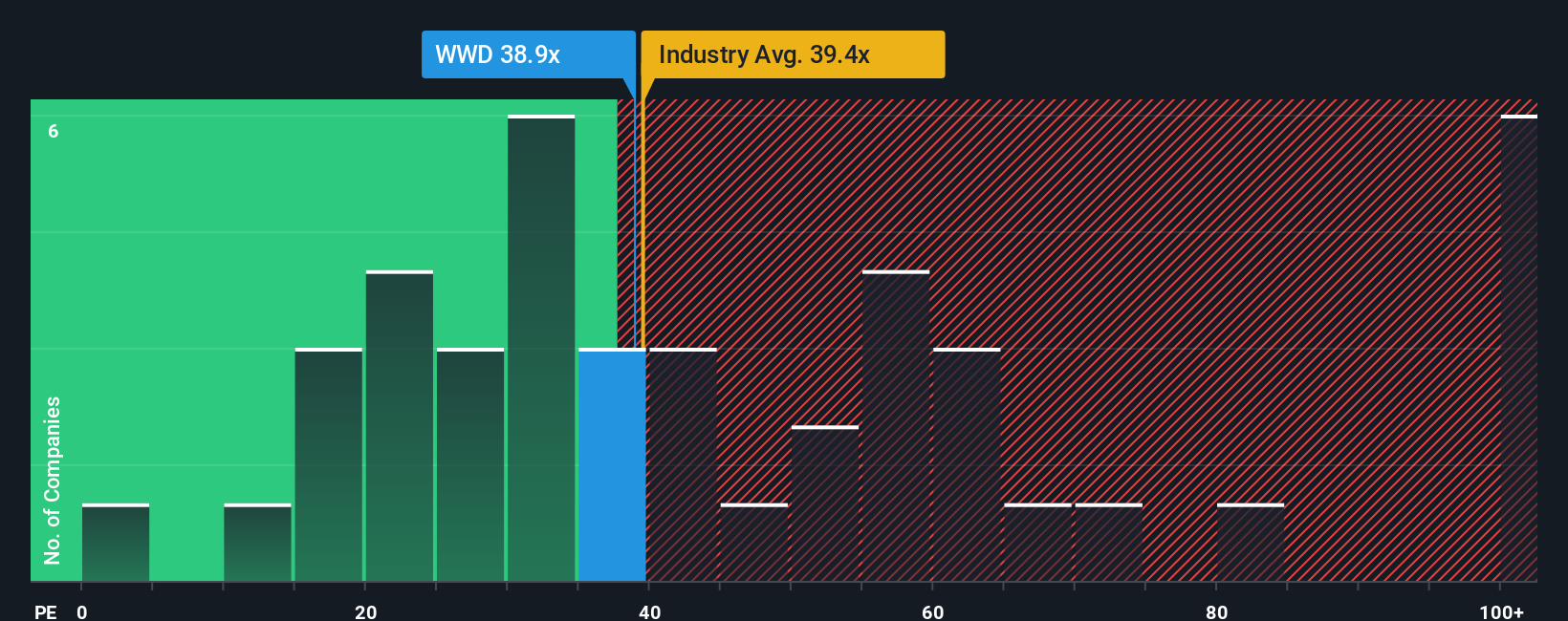

Looked at through its current price to earnings ratio, Woodward screens as expensive rather than modestly undervalued. The stock trades on 41.1 times earnings versus about 37.9 times for the wider US aerospace and defense group and 37.7 times for direct peers.

Our fair ratio, at 26.6 times earnings, sits well below where the market is pricing the stock today, suggesting limited margin for error if growth or margins disappoint from here. For investors, that spread feels less like a safety cushion and more like a test of conviction, especially after such a strong run. How comfortable are you paying up for this story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Woodward Narrative

If this perspective does not quite match your own, or you would rather dig into the numbers independently, you can build a complete narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Woodward.

Looking for more investment ideas?

Take the next step now and line up your watchlist with targeted opportunities, instead of waiting for the market to tell you where to look.

- Capture potential bargains early by scanning these 908 undervalued stocks based on cash flows that the market may be overlooking despite strong cash flow support.

- Ride powerful secular shifts by focusing on these 26 AI penny stocks positioned at the center of surging demand for intelligent automation.

- Lock in reliable income streams by targeting these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s long term return profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Woodward might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WWD

Woodward

Designs, manufactures, and services control solutions for the aerospace and industrial markets worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026